Can ETH Become DEFLATIONARY? EIP 1559 Explained

Summary

TLDREIP-1559 is a proposal designed to overhaul Ethereum's fee model, making transaction costs more predictable and reducing congestion. The key innovation is the introduction of a 'base fee' that adjusts based on network usage, while doubling the block gas limit to increase capacity. As part of the proposal, the base fee is burned, potentially reducing ETH supply and making the network deflationary. While it won’t drastically reduce gas fees on its own, it enhances user experience by smoothing out volatility. Ethereum’s future scalability and fee reduction will depend more on Ethereum 2.0 and Layer 2 solutions.

Takeaways

- 😀 EIP-1559 is a proposal to overhaul Ethereum's fee structure by introducing a base fee that adjusts dynamically based on network congestion.

- 😀 The base fee is burned, meaning it is permanently removed from circulation, creating deflationary pressure on Ethereum's supply.

- 😀 The proposal aims to make transaction fees more predictable, reducing volatility and the likelihood of users overpaying during high congestion.

- 😀 EIP-1559 introduces an increase in the gas limit per block from 12.5 million to 25 million, effectively doubling the block size and increasing network capacity.

- 😀 Miners will still receive a minor tip in addition to the block reward, but will no longer collect the entire gas fee, which could reduce their earnings.

- 😀 The base fee is automatically adjusted based on the network’s utilization, increasing during high demand and decreasing during low demand.

- 😀 EIP-1559 helps to smooth out spikes in gas fees, improving the user experience and making transactions more predictable and efficient.

- 😀 The proposal will not drastically lower gas fees, but it will optimize the fee model and reduce the number of overpaid transactions.

- 😀 The implementation of EIP-1559 creates a feedback loop where more network activity results in more ETH being burned, which could increase ETH's value over time.

- 😀 EIP-1559 could make Ethereum more deflationary in high usage periods, potentially increasing the value of ETH as the supply decreases.

- 😀 While miners resist the proposal due to lower rewards, EIP-1559 could simplify wallet interfaces by automatically setting the base fee, improving the overall user experience.

Q & A

What is EIP-1559, and what does it aim to achieve?

-EIP-1559 is an Ethereum Improvement Proposal that aims to revamp the Ethereum transaction fee model. Its key goals include making transaction fees more predictable, reducing delays in transaction confirmations, improving the user experience by automating the fee bidding system, and creating a positive feedback loop between network activity and the supply of ETH.

How does the current Ethereum fee model work?

-The current Ethereum fee model is based on a first-price auction system, where users bid for block space by setting a gas price. Miners prioritize transactions with higher bids, which often leads to inefficiencies and overpayment, especially during periods of high network activity.

How does EIP-1559 propose to change Ethereum's fee structure?

-EIP-1559 introduces a base fee, which is the minimum fee a transaction must pay to be included in a block. This base fee is adjusted dynamically based on network congestion. The proposal also increases the network's block size capacity, enabling more transactions to be processed per block.

What is the base fee, and how is it determined?

-The base fee is the minimum fee required for a transaction to be included in a block. It is set per block and adjusted up or down based on network utilization. If the network is more than 50% utilized, the base fee increases, and if it’s less than 50%, the base fee decreases.

What is the role of the minor tip in the EIP-1559 model?

-The minor tip is a separate fee that users can pay directly to miners to incentivize them to prioritize their transaction. This is similar to the current system where users can offer higher gas fees for quicker transaction confirmations, especially for time-sensitive transactions like arbitrage.

How does EIP-1559 handle periods of high network activity?

-During periods of high activity, when demand for block space spikes, the base fee will increase in response, and miners will produce blocks with higher gas limits, up to the increased block size of 25 million gas. This helps smooth out fee volatility and ensures that users are less likely to overpay during high-demand periods.

What happens to the base fee in the EIP-1559 model?

-The entire base fee is burned, meaning it is removed from circulation. This creates a deflationary effect, as more ETH is effectively taken out of the market with higher network activity, which can increase the scarcity and value of ETH.

Can EIP-1559 make Ethereum deflationary?

-Yes, EIP-1559 has the potential to make Ethereum deflationary if the amount of ETH burned through base fee burns exceeds the ETH given as block rewards and minor tips. This is most likely to occur during periods of high network activity, such as during a DeFi boom.

