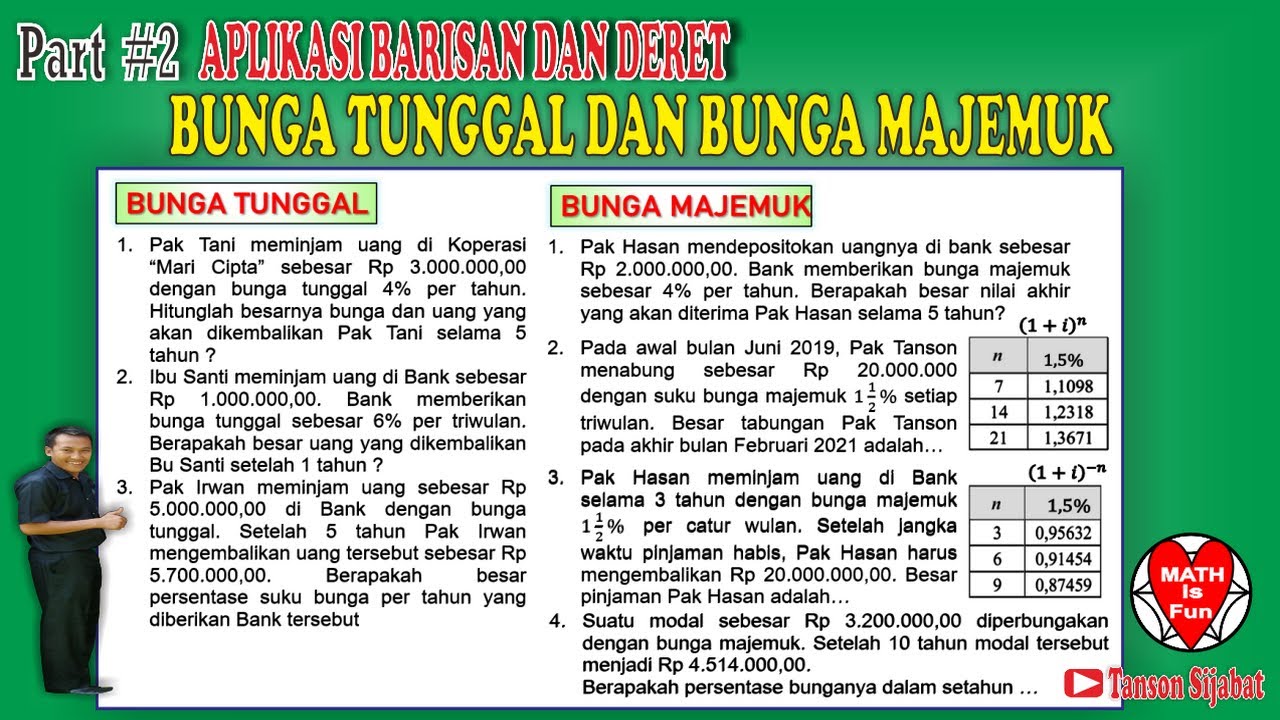

ILLUSTRATING SIMPLE AND COMPOUND INTEREST || GRADE 11 GENERAL MATHEMATICS Q2

Summary

TLDRThis educational video lesson explains the concepts of simple and compound interest, aiming to help viewers understand and differentiate between the two. It defines key terms such as lender, borrower, repayment date, and interest rate. The lesson uses a practical example to compare simple interest, calculated only on the principal, with compound interest, which is calculated on the principal plus accumulated interest. The example illustrates the growth of a 10,000 peso investment over five years at a 2% interest rate, showing that compound interest yields slightly higher returns. The video encourages viewers to share their thoughts on which type of interest they would choose and invites them to engage in the comments section.

Takeaways

- 💼 The video lesson aims to illustrate simple and compound interest, and to distinguish between the two.

- 🏦 A lender or creditor is someone or an institution that provides money or makes funds available for borrowing.

- 📈 Borrower or debtor is the person or institution that owes money or receives funds from the lender.

- 📅 The repayment date or maturity date is the deadline for completely repaying the borrowed money or loan.

- ⏳ The term or time is the duration in years for which the money is borrowed or invested, between the origin and maturity dates.

- 💰 The principal is the amount of money borrowed or invested.

- 📊 The interest rate is the annual rate charged by the lender, usually expressed as a percentage.

- 📈 Simple interest is calculated only on the principal amount, without considering the effect of compounding.

- 🔄 Compound interest is calculated on the principal and also on the accumulated interest from previous periods.

- 💹 The maturity value or future value is the total amount the lender receives from the borrower at the maturity date.

- 💭 The video presents a scenario comparing simple and compound interest for an investment of 10,000 pesos over five years, with different interest rates.

Q & A

What are the objectives of the video lesson on simple and compound interest?

-The objectives are to illustrate simple and compound interest, and to distinguish between the two.

Who is considered a lender or creditor in the context of interest?

-A lender or creditor is a person or institution who invests money or makes funds available, such as someone who lets people borrow money or an investor.

What is the definition of a borrower or debtor?

-A borrower or debtor is a person or institution who owes money or avails of the loan from the lender.

What is meant by the repayment date or maturity date in a loan?

-The repayment date or maturity date is the date on which the borrowed money or loan is to be completely repaid, acting as a deadline or due date.

What does the term 'term' refer to in a financial context?

-In finance, 'term' refers to the amount of time in years that the money is borrowed or invested, or the length of time between the origin and the maturity date.

What is the capital investment rate?

-The capital investment rate is the annual rate, usually in percent, charged by the lender or the rate of increase of the investment.

How is simple interest calculated?

-Simple interest is calculated on the principal amount only, without considering the interest that has been added in previous periods.

What is the difference between simple interest and compound interest?

-Simple interest is calculated only on the principal, whereas compound interest is calculated on the principal plus any accumulated interest from previous periods.

What is the maturity value or future value in the context of loans?

-The maturity value or future value is the total amount the lender receives from the borrower on the maturity date, which includes both the principal and the interest.

If you invest 10,000 pesos for five years at a simple interest rate of 2% per year, how much will you earn?

-At a simple interest rate of 2% per year, investing 10,000 pesos for five years will earn you 1,000 pesos in interest.

If you invest 10,000 pesos for five years at a compound interest rate of 2% per year, how much will you earn?

-At a compound interest rate of 2% per year, investing 10,000 pesos for five years will result in a total amount of 11,040.81 pesos after five years.

Why would someone choose to invest in a compound interest account over a simple interest account?

-Investing in a compound interest account is generally more beneficial because the interest earned also earns interest, leading to higher returns over time compared to simple interest.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)