Financial Accounting Chapter-4 | Trial Balance | BCom/BBA 1st Year | CWG for BCOM

Summary

TLDRThe script is a detailed lecture on financial accounting, focusing on the trial balance as part of basic financial accounting. It explains the importance of understanding the principles and conventions of accounting, the process of recording transactions in the general ledger, and the creation of the trial balance to identify any arithmetic errors. The lecture also covers the preparation of financial statements, including the trading, profit and loss, and balance sheets, as well as the cash flow statement. The instructor emphasizes the significance of accurate posting in the ledger and the use of the trial balance to ensure the accuracy of financial records.

Takeaways

- 📚 The session is part of a financial accounting course, focusing on the basics of financial accounting.

- 🔑 Introduction to Accounting was covered initially, explaining the principles, conventions, and terminology of accounting.

- 📝 The importance of General Entry and Ledger were discussed, emphasizing that without understanding General Entry, one cannot manage Ledger effectively.

- ✅ The process of recording transactions in the General Journal was taught, which is crucial before moving on to the Ledger.

- 🚫 The讲师 made it clear that without completing the Ledger, one cannot proceed to create the Trial Balance, which is a prerequisite for final accounts.

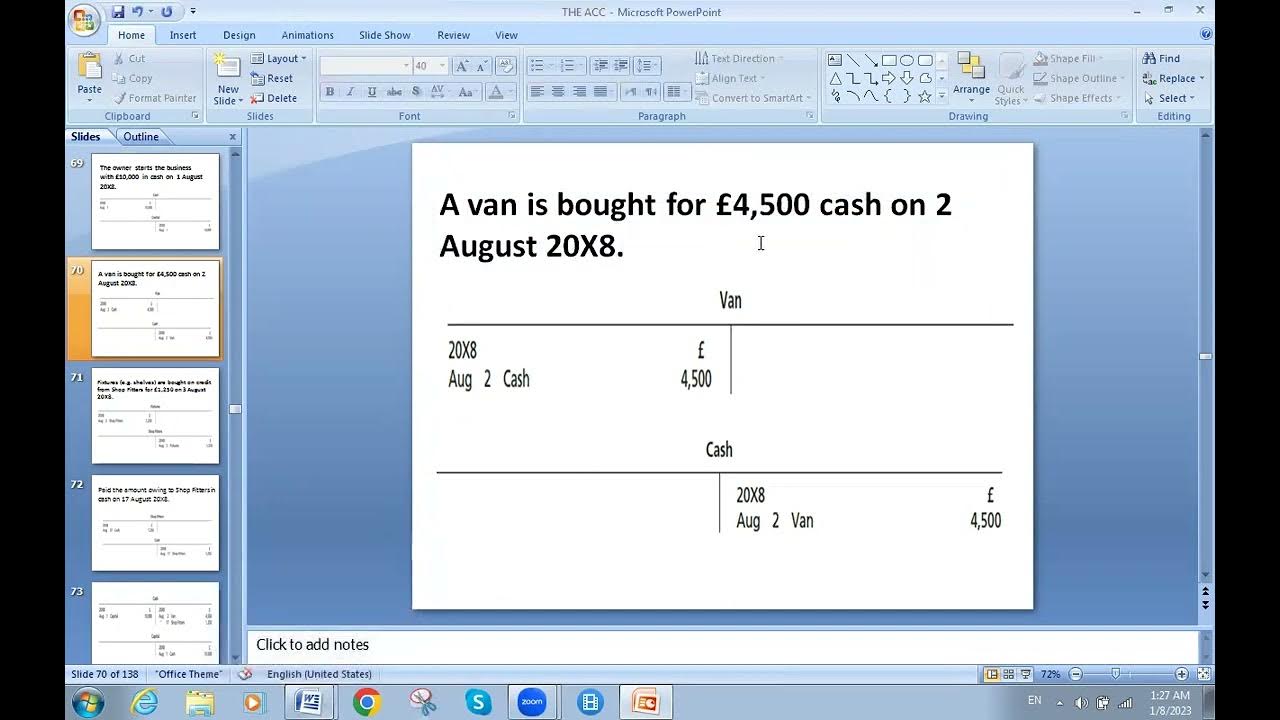

- 📊 The Trial Balance serves as a statement showing the balances and totals of debit and credit sides to check for arithmetic errors in the Ledger or General Journal.