How does EIP-1559 improve the user experience on Ethereum?

-EIP-1559 improves the user experience by automating the fee bidding system. Wallets can automatically set the base fee based on previous blocks, eliminating the need for users to manually estimate gas fees, especially during volatile periods. This reduces the risk of overpaying for transactions.

What challenges might miners face with the implementation of EIP-1559?

-Miners may face reduced profits under EIP-1559 because they will only receive the block subsidy and minor tips, not the full transaction fees. Additionally, miners may be reluctant to adopt the proposal due to the reduced financial incentive, especially during times of high gas fees.

How does EIP-1559 affect the long-term monetary policy of Ethereum?

-EIP-1559 introduces variability in Ethereum’s monetary policy by making the supply of ETH sometimes inflationary and sometimes deflationary, depending on network activity. While the inflation rate is capped at around 0.5-2% per year, the burning of the base fee introduces a level of unpredictability in the long-term supply of ETH.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

EIP-7702: a technical deep dive

Ethereum Layer 2 Solutions Explained: Arbitrum, Optimism And More!

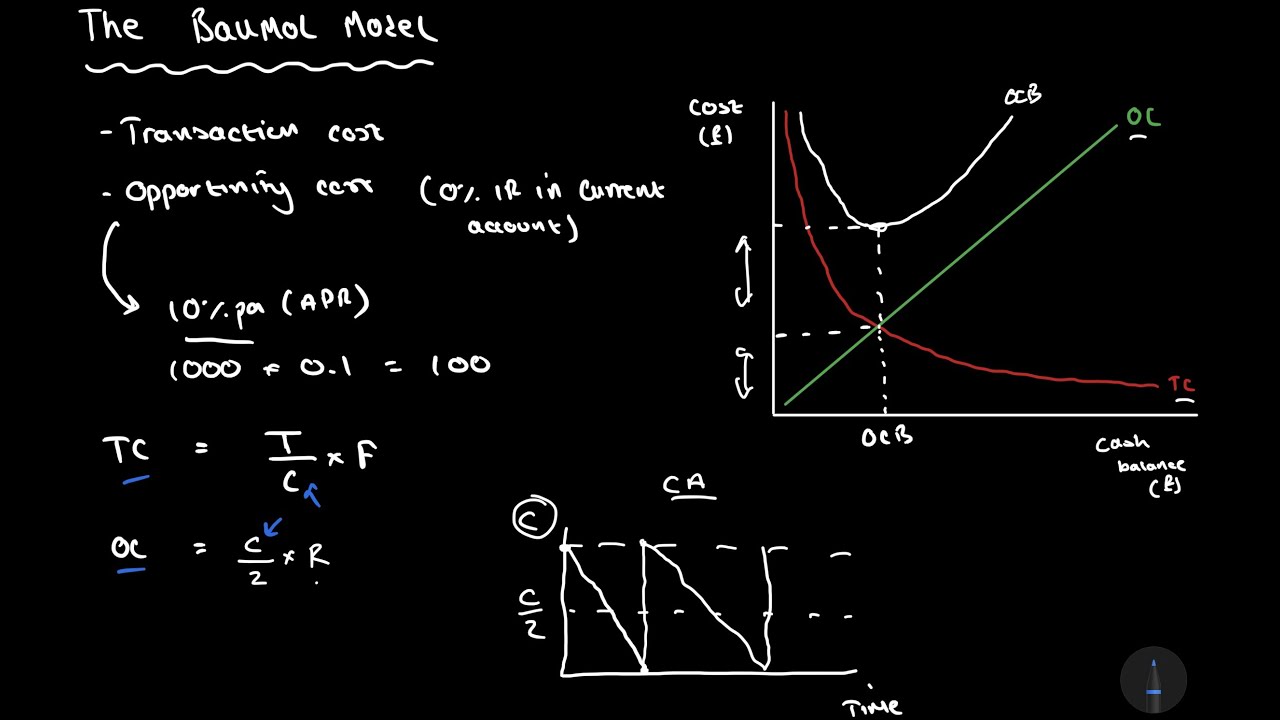

Deriving The Baumol Model of Cash Management | Corporate Finance

Crypto will go INSANE if this happens!

Jonas Eliasson: How to solve traffic jams

Bitcoin Fees and Unconfirmed Transactions - Complete Beginner's Guide

5.0 / 5 (0 votes)