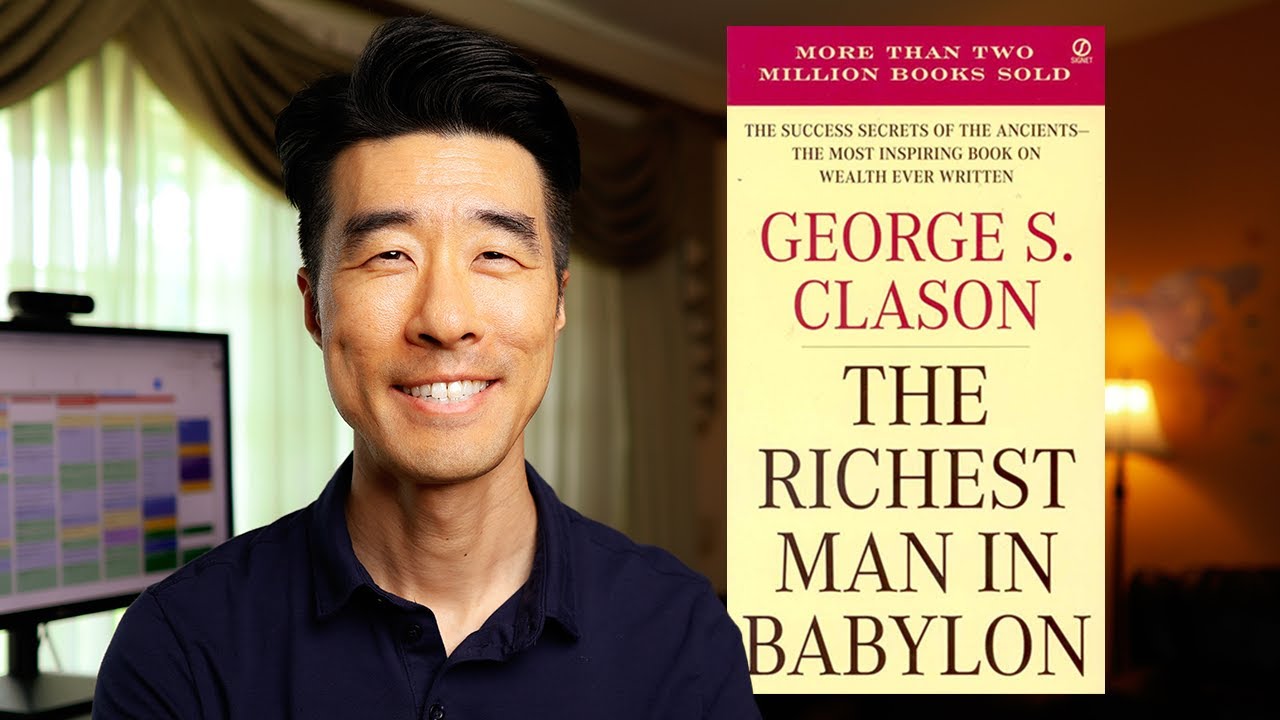

9 Timeless Money Lessons from The Richest Man in Babylon

Summary

TLDRIn this video, the speaker shares nine valuable money lessons from the book *The Richest Man in Babylon*, focusing on spending, making, and protecting money. Key lessons include paying yourself first, controlling lifestyle creep, investing to multiply wealth, and planning for future income. The video emphasizes balancing saving with enjoying life, increasing earning potential, and safeguarding investments. It also highlights the importance of seeking advice from experts and taking proactive action to create opportunities. The speaker provides actionable insights for financial growth while maintaining a fulfilling life.

Takeaways

- 💰 Pay yourself first: Set aside a portion of your income for savings before spending on anything else. This simple mindset shift can significantly improve financial stability.

- 📉 Control lifestyle creep: Avoid letting your expenses grow with your income. Clearly distinguish between true needs and wants disguised as needs.

