🚀 Stock Surge Ahead! Company Receives Major Tata Order, Stock Split, and Bonus Unveiled! 🚀

Summary

TLDRIn this detailed stock analysis, the presenter discusses Bharat Global Developers' recent performance, including impressive order wins from major companies like Reliance and Tata. Key highlights include a boost in the company's order book, with a target revenue growth, and upcoming stock actions like a bonus issue and stock split, aimed at increasing liquidity. The presenter also covers fundamentals such as sales, profit margins, and the overall market sentiment, providing a comprehensive outlook. With JP Morgan upgrading the stock's target price and the company’s strong growth trajectory, the analysis offers valuable insights for potential investors.

Takeaways

- 😀 BGD (Bharat Global Developers) has been diversifying its business into green energy and infrastructure, opening multiple subsidiaries for growth.

- 😀 Recent contracts include significant orders from top companies like Reliance (₹650 crore) and Tata Agro (₹50 crore annual supply contract).

- 😀 The company has seen a notable shift in its financials, moving from losses to profitability with increasing profit margins (currently improving from 11-14%).

- 😀 BGD’s order book is estimated to grow to ₹1,500 crore, indicating strong future revenue growth.

- 😀 A bonus issue in the ratio of 8:1 and a stock split (1:10) have been announced, improving liquidity and boosting shareholder holdings.

- 😀 The stock is currently trading at ₹1,100, with a target price set at ₹8,200 by JP Morgan, reflecting significant upside potential.

- 😀 Management changes and new contracts indicate a strong long-term outlook, though short-term price fluctuations are expected.

- 😀 The company’s focus on green energy aligns with the government's push for renewable energy, further enhancing its growth prospects.

- 😀 The stock shows strong technical indicators, with good volumes during upward price movements, signaling investor confidence.

- 😀 Investors should exercise caution and apply proper risk management strategies due to the stock's volatility and circuit limits in the market.

- 😀 The expected impact of the bonus and stock split will likely lead to price adjustments and increased liquidity, benefiting long-term holders.

Q & A

What was the key focus of the analysis in this video?

-The primary focus of the analysis was on Bharat Global Developers, discussing its stock performance, recent developments, including major orders, management changes, and potential impacts on its future stock price.

What are the major developments that have impacted Bharat Global Developers' stock?

-Key developments include significant orders secured from companies like Reliance and Tata Agro, management changes, a focus on green energy, and plans for a stock bonus and split, all of which have led to increased investor interest.

How has Bharat Global Developers' order book evolved recently?

-The company has secured large orders, including a ₹650 crore order from Reliance, and a ₹50 crore annual supply contract from Tata Agro, contributing to a strong order book and expected growth in sales.

What impact did management changes have on the company?

-Management changes have led to strategic shifts, such as expanding into multiple business sectors and securing high-profile contracts, which have increased the company’s credibility and investor confidence.

What role does the green energy sector play in Bharat Global Developers' future?

-The company has ventured into the green energy sector, capitalizing on government promotions for renewable energy, positioning itself in a growing market that is expected to drive future growth.

How is the stock expected to behave in the short term, according to the analysis?

-The stock is expected to see some positive movement, with immediate price targets set around ₹1400-1500, driven by a combination of solid fundamentals, orders, and potential liquidity improvements due to bonus and stock splits.

What is the significance of the upcoming bonus and stock split announcements for Bharat Global Developers?

-The bonus issue and stock split, scheduled for December 26, are expected to increase liquidity and make the stock more attractive to a wider range of investors. This could lead to price adjustments and more stable trading volumes.

What is the expected impact of the ₹650 crore order from Reliance on Bharat Global Developers?

-This large order from Reliance is expected to significantly boost the company’s revenues and profit margins. It’s anticipated to increase the company's financial performance, particularly with a projected improvement in profit margins from 11-14%.

How does the stock’s liquidity relate to its market performance?

