ISA 계좌 300% 활용법 | 경제적 자유로 가는 첫 시작

Summary

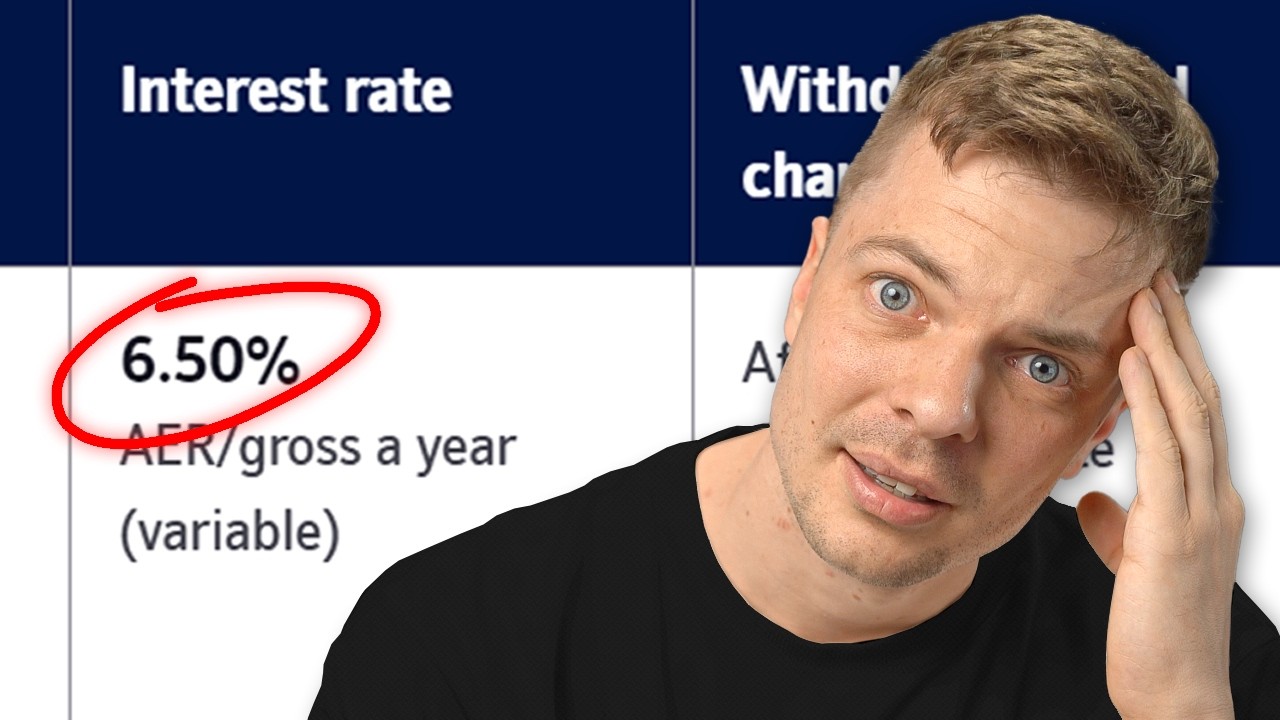

TLDRThis script discusses the importance of investing in ISAs (Individual Savings Accounts) and how they can be utilized for tax-efficient growth. It highlights the benefits of investing in dividend stocks and ETFs, particularly those listed in the US, and emphasizes the tax advantages these investments offer. The speaker also touches on the potential drawbacks of not investing, such as missing out on compound interest and tax benefits, and encourages viewers to educate themselves on investment strategies for a comfortable and wealthy future.

Takeaways

- 💡 Investing in ISAs (Individual Savings Accounts) is beneficial due to their tax advantages, allowing for tax-free growth and dividends.

- 💰 The speaker emphasizes that even with a small amount of money, one can start investing, making it accessible to many.

- 🏦 The script discusses the importance of not working alone with your money but rather letting it work for you, which can make the process less lonely and strenuous.

