Business Math Terms - Breakeven Point Reduced Net Profit Operating Loss And Absolute Loss Explained

Summary

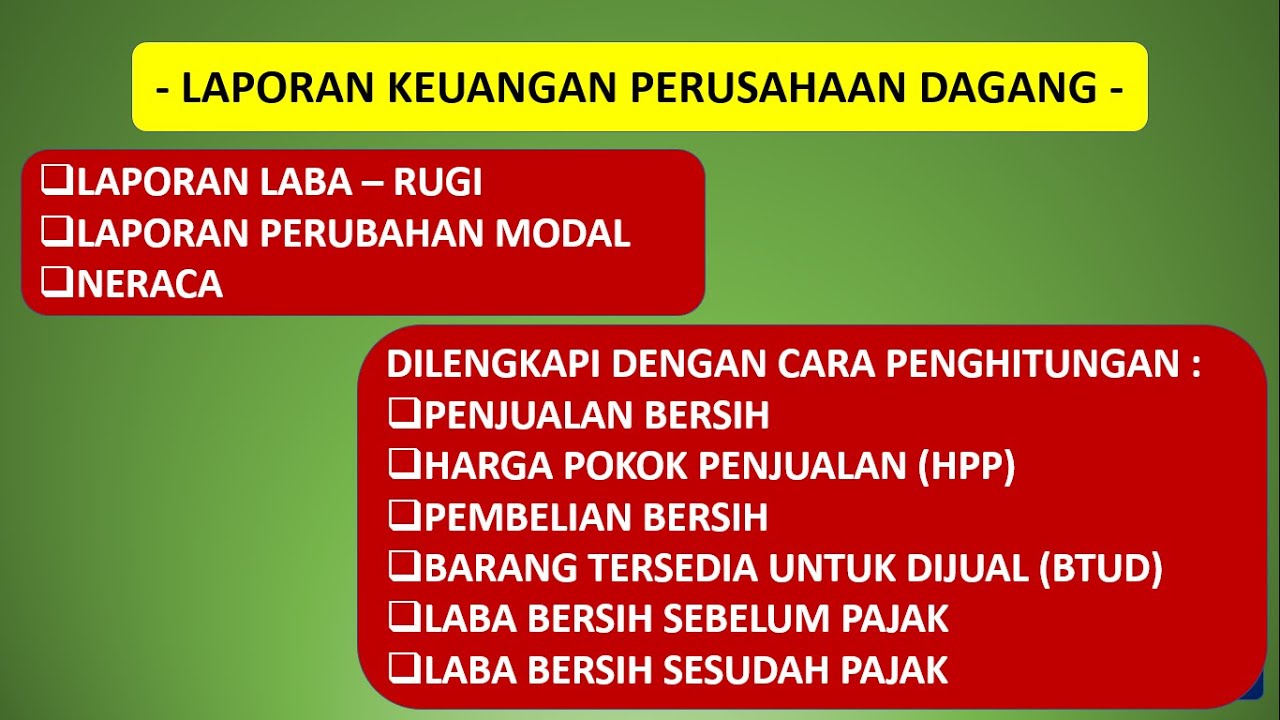

TLDRThis video explains key financial concepts including cost, operating expenses, and net profit, using a chart for visualization. It covers the significance of the selling price in relation to these factors, highlighting the breakeven point where costs are covered without profit. The video further discusses operating loss and absolute loss, demonstrating how markdowns can affect business profitability. It provides essential formulas for calculating breakeven, operating loss, and absolute loss, emphasizing their importance in business mathematics. The presenter encourages viewers to engage with additional resources for further learning.

Takeaways

- 📊 The chart illustrates sections for cost, operating expenses, and net profit.

- 💰 The selling price should ideally cover costs, operating expenses, and provide a net profit.

- 🔻 A reduced net profit occurs when an item is marked down but still covers costs and expenses.

- 📉 The breakeven point is when the selling price covers only the cost and overhead, with no profit.

- 🚫 An operating loss happens when the selling price falls below the breakeven point, leading to a loss.

- ❌ An absolute loss occurs when the selling price does not cover the item's cost.

- ⚖️ The formula for breakeven point is: Breakeven Point = Cost + Operating Expenses.

- 📉 The formula for operating loss is: Operating Loss = Breakeven Point - Reduced Selling Price.

- 💸 The formula for absolute loss is: Absolute Loss = Cost - Reduced Selling Price.

- 🎓 Understanding these concepts is crucial for managing breakeven points in business.

Q & A

What are the main components listed in the chart regarding pricing?

-The main components are cost, operating expenses, and net profit, which should ideally be covered by the selling price.

What does a reduced net profit indicate?

-A reduced net profit indicates that an item is marked down but still covers its cost and operating expenses while providing a small net profit.

What is the breakeven point?

-The breakeven point is the selling price of an item that covers just the cost of the item plus any overhead, with no profit included.

What constitutes an operating loss?

-An operating loss occurs when an item's selling price is marked down below the breakeven point, meaning it does not cover total operating expenses.

What is an absolute loss?

-An absolute loss happens when the reduced selling price does not even cover the cost of the item.

How do operating loss and absolute loss affect a business?

-Both operating loss and absolute loss result in the business losing money on the item.

What is the formula for calculating the breakeven point?

-The formula for the breakeven point is: breakeven point = cost + operating expenses.

How is operating loss calculated?

-Operating loss is calculated using the formula: operating loss = breakeven point - reduced selling price.

What formula is used to determine absolute loss?

-The formula for absolute loss is: absolute loss = cost - reduced selling price.

Why is it important to understand these concepts?

-Understanding these concepts is crucial for managing breakeven points effectively, which will be further explored in upcoming business math videos.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)