PH needs to adapt on changing global economy — analyst

Summary

TLDRThe Philippine government faces the challenge of adapting to the shifting global economy after being labeled as one of the 'troubled ten' emerging markets by Nomura. Vulnerable to monetary policy changes in the US and China, the country's economy could be impacted by debt issues, capital flight, and fiscal deficits. Financial analyst Astro del Castillo expresses confidence in the government's ability to manage these challenges and advises seeking alternative funding sources. Economic managers remain optimistic about the economy's recovery to pre-pandemic levels by the end of 2022 or early 2023.

Takeaways

- 🌐 The Philippine government, especially the economic managers, are urged to adapt to the changing global economy.

- 📉 The country has been identified as part of the 'troubled markets' due to vulnerability to shifts in monetary policy in the United States and China.

- 💼 Financial analyst and economist Astro del Castillo suggests that Banco Central Pilipinas must adjust to these global economic changes.

- 🏦 Nomura, Japan's global investment bank, has labeled the Philippines as one of the 'troubled ten' emerging markets.

- 💡 The potential for monetary policy normalization in the U.S. and China's economic growth could make these economies particularly susceptible to debt issues, capital flight, and fiscal challenges.

- 🔍 Nomura's chief economist, Rob Subharaman, has highlighted the vulnerability of the ten economies to these economic risks.

- 📉 Despite the challenges, del Castillo is confident in the government's ability to manage debt and other economic indicators.

- 💡 He advises the president's administration to seek alternative funding sources to bolster the economy.

- 📈 Economic managers are optimistic about the Philippine economy returning to pre-pandemic levels by the end of 2022 or early 2023.

- 🎙️ The report by Arlene Del Mar and Behold provides a live update on the economic situation and government response.

Q & A

What is the main concern for the Philippine government regarding the global economy?

-The main concern is the need to adapt to the changing global economy, especially as the Philippines has been included as one of the troubled markets vulnerable to changes in monetary policy in the United States and China.

What impact can changes in monetary policy have on foreign investors' investment portfolios?

-Changes in monetary policy can have a significant impact on investment portfolios of foreign investors, potentially affecting their investment decisions and the attractiveness of the market.

Why does Banco Central Pilipinas need to adjust to the changing global economies?

-Banco Central Pilipinas needs to adjust to ensure the stability of the Philippine economy and to mitigate the risks associated with global economic fluctuations.

Which financial institution has identified the Philippines as one of the 'troubled ten emerging markets'?

-Nomura, Japan's global investment bank, has tagged the Philippines as one of the 'troubled ten emerging markets'.

What are the potential consequences of normalizing monetary policy in the United States and China for the Philippines?

-The potential consequences include vulnerability to debt problems, capital flight, and large fiscal and current account deficits.

What is Astro Del Castillo's view on the government's ability to manage the debt and other economic indicators?

-Astro Del Castillo is confident that the government can manage the debt and other indicators that can affect the economy.

What advice did Astro Del Castillo give to the president administration regarding economic management?

-He advised the president administration to look for other sources of funds due to the growing need for a government's confidential response.

What is the economic outlook expressed by the economic managers for the Philippine economy?

-The economic managers are optimistic that the economy will be back at pre-pandemic levels before the year 2022 ends or early 2023.

What is the significance of the 'troubled ten emerging markets' label for the Philippines?

-The label indicates that the Philippines is among the economies that are particularly at risk due to global economic shifts, requiring careful economic management and strategy.

What role does the Philippine government play in ensuring economic stability amidst global economic changes?

-The Philippine government, particularly the economic managers, play a crucial role in adapting policies and strategies to navigate the changing global economy and safeguard the nation's financial health.

What measures can the Philippine government take to reduce vulnerability to global economic changes?

-The government can diversify its sources of funds, improve fiscal management, and implement policies that promote economic resilience and reduce dependence on external economic factors.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

KELOMPOK 6 | EKONOMI INTERNASIONAL KELAS A EP 23

China Menutup Seluruh Industri Kanada Dalam Semalam

Institutional Voids in Emerging Markets Explained: A 6-Minute Overview

What is an emerging market? | CNBC Explains

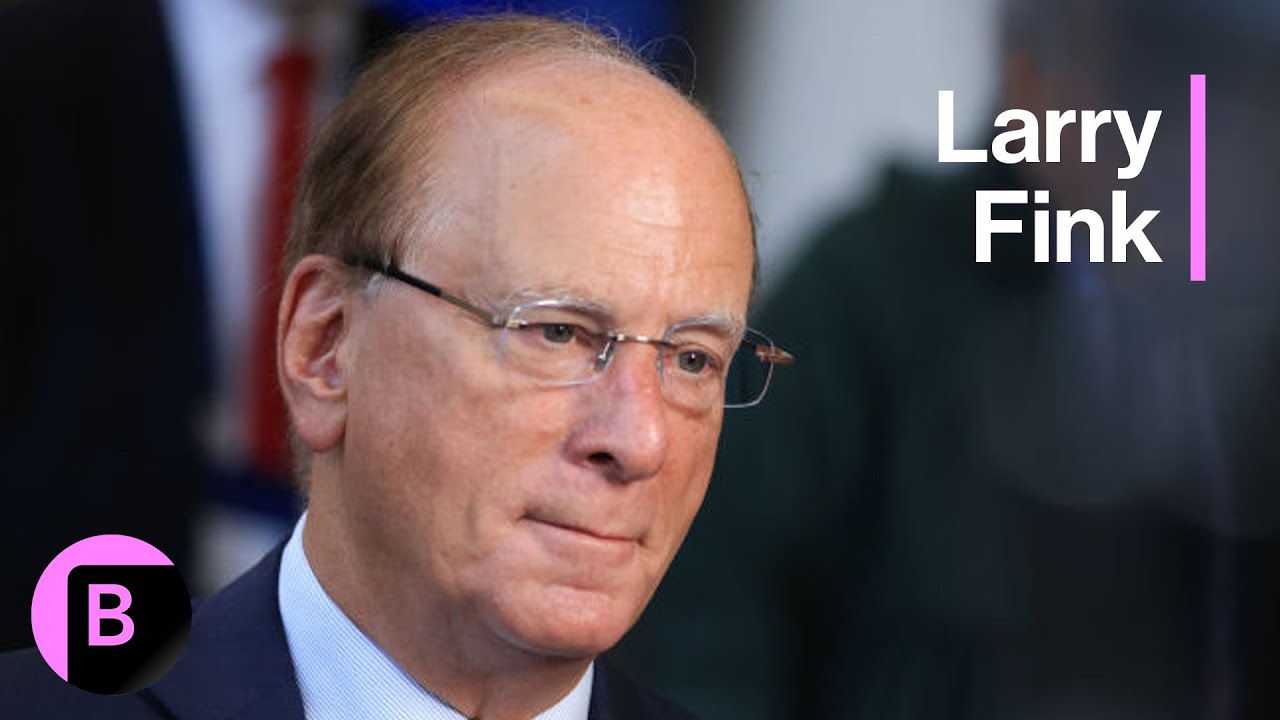

BlackRock CEO Larry Fink on US Economy, Trump Vs. Harris, Geopolitical Risks (Full Interview)

Why Is Russia's Economy Growing?

5.0 / 5 (0 votes)