THIS Is How The US Losing Reserve $ Status Could Play Out

Summary

TLDRThe transcript discusses the US dollar's role as a global reserve currency and the potential consequences of its weaponization through deficit spending and inflation. It highlights the 'exorbitant privilege' the US enjoys, which has led to a wealth transfer from the world to the US. However, this privilege is at risk of being lost if a reasonable alternative emerges, as nations like China and Russia seek to de-dollarize. The speaker emphasizes the powerful network effect of the dollar and suggests that a decline in dollar-denominated debt could signal the beginning of the end for the dollar's reserve status. The impact of sanctions on Russia following the invasion of Ukraine is also mentioned, suggesting that these actions may have accelerated the process of de-dollarization.

Takeaways

- 💵 The U.S. dollar has been weaponized, leading to massive deficit spending and currency expansion.

- 🌐 Inflation and currency dilution affect global purchasing power, impacting all holders of dollars worldwide.

- 💰 The U.S. has enjoyed an 'exorbitant privilege' due to the dollar being the global reserve currency, as noted by Charles de Gaulle.

- 🔄 There is a significant wealth transfer from the world to the U.S. due to the dollar's status, which is now being abused.

- 🌐 The global reserve status of the dollar is threatened by the lack of a reasonable alternative, with countries like China and Russia seeking alternatives.

- 🔗 The strength of the dollar is attributed to its powerful network effect, similar to tech giants like Facebook and Google.

- 📉 The decline of the dollar as a reserve currency could be indicated by a decrease in global dollar-denominated debt.

- 🏦 The global financial system heavily relies on banks creating dollar-denominated debt, which sustains the demand for dollars.

- 🚫 The U.S.'s use of sanctions, particularly against Russia following the invasion of Ukraine, has demonstrated the weaponization of the dollar.

- 🌐 The potential for countries to reject paying in dollars, especially in the face of U.S. sanctions, could accelerate de-dollarization.

Q & A

What does the term 'weaponizing the dollar' refer to in the context of the script?

-The term 'weaponizing the dollar' refers to the use of economic sanctions and financial measures by the United States to exert pressure on other countries, particularly in response to political or military actions, such as the sanctions imposed on Russia following the invasion of Ukraine.

What is the concept of 'exorbitant privilege' mentioned by Charles de Gaulle?

-The 'exorbitant privilege' is a term used to describe the unique advantage the United States enjoys because the US dollar is the world's primary reserve currency, allowing the US to borrow more easily and at lower costs, and to print money without the same inflationary consequences that other countries might face.

How does the expansion of the currency supply relate to inflation and the dilution of purchasing power?

-When a country expands its currency supply, it can lead to inflation, which erodes the purchasing power of the currency. This means that each unit of currency can buy fewer goods and services, effectively 'stealing' purchasing power from those holding the currency.

What is the significance of the 'network effect' in the context of the global monetary system?

-The 'network effect' in the context of the global monetary system refers to the strength and influence of the US dollar due to its widespread use and acceptance in international trade and finance. This creates a self-reinforcing cycle where more use leads to greater stability and value.

Why might countries seek an alternative to the US dollar as the global reserve currency?

-Countries might seek an alternative to the US dollar to avoid the risks and consequences of US unilateral actions, such as sanctions, and to diversify their financial systems, reducing reliance on a single currency that can be subject to political and economic pressures.

What role does dollar-denominated debt play in maintaining the US dollar's status as a global reserve currency?

-Dollar-denominated debt is a significant factor in maintaining the US dollar's status because it creates ongoing demand for dollars to service and repay that debt, reinforcing the currency's importance in international finance.

How could a decrease in dollar-denominated debt impact the US dollar's reserve status?

-A decrease in dollar-denominated debt could signal a reduction in the global demand for US dollars, potentially weakening the currency's reserve status as countries and institutions require fewer dollars for transactions and debt servicing.

What was the unprecedented action taken by the United States against Russia's Central Bank assets?

-In response to Russia's invasion of Ukraine, the United States imposed sanctions that included freezing Russia's Central Bank assets denominated in US dollars, effectively taking control of these assets and demonstrating the potential risks of holding US dollar reserves.

What are the potential long-term consequences of the US 'weaponizing the dollar' for its reserve status?

