Monetary Policy UK Themes - HOT TOPIC for Paper 2! Must Watch 🔥

Summary

TLDRThis video discusses the UK's monetary policy, focusing on the shift from expansionary measures during the COVID-19 pandemic to current contractionary policies. It reviews the Bank of England's response to the economic crisis, including cutting interest rates and implementing quantitative easing, which led to high inflation. The video also examines the bank's delayed reaction to rising inflation and its subsequent rate hikes. It debates the effectiveness of these policies in curbing inflation, their impact on growth, unemployment, and living standards, and considers whether it's time to cut rates amid ongoing economic challenges.

Takeaways

- 📉 The UK has transitioned from expansionary to contractionary monetary policy in response to economic conditions.

- 🏥 During the COVID-19 pandemic, the Bank of England implemented an expansionary monetary policy, cutting interest rates to a historic low of 0.1% and conducting £495 billion in quantitative easing.

- 💹 The initial response to COVID-19 aimed to boost AD, increase growth, reduce unemployment, and combat the recession, but also led to high inflation.

- 🚫 Banks were initially hesitant to lend due to uncertainty about the post-pandemic economic landscape.

- 📈 The large-scale quantitative easing sowed the seeds for high inflation, which peaked at 11.1% in October 2022.

- ⬆️ In response to rising inflation, the Bank of England raised interest rates from 0.1% to 5.25% and initiated quantitative tightening.

- 🔍 The Bank of England was slow to react to inflation, initially downplaying concerns before taking action in December 2021.

- 📉 The contractionary monetary policy has contributed to stagnating growth and rising unemployment in the UK.

- 💸 Higher interest rates have had a negative impact on indebted households and businesses, potentially leading to bankruptcies and reduced living standards.

- 🏦 The rapid increase in interest rates has also affected banks, with some experiencing failures due to borrowers' inability to repay debts.

Q & A

What is the current stance of the UK's monetary policy?

-The UK is currently using contractionary monetary policy to combat high inflation.

What was the Bank of England's response to the economic crisis during COVID-19?

-The Bank of England implemented expansionary monetary policy, cutting interest rates to 0.1% and conducting £495 billion worth of quantitative easing.

What were the intentions behind the expansionary monetary policy during the COVID-19 pandemic?

-The intentions were to boost economic growth, reduce unemployment, fight against the recession, and promote economic recovery, as well as to prevent deflation.

What were some of the concerns with the expansionary monetary policy during COVID-19?

-Banks were initially reluctant to lend due to uncertainty, and the policy led to high inflation, which peaked at 11.1% in October 2022.

How did the Bank of England respond to rising inflation post-COVID?

-The Bank of England raised interest rates from 0.1% to 5.25% and began quantitative tightening to reduce the money supply and increase bond interest rates.

What has been the impact of contractionary monetary policy on inflation?

-Inflation has come down to 3.2%, but it took a long time and recent drops may be due to easing supply-side factors like the war in Ukraine rather than solely monetary policy.

What are some of the positive outcomes of raising interest rates according to the script?

-Higher interest rates have reduced household debt and insolvencies, promoted saving, and moved the UK economy towards more sustainable growth.

What are the negative consequences of contractionary monetary policy mentioned in the script?

-The policy has contributed to stagnating growth, rising unemployment, and a decrease in living standards, especially during the cost of living crisis.

How have high interest rates affected businesses and households financially?

-High interest rates have increased the risk of bankruptcy for indebted households and businesses, and reduced disposable income for mortgage holders by up to 20%.

What is the current debate regarding interest rates in the developed world?

-There is a debate on whether it's time to start cutting interest rates due to the negative consequences, but the primary concern remains inflation, suggesting it's too early to reduce rates.

Why did the Bank of England initially downplay the threat of inflation in summer 2021?

-The Bank of England initially stated that inflation was not a significant threat and would self-correct, only to change their stance in December 2021 and raise interest rates due to rising inflation.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

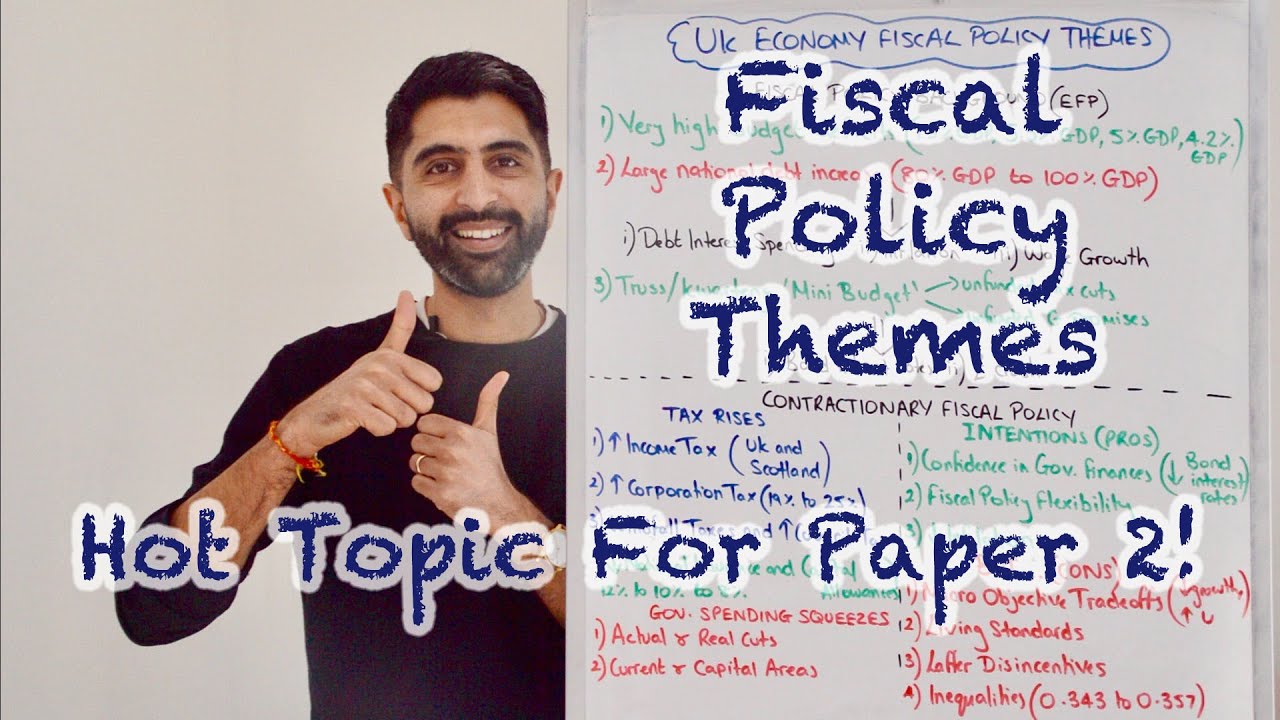

UK Fiscal Policy Themes - HOT TOPIC for Paper 2! Must Watch 🔥

KEBIJAKAN FISKAL DAN MONETER

Y1 30) Fiscal Policy - Government Spending and Taxation

Whatever-It-Takes Policymaking during the Pandemic | Economics, Applied

Macroeconomics Unit 5 COMPLETE Summary - Policy Consequences - 2025 Update

Pengantar Ekonomi Makro - Pengaruh Kebijakan Moneter dan Fiskal terhadap Permintaan Agregat

5.0 / 5 (0 votes)