5 Scalping SECRETS that can Grow SMALL Forex Accounts FAST

Summary

TLDRThis video reveals five sculpting secrets for rapid trading account growth through scalping. It emphasizes eliminating mistakes, using key levels for strategic trades, focusing on quality over quantity of trades, applying progressive overload to increase lot size gradually, and committing to daily improvement. The speaker shares personal experiences and strategies, aiming to guide viewers from novice to successful, profitable traders.

Takeaways

- 🛑 Eliminate Mistakes: To become a successful trader, it's crucial to identify and stop repeating the same mistakes, which are often the root cause of losses.

- 📊 Use Key Levels: Trading should not be random; instead, focus on key levels such as trend lines, support and resistance, or supply and demand zones for more strategic entries.

- 🎯 Focus on Quality Over Quantity: It's better to take fewer, well-thought-out trades rather than numerous poor-quality trades. Aim for precision like a sniper rather than overtrading.

- 🌱 Build Skills for Long-Term Success: Developing trading skills is more important than immediate profits. As skills improve, profitability will naturally follow.

- 💡 Learn from Experience: Apply what you learn about trading to gain experience, making trading decisions more instinctive and effective over time.

- 🏋️ Progressive Overload: Just like in fitness, slowly increase your trading lot size to challenge yourself and grow your account without risking too much too soon.

- 🚫 Avoid Emotional Trading: Don't let emotions like revenge or anger dictate your trading decisions. Maintain discipline and a clear, rational approach.

- 🔄 Continuous Improvement: Every day is a new opportunity to improve. Learn from past mistakes and strive to make the next day better than the last.

- 💰 Money is a Byproduct: Focus on becoming a skilled trader first; financial success will come as a result of your expertise and not the other way around.

- 🌐 Freedom and Fame as Side Effects: Successful trading can lead to various types of freedom and potentially fame, but these should not be the primary focus.

- 🎓 Invest in Yourself: Your circumstances do not define you. There's always a chance to improve your situation, whether it's through work, learning, or trading.

Q & A

What are the five sculpting secrets mentioned in the video for growing a trading account quickly?

-The five secrets are: 1) Eliminate mistakes, 2) Use key levels for trading, 3) Take the right trade focusing on quality over quantity, 4) Apply progressive overload by slowly increasing lot size, and 5) Improve every day by learning from mistakes and making tomorrow better than yesterday.

Why is eliminating mistakes important for becoming a successful trader?

-Eliminating mistakes is crucial because the fewer mistakes you make, the closer you are to becoming a successful trader. It helps in reducing losses and moving towards the success line, which represents profitability and consistency in trading.

What are some common mistakes made by traders that were highlighted in the video?

-Some common mistakes include revenge trading after a losing streak, forcing trades when there are no opportunities, and using a lot size that is too large for the account, which can lead to blowing the account.

What is a 'supply and demand zone' and how is it used in trading?

-A supply and demand zone represents areas of aggressive buying and selling in the market. Supply zones are identified by multiple red candlesticks indicating selling pressure, and demand zones by multiple green candlesticks showing buying pressure. Traders wait for the price to return to these zones to enter trades.

Why is focusing on the quality of trades rather than the quantity important for a trader?

-Focusing on quality over quantity helps in building trading skills and ensures that each trade taken is based on opportunity rather than the compulsion to trade every day. This approach leads to a more disciplined and profitable trading strategy.

What does the term 'progressive overload' mean in the context of trading?

