Learn Where Traders are Positioned & Add an Extra Edge to Your Strategy - How to Read COT Charts

Summary

TLDR在这段视频中,Jason Shapiro 从 crowdedmarketreport.com 介绍了如何阅读和理解期货市场中的持仓报告(COT)图表。他解释了市场参与者分为商业对冲者、大投机者和小投机者三种类型,并强调了市场极端情况下投机者仓位的重要性。Shapiro 通过木材和铜的例子,展示了如何使用COT图表来发现交易机会,同时强调了市场确认的重要性以及风险管理在交易中的必要性。

Takeaways

- 📈 视频讲述了如何阅读和理解COT(持仓比率)图表,这对于那些新关注者来说可能是基础内容。

- 🏦 COT图表展示了期货市场中的三类参与者:商业对冲者、大投机者和小投机者,由CFTC分类。

- 📊 视频通过木材期货的例子,解释了在市场转折点如何使用COT图表来识别交易机会。

- 📉 作者强调,当大投机者极度看空时,可能是买入的好时机,但这需要市场确认,不能仅凭COT图表做交易决策。

- 📝 COT数据是免费的,可以从CFTC下载,但作者认为现有的图表可视化和功能性不足,因此创建了自己的图表。

- 💡 作者提到,COT图表可以帮助识别风险回报比高的交易,并帮助避免麻烦。

- 🔍 视频提到,COT图表不仅仅是短期的,还可以查看多年的历史数据,以更全面地评估市场极端情况。

- 🤔 作者提醒,没有完美的数据,COT图表也有局限性,需要结合市场确认和其他指标一起使用。

- 📊 视频还提到了其他商品如铜和NASDAQ的COT图表,展示了不同市场和不同时间的投机者持仓情况。

- 📉 NASDAQ的COT图表显示,当前投机者极度看空,与市场上涨趋势形成对比,这可能是一个值得关注的信号。

- 📈 作者最后强调,交易不仅仅是技术分析,还包括风险管理、止损设置等,没有万能的方法,需要综合考虑。

Q & A

什么是COT报告,它在交易中有什么作用?

-COT报告,即持仓报告,由美国商品期货交易委员会(CFTC)发布,显示了期货市场中各类参与者的持仓情况。它帮助交易者了解市场结构,包括商业对冲者、大投机者和小投机者的持仓分布,从而分析市场情绪和可能的转折点。

COT报告中,红色、蓝色和黄色分别代表什么?

-在COT报告中,红色代表商业对冲者的持仓,蓝色代表大投机者的持仓,黄色代表小投机者的持仓。

为什么商业对冲者和投机者的持仓加起来的净仓位可能是零?

-因为期货市场中的每个多头仓位都有一个对应的空头仓位,所以当投机者持仓极度偏向空头时,商业对冲者则可能极度偏向多头,使得净仓位可能为零。

为什么说商业对冲者是'聪明钱'?

-商业对冲者通常是基于实际的供需关系进行交易,比如农民为了对冲作物价格波动而进行期货交易。市场有时认为他们的交易行为能反映市场基本面,因此被称为'聪明钱'。

为什么说投机者进入市场是为了从对冲者那里赚取利润?

-投机者利用市场的波动来获取利润,而对冲者通过期货市场来减少价格波动的风险。长期来看,对冲者可能因为对冲成本而亏损,投机者则试图通过预测市场走势来赚取这部分成本。

如何使用COT报告来判断市场转折点?

-当大投机者的持仓达到极端水平时,比如极度做空,这可能预示着市场转折点的到来。交易者可以利用这一点来寻找买入机会,但需要结合市场确认信号,如基本面或技术指标的变化。

COT报告中的数据可以追溯到多久以前?

-COT报告的数据可以根据需要追溯到不同的时间,比如一年、五年、十年甚至更久。这有助于交易者从不同时间尺度上分析市场行为。

为什么COT报告不能单独作为交易依据?

-尽管COT报告提供了市场持仓的深入信息,但它不能单独作为交易依据,因为它不包含所有影响市场价格的因素。交易者需要结合其他市场信息和个人分析来做出交易决策。

如何结合COT报告和其他市场信息来提高交易效率?

-交易者可以将COT报告中的持仓信息与其他市场分析工具结合使用,比如技术分析、基本面分析和宏观经济指标,以获得更全面的市场视角,从而提高交易决策的质量。

COT报告中的持仓数据如何帮助交易者管理风险?

-通过了解市场持仓分布,交易者可以识别可能的风险区域,比如当大多数投机者都持有同一方向的仓位时,市场可能会出现剧烈波动。这有助于交易者设定合理的止损和风险管理策略。

视频中提到的木材期货市场的例子说明了什么?