-The stock's liquidity is currently low due to a high promoter holding and limited free float. However, the upcoming bonus and stock split should improve liquidity by increasing the number of shares available for trading.

What is the target stock price for Bharat Global Developers as per JP Morgan’s analysis?

-JP Morgan has raised the target price for Bharat Global Developers to ₹8200, based on the company's strong order book, improving profit margins, and favorable long-term growth prospects.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Tata Motors Share Analysis | Best Stock to play EV Theme?🔥

MyStockScanner Live 22-10-25

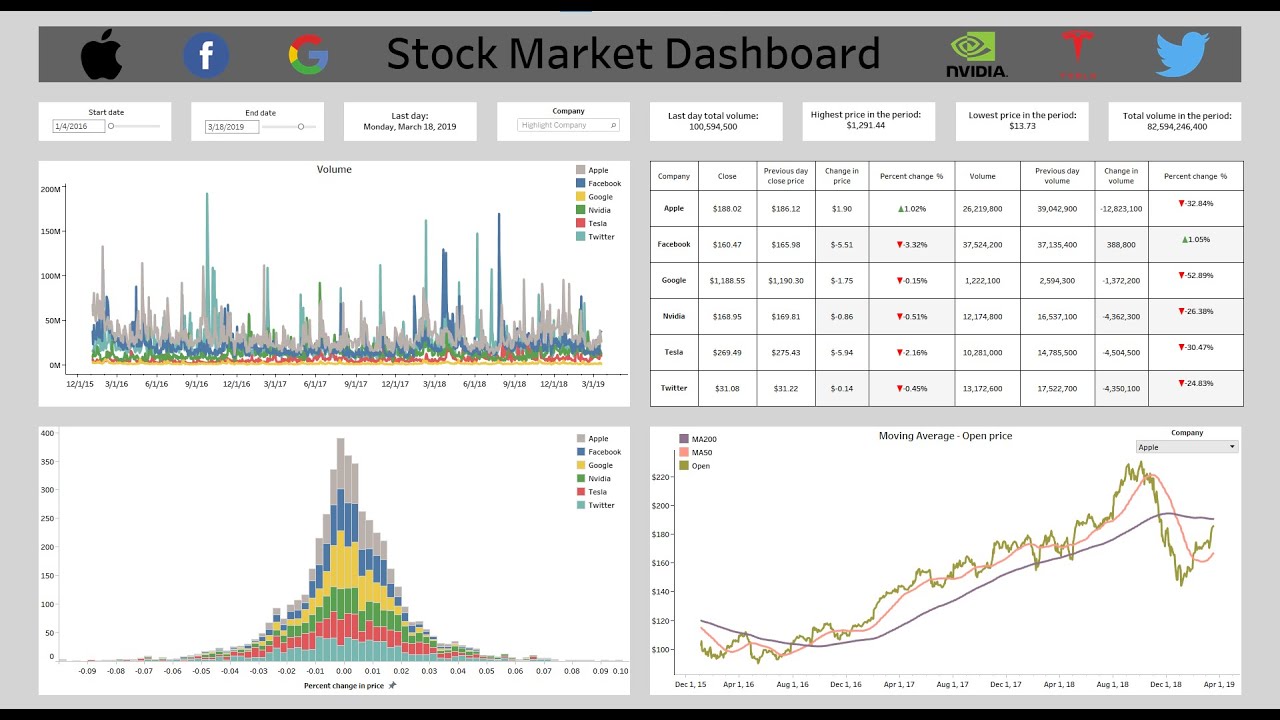

THE ULTIMATE TABLEAU PORTFOLIO PROJECT: From Pandas to an Amazing Interactive Stock Market Dashboard

TESLA Stock - Are TSLA Bulls Back?

Is INTEL A BUY Before EARNINGS? | Nvidia New HIGH | Semiconductor Stock Show

TATA - Should you enter it now ? |Vinod Srinivasan|

5.0 / 5 (0 votes)