Ini Dia Isu Paling Hot Terkait Bank Syariah

Summary

TLDRIn this engaging video, the speaker addresses a controversial topic in Islamic finance: the claim that Islamic banks are not truly Sharia-compliant. They explore three main arguments against Islamic banking—its use of fractional reserve banking, fixed-income products like murabaha, and the perception that these products merely disguise conventional banking practices. The speaker defends Islamic finance by clarifying these misconceptions and emphasizing its unique characteristics, including oversight by Sharia boards. They highlight the broader significance of Islamic finance in promoting economic justice and addressing inequalities in conventional financial systems.

Takeaways

- 😀 The speaker addresses misconceptions about Islamic financial institutions, emphasizing their adherence to Sharia law.

- 🤔 Critics claim that Islamic banks are not truly Islamic due to their use of fractional reserve banking and credit creation.

- 💰 Fractional reserve banking involves creating credit, which some argue contradicts Islamic principles, but the speaker defends this practice as asset-backed.

- 📜 Murabahah, a key product in Islamic banking, is criticized for providing fixed returns, but it is fundamentally a legitimate asset-based sale.

- 🔍 The speaker highlights the importance of understanding Islamic finance practices and the misconceptions surrounding them.

- ✅ Islamic banks are regulated by Sharia supervisory boards to ensure compliance with Islamic laws and principles.

- 📈 The existence of these boards distinguishes Islamic banks from conventional banks, enhancing their credibility.

- 💡 Literature increasingly recognizes Islamic finance as a means to promote economic justice and address systemic financial inequalities.

- 🚀 The speaker encourages viewers to engage with the content, aiming to spread awareness about the validity of Islamic banking practices.

- 🌍 The discussion emphasizes the potential of Islamic finance to provide solutions to the injustices present in conventional financial systems.

Q & A

What is the main topic discussed in the video?

-The video discusses the controversy surrounding the Shariah compliance of Islamic banks and addresses common criticisms against them.

What are the three main criticisms of Islamic banks mentioned in the video?

-The three main criticisms are: 1) Islamic banks create credit through fractional reserve banking, 2) The use of fixed-rate products like Murabaha is un-Islamic, and 3) Islamic products are merely repackaged conventional financial products.

Why do some critics argue that Islamic banks should not create credit?

-Critics believe that creating credit, similar to conventional banks, contradicts Shariah principles, as it may lead to the generation of money without tangible backing.

How does the speaker defend the practice of credit creation in Islamic banking?

-The speaker defends credit creation by stating it is permissible when it is backed by real assets and productivity, citing economic theorists like Umer Chapra.

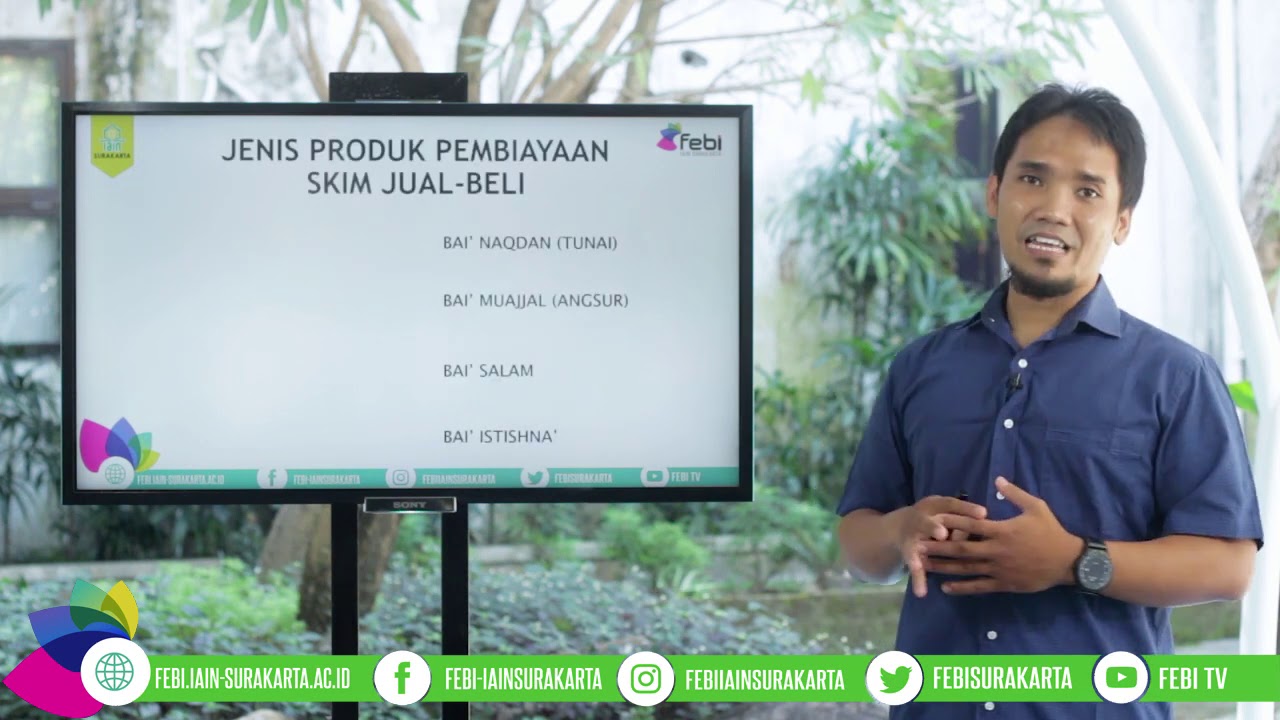

What is Murabaha, and why is it criticized?

-Murabaha is a fixed-rate product where banks buy an asset and sell it to a customer at a markup. It is criticized because some believe it does not align with the risk-sharing principles of Islamic finance.

How does the speaker justify the legitimacy of Murabaha?

-The speaker justifies Murabaha by explaining that it is asset-backed and follows trade principles, fulfilling the needs of consumers while remaining compliant with Shariah.

What role do Shariah supervisory boards play in Islamic banking?

-Shariah supervisory boards oversee all products offered by Islamic banks to ensure their compliance with Islamic law and principles.

How does the speaker address the claim that Islamic banking products are just conventional products in disguise?

-The speaker emphasizes that Islamic banking is distinct from conventional banking, highlighting the involvement of Shariah supervisory boards and the underlying compliance with Islamic law.

What broader societal issue does Islamic finance aim to address, according to the video?

-Islamic finance aims to address economic injustices and promote fairness within the financial system.

What is the speaker's final message to viewers regarding Islamic finance?

-The speaker encourages viewers to share and subscribe for further insights on Islamic economic issues, emphasizing the importance of understanding the legitimacy and benefits of Islamic finance.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Benarkah Bank syariah hanya kedok? - Ustadz Dr Erwandi Tarmizi LC, MA

290 Hukum Investasi di Reksadana - Dr. Muhammad Arifin Badri, M.A. حَفِظَهُ اللهُ

Prinsip-prinsip Dasar Bank Syariah • Perbankan Syariah #4

PART#2 EKONOMI DAN ISLAM.

Which Islamic banks are truly Islamic? - Assim al hakeem

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

5.0 / 5 (0 votes)