At Fenway Park, home of the Boston Red Sox, seating is limited to about 38,000 Hence, the number of

Summary

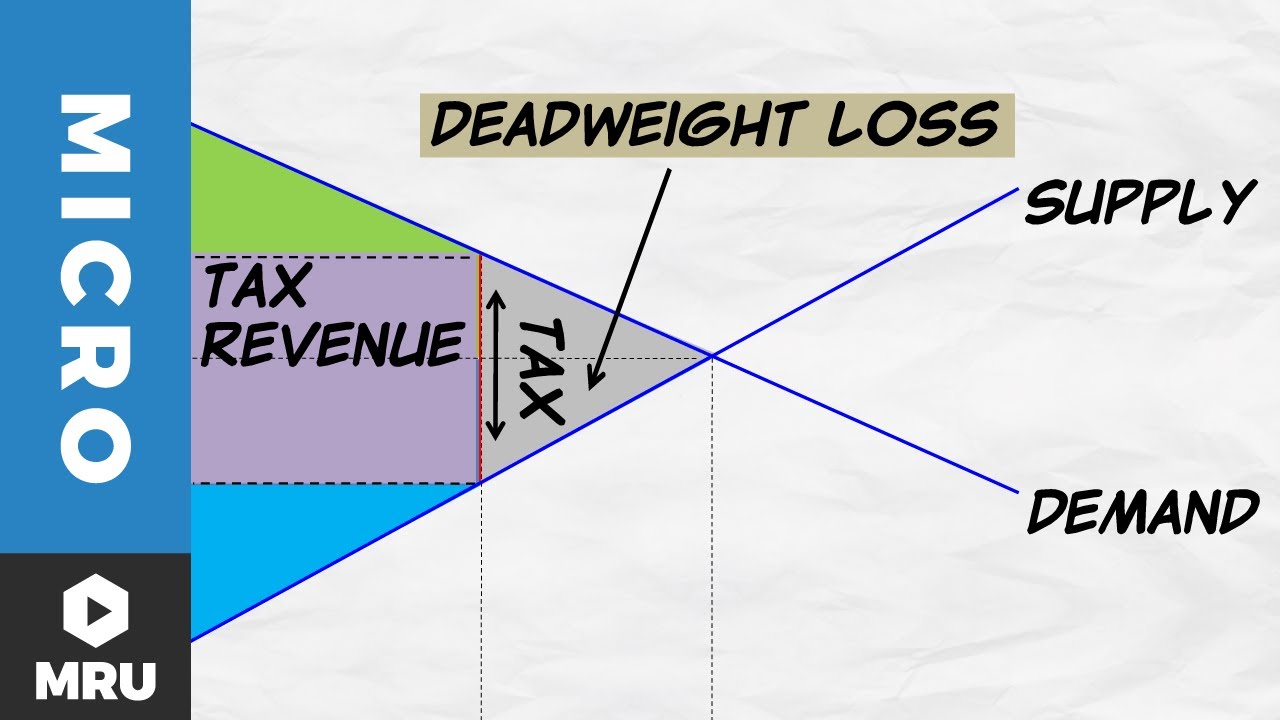

TLDRThe script discusses the impact of a tax on ticket sales, emphasizing that the tax is levied on buyers, not sellers. With a fixed supply of 38,000 tickets, the supply curve is perfectly inelastic. The tax shifts the demand curve leftward, reducing the equilibrium price from P to P1. The burden of the tax is entirely absorbed by the seller (Red Sox), as they cannot adjust supply, resulting in lower ticket prices. Buyers continue to pay the same price, indicating no burden shift to them.

Takeaways

- 💼 The tax is levied on the buyer, not the seller, which influences the demand side of the market.

- 🎟️ The number of tickets is fixed at 38,000, making the supply perfectly inelastic.

- 📉 The supply curve is a vertical line at 38,000 tickets, indicating no change in quantity supplied with price changes.

- 📊 The demand curve is downward sloping, showing the typical relationship between price and quantity demanded.

- 📉 The imposition of the tax causes the demand curve to shift leftwards, indicating reduced demand at each price level.

- 💸 The new equilibrium price after the tax (P1) is lower than the original equilibrium price (P).

- 💵 The difference between the original price (P) and the new price (P1) is $5, representing the tax amount.

- 💸 The buyer's burden from the tax is zero, as they continue to pay the same price (P) after the tax is levied.

- 🏭 The seller (Red Sox) bears the full burden of the tax, amounting to $5, due to the inability to adjust the supply.

- 📉 The seller absorbs the entire tax by lowering ticket prices, resulting in a lower equilibrium price (P1).

Q & A

Who bears the tax burden according to the transcript?

-According to the transcript, the tax burden is borne entirely by the seller, represented by the Red Sox in this scenario, since they cannot alter the supply of tickets which is fixed at 38,000.

Why is the supply curve described as perfectly inelastic?

-The supply curve is described as perfectly inelastic because the number of tickets is fixed at 38,000, meaning that the quantity supplied does not change with price changes.

How does the tax affect the demand curve?

-The tax affects the demand curve by causing it to shift leftwards, indicating that at any given price, there will be a lower quantity demanded due to the increased cost to the buyer.

What is the original equilibrium price before the tax is implemented?

-The original equilibrium price before the tax is implemented is denoted as 'P' in the transcript.

What is the new equilibrium price after the tax is implemented?

-The new equilibrium price after the tax is implemented is denoted as 'P1', which is lower than the original equilibrium price 'P'.

How much does the tax affect the price?

-The tax results in a price difference of $5 between the original equilibrium price 'P' and the new equilibrium price 'P1'.

Why does the buyer not bear any tax burden according to the transcript?

-The buyer does not bear any tax burden because they continue to pay the same price 'P' after the tax is levied, as the seller absorbs the entire tax through lower ticket prices.

What is the implication of the tax being levied on the buyer?

-The implication of the tax being levied on the buyer is that it affects the demand side of the market, causing the demand curve to shift leftwards and leading to a new equilibrium at a lower price.

Why is the supply curve represented as a vertical line?

-The supply curve is represented as a vertical line because it is perfectly inelastic, indicating that the quantity supplied does not change regardless of the price.

What is the significance of the fixed number of tickets at 38,000?

-The significance of the fixed number of tickets at 38,000 is that it sets a limit on the supply, making the supply curve perfectly inelastic and affecting how the tax impacts the market.

How does the tax impact the seller's revenue?

-The tax impacts the seller's revenue by reducing the equilibrium price from 'P' to 'P1', meaning the seller absorbs the tax through lower ticket prices, effectively reducing their revenue.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)