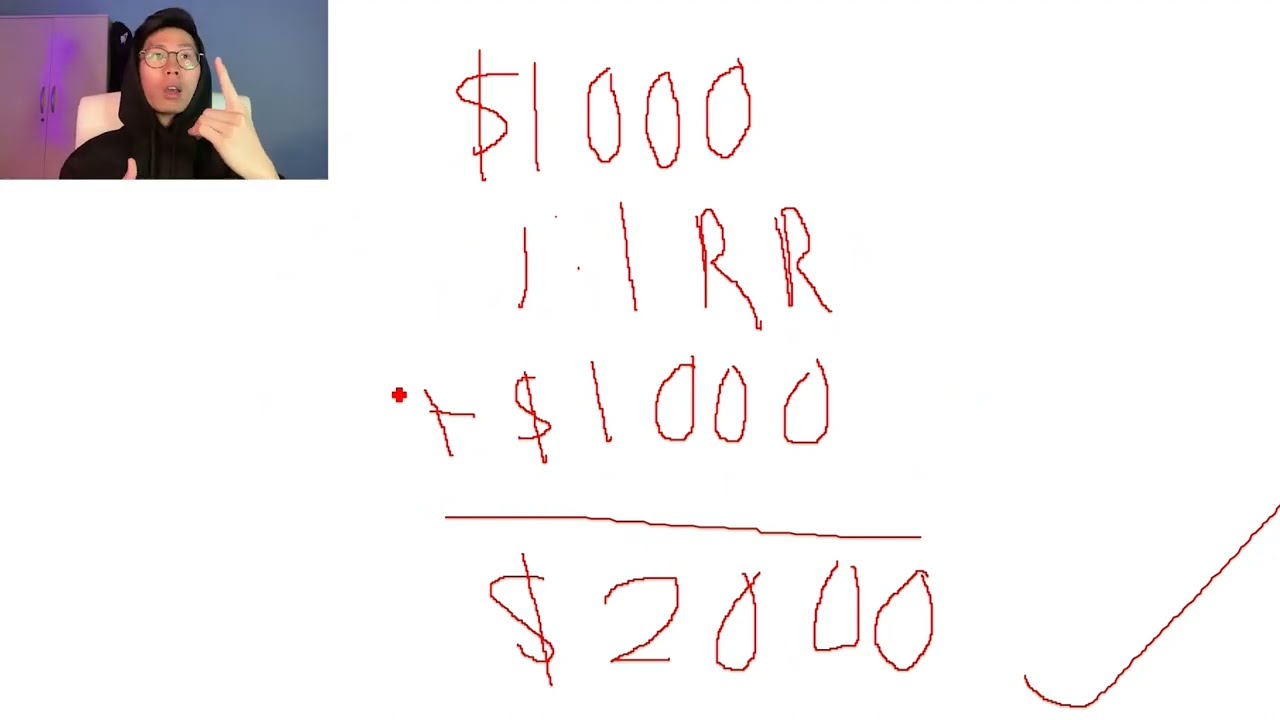

-In trading, 'progressive overload' refers to the strategy of slowly increasing the lot size as you gain experience and confidence. This concept helps in managing risk and growing the trading account steadily without rushing the process.

How does the concept of progressive overload apply to a small trading account?

-For a small trading account, progressive overload means gradually increasing the lot size to challenge the account and grow it without taking on too much risk at once. It's about steady growth and avoiding large, risky jumps in lot size that could lead to significant losses.

What are the three main types of freedom mentioned in the video that a successful trader can experience?

-The three main types of freedom are location freedom, time freedom, and financial freedom. Location freedom allows working from anywhere, time freedom provides flexibility in work hours, and financial freedom comes from the profits made through successful trading.

Why should a trader not focus on making money as the primary goal when starting out?

-Focusing on making money as the primary goal can lead to rushed decisions and increased risk-taking, which may result in losses. Instead, a trader should focus on building skills, discipline, and a solid trading strategy, after which money will naturally follow as a byproduct of success.

What is the advice given in the video for someone who feels they cannot change their current situation in trading?

-The advice is to not view one's life or situation as fixed. There is always the opportunity to improve and change circumstances, such as by getting a job to increase income for trading or by learning from past mistakes to trade better in the future.

How does the video suggest traders should approach their mindset after making a mistake or losing money on a trade?

-The video suggests that traders should view life as a video game where mistakes are part of the learning process. They should not dwell on past errors but instead learn from them and focus on making the next day better, improving their trading skills and mindset continuously.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

How to Grow Small Trading Accounts FAST in 2024

5 SECRETS Prop Firms don’t want you to KNOW (2024)

How to Grow SMALL Forex Account with little money (No Bullsh*t Guide)

2025 FRESH MACD Buy and Sell 1 minute Scalping | Buy and Sell Indicator

1 Minute SCALPING STRATEGY Makes $100 Per Day (BUY/SELL Indicator)

7 Secrets Funded Traders NEED to Know

5.0 / 5 (0 votes)