-The long-term consequences could include a loss of trust in the US dollar as a stable and reliable reserve currency, leading to a faster transition towards de-dollarization and the adoption of alternative reserve currencies or financial systems.

How do 'cross currents' in the global economy relate to the stability or decline of the US dollar?

-The 'cross currents' refer to various economic and political factors that can either support or undermine the US dollar's position. The balance of these factors determines whether the dollar's status strengthens or weakens over time.

What is the potential impact of countries refusing to pay their dollar-denominated debts on the US dollar?

-If countries refuse to pay their dollar-denominated debts, it could lead to a loss of confidence in the US dollar, increased financial instability, and potentially accelerate the process of de-dollarization.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Why The U.S. Dollar May Be In Danger

BRICS Tariff Could Destroy The Dollar (Hedge With Gold & Silver)

🚨 DOLLAR CRASH & END OF EMPIRE: Iran War, Dollar's Loss of Reserve Status, Propaganda | Dr. Ron Paul

Почему евро не заменит доллар

Saudi Arabia Just Ditched The US Dollar (How This Affects You)

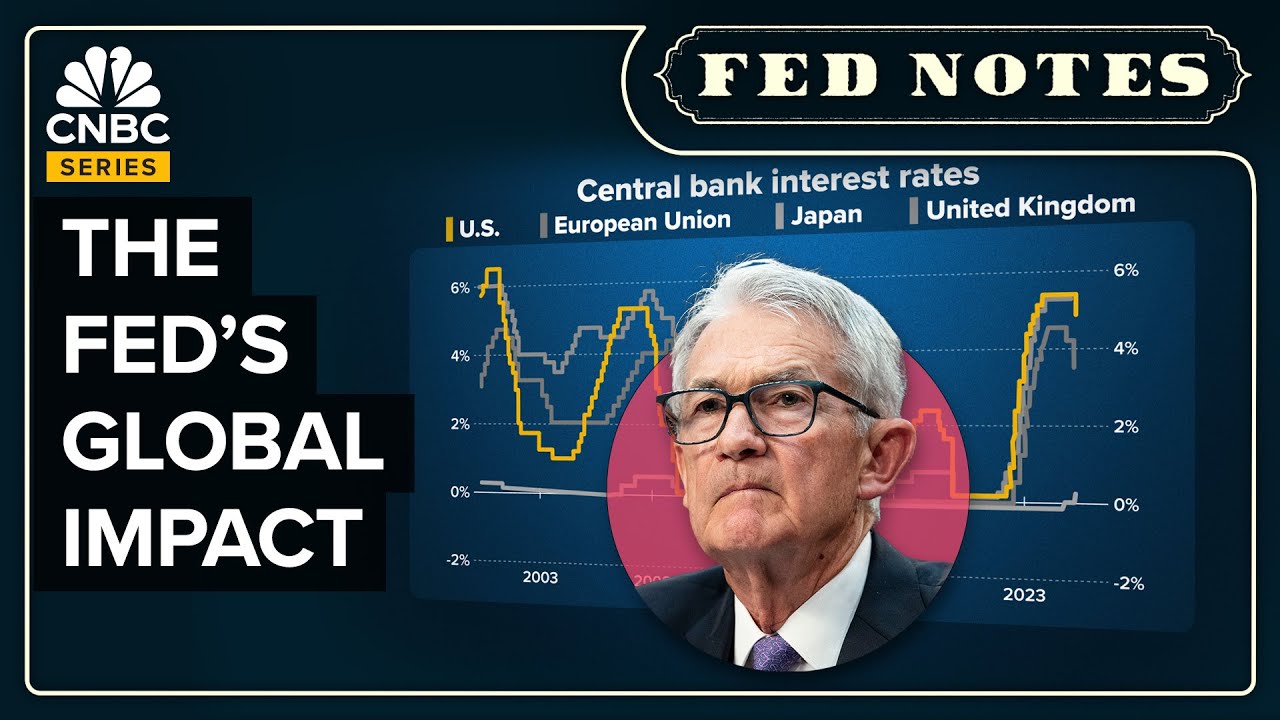

How Fed Rate Cuts Affect The Global Economy

5.0 / 5 (0 votes)