-视频中的木材期货市场例子说明了COT报告如何帮助交易者识别市场转折点。当大投机者极度做空时,市场出现了底部,随后价格大幅上涨,这验证了COT报告在分析市场情绪和寻找交易机会方面的价值。

为什么说交易不仅仅是科学,也是艺术?

-交易不仅仅是基于数据和分析的科学,它也涉及到直觉、经验和市场感知的艺术性。交易者需要将定量分析与定性判断相结合,以适应市场的不断变化。

视频中提到的NASDAQ的例子说明了什么?

-NASDAQ的例子说明了即使在市场持续上涨的情况下,投机者也可能极度做空。这种情况可能预示着市场情绪的极端化,为交易者提供了潜在的交易机会。

如何通过COT报告识别市场的过度投机行为?

-通过观察COT报告中投机者的持仓水平,如果发现他们在某一种资产上极度偏向多头或空头,这可能表明市场存在过度投机行为,交易者可以利用这一点来寻找可能的逆向交易机会。

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

CMR Member Guide: TradingView Indicators

【手把手教學】如何用AI做睡前故事,月入1w美金,引流特定用戶 Earn Money With AI By Faceless Kids Bedtime Story Video

"That Fight Was EPIC!" | TYSON FURY vs USYK INSTANT REACTION!

莫言侮辱英烈了吗?|莫言|说真话的毛星火|胡锡进|侮辱英烈|起诉|红高粱家族|丰乳肥臀|诺贝尔文学奖|文革|刘晓波|王局拍案20240304

The "Male Gaze" is Why You're Ugly

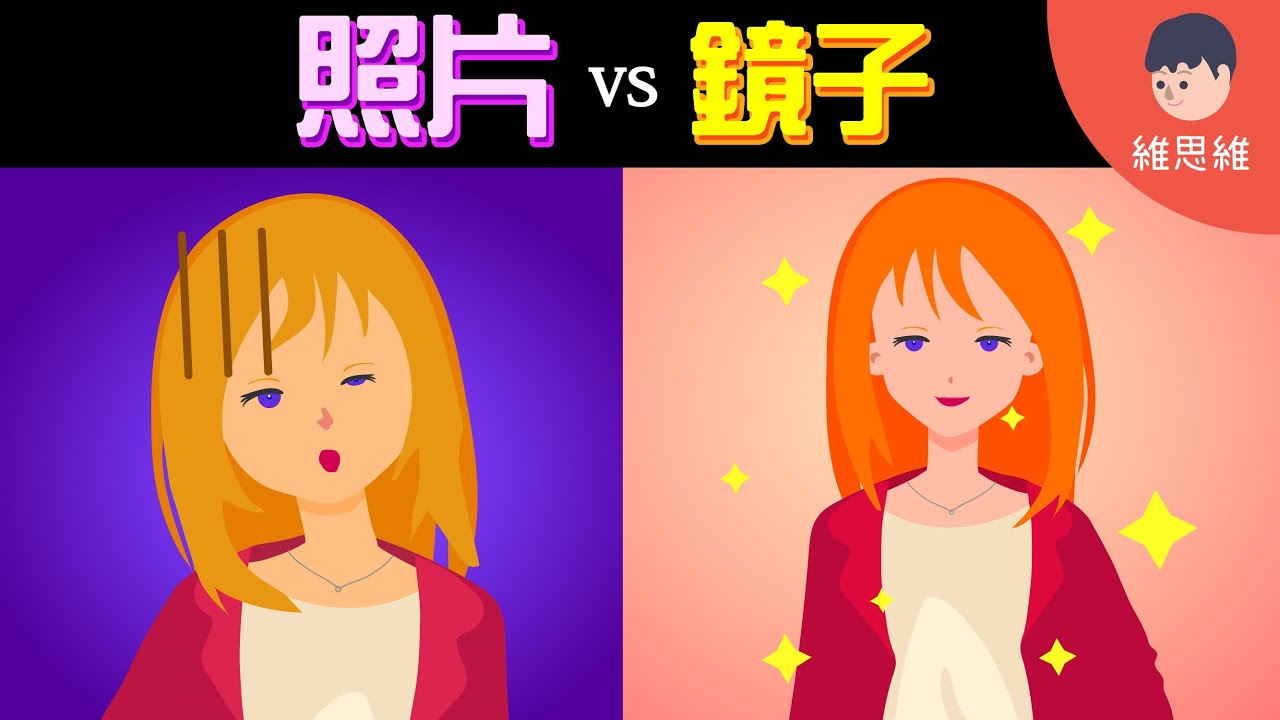

為什麼鏡子裡的你比照片好看? 哪個才是你真實的樣子?【生活】(#CC字幕) | 維思維

5.0 / 5 (0 votes)