Accounting for IGCSE - Video 36 - Limited companies (Part 2) - Financial statments

Summary

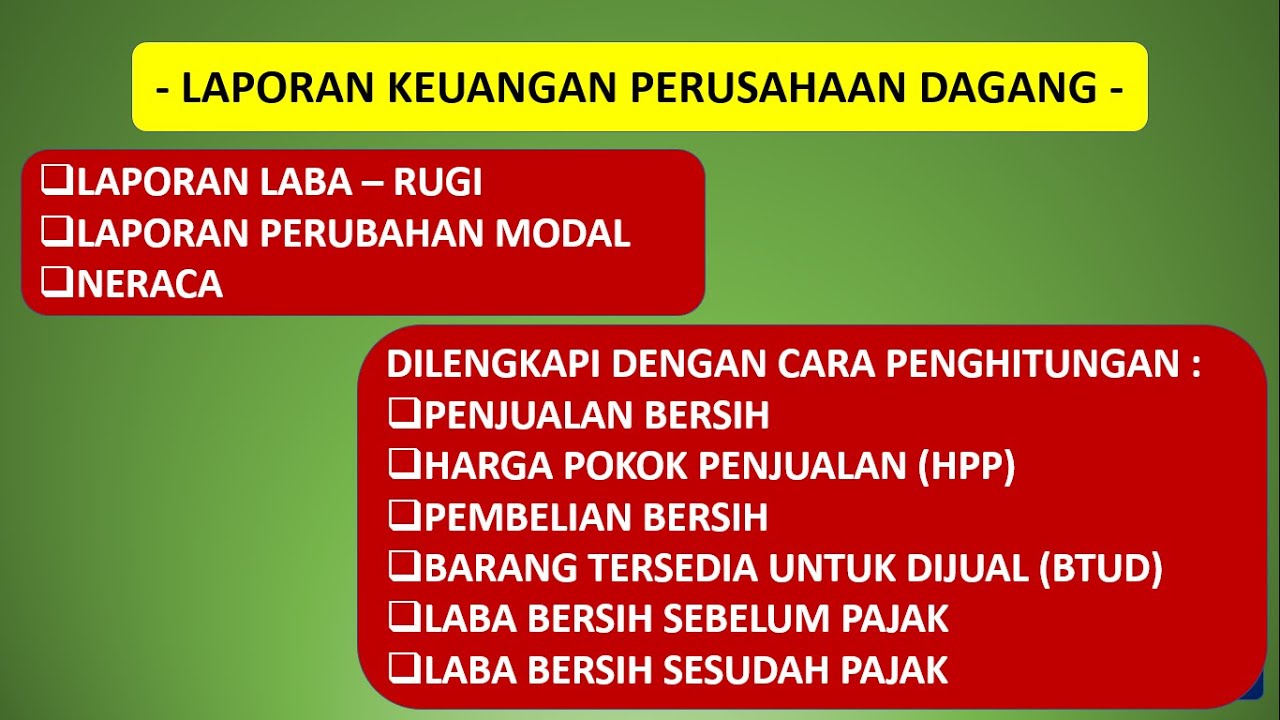

TLDRThis video continues the discussion on preparing financial statements for limited companies, focusing on the income statement, statement of changes in equity, and the balance sheet. It explains the components of each statement, including gross profit, operating profit, and net profit, while differentiating between operating and non-operating expenses. The importance of equity and dividends—both interim and final—is highlighted, along with their accounting treatment. An example illustrates these concepts in practice, providing viewers with a clearer understanding of financial reporting essential for stakeholders.

Takeaways

- 📊 The income statement calculates profit by deducting costs from sales, showing gross, operating, and net profit.

- 📈 Operating expenses support day-to-day business operations, while non-operating expenses, like interest, are related to financing.

- 📚 The statement of changes in equity tracks how equity components, such as retained earnings and reserves, change over time.

- 💰 Dividends to preference shareholders must be paid before any dividends are distributed to ordinary shareholders.

- 🔄 Interim dividends are declared during the year based on current profits, while final dividends are proposed after year-end and need shareholder approval.

- ❗ Proposed dividends are not recorded as liabilities until they are approved in the annual general meeting (AGM).