- 🌟 The speaker suggests that investing in ISAs can bring hope for an improved financial situation in the future.

- 📈 The transcript mentions that the most common investments within ISAs are individual stocks, particularly dividend-paying stocks, followed by exchange-traded funds (ETFs).

- 💹 It is highlighted that investing in dividend stocks within an ISA is advantageous because the dividends received are tax-free, allowing for compound interest effects.

- 🌍 The script also touches on the benefits of investing in foreign ETFs through ISAs, comparing the tax benefits to those of investing in a regular account.

- 📊 The importance of diversification in investing is stressed, with the speaker recommending a spread of investments across different types of assets.

- 📚 The speaker recommends studying and understanding the different investment options, such as ETFs and dividend stocks, to make informed decisions.

- 🔑 The transcript provides a method to identify popular investment choices by looking at the market capitalization and trading volume of various ETFs.

- 🚀 The speaker concludes by encouraging a simple, easy, and comfortable approach to investing, suggesting that even small amounts can accumulate over time to significant results.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is investment strategies, specifically focusing on ISA (Individual Savings Account) and where to invest within it for tax benefits and growth.

What is an ISA and why is it beneficial for investments?

-An ISA, or Individual Savings Account, is a tax-advantaged financial account in the UK. It is beneficial for investments because it allows individuals to earn interest, dividends, or capital gains tax-free within the account, up to certain limits.

What types of investments are popular within ISA accounts according to the script?

-According to the script, popular investments within ISA accounts include individual stocks, particularly dividend-paying stocks, overseas ETFs, domestic ETFs, and bonds.

Why are dividend-paying stocks recommended for ISA investments?

-Dividend-paying stocks are recommended for ISA investments because the dividends received are tax-free, allowing for reinvestment and the benefit of compound interest without tax deductions.

What is the significance of the tax benefits when investing in dividend-paying stocks within an ISA?

-The significance of the tax benefits when investing in dividend-paying stocks within an ISA is that the dividends received are not subject to tax, which can lead to higher returns over time due to the power of compounding without tax deductions.

How does investing in overseas ETFs within an ISA provide tax benefits compared to a regular account?

-Investing in overseas ETFs within an ISA provides tax benefits because the capital gains are tax-exempt up to the ISA allowance, and the tax rate on dividends is significantly lower than what would be paid in a regular account.

What are some of the popular ETFs that people invest in according to the script?

-Some of the popular ETFs that people invest in, as mentioned in the script, include those that track the U.S. S&P 500, NASDAQ 100, and other indices focusing on sectors like technology, semiconductors, and electric vehicles.

What is the current annual limit for ISA investments mentioned in the script?

-The current annual limit for ISA investments mentioned in the script is £20,000, with a maximum of £1 million that can be invested over the lifetime of the account.

What is the potential disadvantage of investing in individual stocks outside of an ISA for high-income individuals?

-The potential disadvantage of investing in individual stocks outside of an ISA for high-income individuals is that if their capital gains exceed a certain threshold, they may lose certain tax benefits, such as personal allowances and family exemptions.

How can one determine which ETFs are popular and heavily invested in by others?

-One can determine which ETFs are popular and heavily invested in by checking the market capitalization or trading volume of the ETFs, which can be found on financial platforms like Naver Securities.

What is the speaker's view on the approach to investing in the script?

-The speaker's view on the approach to investing is that it should be simple, easy, and stress-free. They emphasize the importance of starting with a basic understanding of ISA and gradually building up an investment portfolio with a focus on long-term growth and tax efficiency.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

UK ISA Accounts Explained | Everything you Need to Know (2025)

ISA Explained for Beginners: Everything You Need to Know

The BIG Changes To ISA's In This Budget

Should You Use a Cash ISA?

Halal stock investing - all you need to know

Maximize Your Tax Deductions With A Nonprofit-501 c3 (Nonprofit Tax Information Get BIG DEDUCTIONS!)

5.0 / 5 (0 votes)