Taxes and perfectly elastic demand | Microeconomics | Khan Academy

Summary

TLDRThis video explains the effects of a tax on a product with highly elastic demand, using the example of flags made in China. The narrator highlights that even a small price increase will drastically reduce the quantity demanded as buyers can easily switch to substitutes. The introduction of a $5 tax raises the supply curve, reducing the quantity sold from 25,000 to 18,000 flags. The tax burden falls primarily on producers due to the almost perfectly elastic demand, leading to deadweight loss and diminished producer surplus, while consumers experience no surplus loss.

Takeaways

- 📉 The product in question is a flag made in China, with an equilibrium price of $70 and a quantity of 25,000 units demanded per year.

- 🔄 The demand for this product is highly elastic, meaning small changes in price lead to large changes in the quantity demanded.

- 🌍 If the price increases slightly, consumers will substitute with similar products made in Taiwan, Mexico, or the U.S., causing demand for the Chinese-made flag to drop sharply.

- 💸 A $5 tax per flag is proposed, shifting the supply curve upward and increasing the price seen by consumers.

- ⚖️ Despite the tax, the equilibrium price remains around $70, but the quantity demanded decreases significantly to 18,000 flags per year.

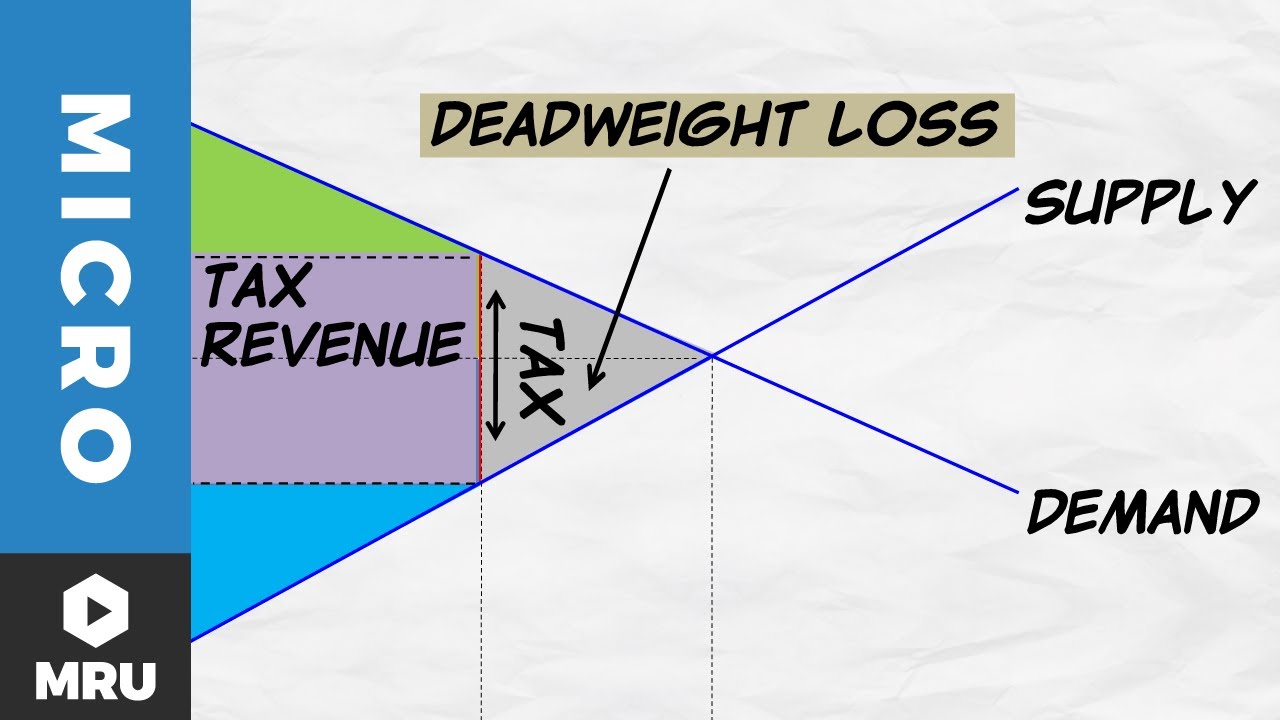

- 📊 The tax revenue generated is $5 per flag multiplied by 18,000 flags, representing the government's earnings from the tax.

- 💼 The producer bears the bulk of the tax burden due to the highly elastic demand, as most of the tax is taken from the producer's surplus.

- 📉 The tax causes a deadweight loss, which is the lost producer surplus not recovered by either the government or consumers.

- 🔍 With almost perfectly elastic demand, there's little to no consumer surplus, meaning consumers are not benefiting from paying less than their maximum willingness to pay.

- 🧮 In this scenario, the entirety of the tax and the loss in surplus is absorbed by the producer, while the consumer remains unaffected in terms of surplus.

Q & A

What happens when the price of the Chinese-made flags increases slightly?

-If the price of the Chinese-made flags increases even slightly, consumers will switch to substitutes, such as flags made in Taiwan, Mexico, or the U.S., as they are indistinguishable from a distance. This results in a significant drop in the quantity demanded.

How does the demand curve for Chinese-made flags behave in the scenario described?

-The demand curve for Chinese-made flags is described as almost perfectly elastic. A small change in price leads to a large change in the quantity demanded.

What is the initial equilibrium price and quantity for the Chinese-made flags?

-The initial equilibrium price is $70 per flag, and the quantity demanded is 25,000 flags per year.

What effect does a tax on Chinese-made flags have on the supply curve?

-A tax on Chinese-made flags shifts the supply curve upwards by the amount of the tax. For example, a $5 tax per flag shifts the supply curve upward by $5 at every price point.

How does the tax affect the equilibrium quantity and price?

-After the tax is applied, the equilibrium quantity decreases from 25,000 to approximately 18,000 flags per year. The equilibrium price remains around $70, as the demand is highly elastic.

Who bears the burden of the tax in this scenario?

-In this scenario with almost perfectly elastic demand, the producer bears the burden of the tax. The tax reduces the producer surplus, as there is little to no consumer surplus in this case.

How is tax revenue calculated in this example?

-The tax revenue is calculated by multiplying the quantity of flags sold (18,000) by the tax amount ($5 per flag), resulting in $90,000 in tax revenue.

What is deadweight loss in this context, and how is it represented?

-Deadweight loss refers to the loss of economic efficiency when the equilibrium quantity is reduced due to the tax. It is represented as the area between the original supply curve and the supply plus tax curve.

What happens to consumer surplus in the case of perfectly elastic demand?

-In the case of perfectly elastic demand, there is no consumer surplus because the marginal benefit to the consumer is always equal to the price they pay. Thus, no surplus exists to be reduced by the tax.

Why does the producer bear the brunt of the tax instead of the consumer?

-Since the demand is almost perfectly elastic, any increase in price causes a significant reduction in the quantity demanded, meaning consumers can easily switch to substitutes. As a result, the producer cannot pass the tax onto the consumer and must absorb it, leading to a reduction in producer surplus.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)