Where to Park Cash in Today's Market

Summary

TLDRThis video explores the significance of cash and cash-like investments in an investment portfolio. It discusses their low-risk nature, liquidity, and the role they play in diversifying equity holdings. Key cash-like options include fixed-term deposits, cash ISAs, money market funds, and UK government bonds (gilts). The presenter explains the current interest rate landscape, how central banks influence rates, and offers insights into choosing the best places to hold cash today. Ultimately, the video highlights the importance of cash-like investments for stability, especially during economic volatility.

Takeaways

- 💰 Cash is an essential part of your investment toolkit, providing liquidity and low risk.

- 📊 Cash-like investments should be liquid, low-risk, and interest rate insensitive.

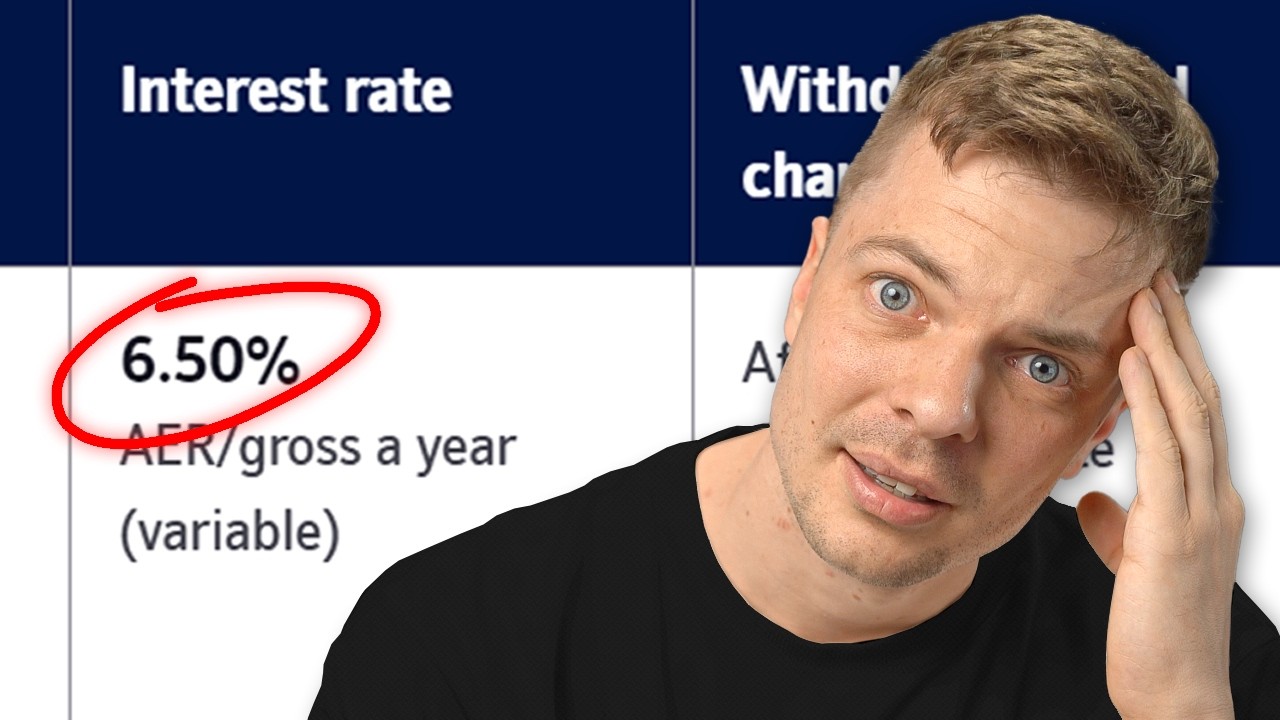

- 🏦 Fixed-term bank deposits are safe but may lack liquidity due to withdrawal penalties.

- 🔒 Cash ISAs allow tax-free savings and offer flexible access to funds within the annual allowance.

- 📈 Money market funds are generally safe and track short-term interest rates closely.

- 🇬🇧 UK government bonds (guilts) can serve as cash-like investments, particularly short-term ones.

- 🔍 Diversifying equity holdings with cash-like investments can reduce portfolio volatility.

- 🛒 Cash is essential as 'dry powder' for taking advantage of stock market downturns.

- 📅 For investment horizons under five years, cash-like options are preferable to reduce risk.

- 📉 Central banks, like the Bank of England, primarily drive short-term interest rates through monetary policy.

Q & A

What are cash-like investments?

-Cash-like investments are assets that share characteristics with cash, such as liquidity, low risk, and stability in purchasing power.

What is the primary reason for holding cash in an investment portfolio?

-The primary reason is to diversify equity holdings, as cash can dampen volatility and provide stability during market fluctuations.

How do fixed-term deposits compare to cash in terms of liquidity?

-Fixed-term deposits are less liquid than cash because they often come with penalties for early withdrawal, making them less accessible in emergencies.

What advantages do cash ISAs offer?

-Cash ISAs provide tax benefits, allowing you to earn interest without paying capital gains or income tax, and offer flexibility in withdrawals.

Why is it important to monitor short-term interest rates?

-Monitoring short-term interest rates, primarily driven by the central bank's monetary policy, helps investors make informed decisions about where to park their money.

What are money market funds, and how do they function?

-Money market funds are low-risk investment funds that typically invest in short-term, high-quality investments, providing liquidity and returns similar to cash.

Why might investors prefer UK gilts over other cash-like investments?

-Investors may prefer UK gilts for their safety, predictable returns, and tax advantages, especially as they are government-backed and do not incur capital gains tax.

What role does inflation play in determining interest rates?

-Inflation influences the central bank's decisions on interest rates; if inflation exceeds the target, the bank may raise rates to cool the economy.

What is the financial services compensation scheme (FSCS)?

-The FSCS provides protection for deposits at banks and credit unions up to £85,000 per person per institution, ensuring safety for depositors.

What should investors consider when choosing between cash ISAs and money market funds?

-Investors should consider the tax implications, liquidity needs, and current interest rates when choosing between cash ISAs and money market funds, as well as their investment goals.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)