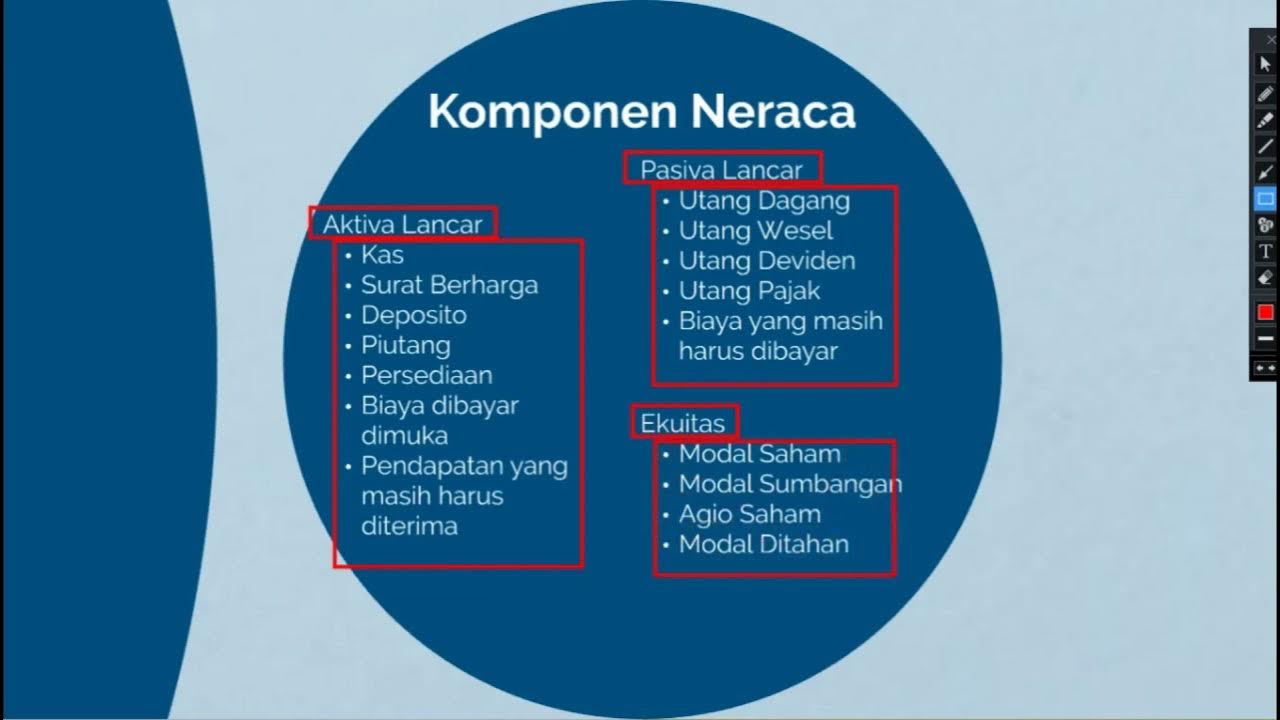

- 🔍 The balance sheet presents the company’s financial position, listing assets, liabilities, and equity, and must always balance.

- 📝 All dividends are recorded only when paid; no accrual is made for unpaid proposed dividends at year-end.

- 🔢 The total equity of shareholders combines ordinary share capital, preferential capital, and retained earnings.

- 👩🏫 Understanding these financial statements is crucial for both academic exams and real-world business applications.

Q & A

What is the primary purpose of preparing financial statements for limited companies?

-The primary purpose is to provide an overview of the company's financial performance and position, including calculations of profit or loss and changes in equity.

What are the main components of the income statement for a limited company?

-The main components are gross profit, operating profit, and net profit, calculated by subtracting operating and non-operating expenses from sales.

How is gross profit calculated in the income statement?

-Gross profit is calculated as sales minus the cost of sales.

What is the difference between operating and non-operating expenses?

-Operating expenses are necessary for day-to-day operations, like salaries and rent, while non-operating expenses are related to financing the business, such as interest on loans.

What does the statement of changes in equity reflect?

-It reflects the changes in the equity components, including share capital, retained earnings, and reserves over a financial period.

What is the significance of the preference dividend?

-The preference dividend is a fixed rate that must be paid to preference shareholders before any dividends are paid to ordinary shareholders.

What are interim and final dividends, and how do they differ?

-Interim dividends are declared and paid during the year by directors, while final dividends are proposed at year-end and require shareholder approval at the AGM.

When should dividends be accrued in financial statements?

-Dividends should be recorded on a payment basis only; proposed dividends are not accrued as liabilities until approved by shareholders.

What are the main sections of a balance sheet for a limited company?

-The main sections are non-current assets, current assets, equity, and liabilities, which must balance to show the company's financial position.

How does the statement of changes in equity affect retained earnings?

-Net profit for the year is added to retained earnings, while dividends declared are deducted, showing the overall change in retained earnings.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآن5.0 / 5 (0 votes)