- 📋 The Trial Balance format was explained, including columns for debit, credit, account names, and other relevant details.

- 🔍 Two methods for preparing the Trial Balance were mentioned: the Total Method and the Balance Method, with the Balance Method being commonly used.

- 📝 The process of posting from the Ledger to the Trial Balance was described, highlighting the need to correctly transfer debit and credit amounts to ensure accuracy.

- 🧐 The lecturer pointed out potential areas where arithmetic errors might occur and how the Trial Balance helps in identifying them.

- 🔚 The session concluded with a discussion on how the Trial Balance is an essential step towards finalizing financial statements and ensuring the accuracy of accounting records.

Q & A

What is the purpose of creating a trial balance in financial accounting?

-The purpose of creating a trial balance is to verify that the total debits equal the total credits, ensuring that there are no arithmetic errors in the ledger postings, which is a fundamental aspect of the double-entry accounting system.

What is the significance of the double-entry accounting system in the context of the trial balance?

-In the double-entry accounting system, every transaction has two effects, which are recorded as one debit and one credit. The trial balance is used to ensure that these debits and credits are correctly balanced, reflecting the accuracy of the financial records.

Why is it important to understand the introduction to accounting before delving into trial balances?

-Understanding the introduction to accounting is crucial because it covers the fundamental principles, conventions, and terminology that are essential for comprehending more complex topics like general entries and trial balances, which are prerequisites for creating a ledger and ultimately a trial balance.

How does the process of posting from the general journal to the ledger affect the trial balance?

-Posting from the general journal to the ledger involves transferring the recorded transactions into the ledger accounts. This process affects the trial balance as it influences the debit and credit balances that are used to determine if the total debits equal the total credits.

What is the role of the ledger in the creation of a trial balance?

-The ledger plays a critical role in the creation of a trial balance as it contains the account balances that are used to prepare the trial balance. The ledger accounts are where all the debit and credit transactions are posted, and their balances are then used to check the accounting equation's validity.

What are the two methods mentioned for preparing a trial balance, and which one is commonly used?

-The two methods mentioned for preparing a trial balance are the Total Method and the Balance Method. The Balance Method is commonly used because it involves considering only the balances of the accounts, which is a more straightforward and accurate way to ensure the trial balance is correct.

How does the trial balance help in identifying arithmetic errors in the ledger?

-The trial balance helps in identifying arithmetic errors by comparing the total debits and total credits. If the totals do not match, it indicates that there is an arithmetic error somewhere in the ledger postings that needs to be corrected.

What is the significance of the suspense account in the context of the trial balance?

-The suspense account is significant in the context of the trial balance because it is used to record any differences between the total debits and total credits that cannot be immediately explained. This account helps in identifying and later resolving any discrepancies found during the trial balance process.

What is the role of the 'total method' in preparing a trial balance, and how does it differ from the 'balance method'?

-The total method in preparing a trial balance involves listing the total amounts for both debits and credits for each account, whereas the balance method lists only the account balances. The total method is less commonly used because it does not directly indicate whether the account balances are correct, unlike the balance method.

How does the process of creating a trial balance contribute to the finalization of financial statements?

-Creating a trial balance is a crucial step in finalizing financial statements because it ensures that all transactions are accurately recorded and that the accounting equation (assets = liabilities + owner's equity) holds true. This verification process helps in preparing accurate and reliable financial statements, such as the income statement and balance sheet.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآن5.0 / 5 (0 votes)