- 🎉 Enjoy life responsibly: While saving and building wealth, it’s important to allocate money for enjoyment, making room for experiences that enrich your life.

- 📈 Invest to grow wealth: Simply saving money is not enough. To multiply your wealth, you need to invest it in opportunities like the stock market for exponential growth.

- 🏦 Plan for future income: Ensure financial stability for your later years by saving and investing early, preventing the need to rely on others later in life.

- 🚀 Increase earning potential: Focus not only on saving but also on increasing your ability to earn by investing in yourself and adopting a growth mindset.

- 🔒 Protect your money: Be cautious with your investments. Only invest where your principal is safe, avoiding high-risk, speculative ventures that could lead to loss.

- 👨🏫 Seek advice from experts: When it comes to growing your wealth, listen to experienced individuals who have successfully navigated the path you are on.

- 🍀 Create your own luck: Luck often comes from preparation and action. Be proactive, take calculated risks, and create opportunities for success.

- 📚 Learn from money books: Books like *The Richest Man in Babylon* offer timeless lessons on wealth-building, encouraging practical actions that lead to long-term financial success.

Q & A

What is the main theme of the video?

-The video discusses nine money lessons learned from the book 'The Richest Man in Babylon,' focusing on spending money, making money, and protecting money.

What does the first lesson 'Start Thy Purse to Fattening' suggest?

-'Start Thy Purse to Fattening' suggests paying yourself first by setting aside a portion of your earnings into savings before spending on other things.

How does the speaker apply the concept of 'paying yourself first'?

-The speaker applies this by automatically transferring a percentage of their income to a savings account before spending, starting with 5% and increasing it gradually over time.

What is 'lifestyle creep' as described in the second lesson?

-'Lifestyle creep' refers to the tendency to increase spending as income grows, leading to unnecessary expenses. The lesson emphasizes controlling expenditures to prevent this.

How can one distinguish between true needs and wants, according to the second lesson?

-One should carefully examine their expenses and identify wants that are disguised as needs, ensuring they don't fall into the trap of unnecessary spending.

What is the significance of the third lesson, 'Enjoy life while you can'?

-The third lesson highlights the importance of balancing saving and enjoying life, advocating for budgeting a portion of income for activities and experiences that bring happiness.

What does 'Make thy gold multiply' from lesson four teach?

-It teaches the importance of investing money rather than just saving it, as investments have the potential to grow wealth through compound interest, unlike savings.

Why is it important to 'Ensure a future income,' according to lesson five?

-Ensuring a future income is important because it helps safeguard one's financial security in old age when they can no longer work, preventing financial struggles later in life.

How does lesson six, 'Increase thy ability to earn,' challenge common financial thinking?

-Lesson six challenges the idea that income is fixed and focuses on increasing earning potential through skill development and career growth, rather than only cutting expenses.

What is the message behind 'Guard thy treasures from loss' in lesson seven?

-The message is to protect your wealth by making safe and informed investments, avoiding risky ventures that could result in significant financial loss.

Why does lesson eight emphasize seeking advice from wise individuals?

-It emphasizes that people serious about building wealth should seek advice from experienced individuals who have successfully navigated financial risks, rather than following popular trends.

What is the key takeaway from lesson nine, 'Cultivate good luck through action'?

-The key takeaway is that what is often perceived as luck is actually the result of preparation and action, suggesting that proactive behavior increases opportunities for success.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

The Richest Man In Babylon // 10 Timeless Wealth Lessons

ENCONTRE O EQUILÍBRIO ENTRE INVESTIR E APROVEITAR O PRESENTE

The Book That Changed My Financial Life 🤑

O melhor resumo [PAI RICO PAI POBRE] as 5 lições do livro

15 Things To Do If You Get Rich All Of A Sudden

كيف تتخلص من الديون وتصبح أغنى شخص في العالم؟ | بوكافيين

5.0 / 5 (0 votes)