Using ICT Macros To Trade With Precision

Summary

TLDRIn this video, the trader discusses their approach to market analysis, emphasizing the importance of following a structured model rather than chasing volatility. They break down key trading concepts such as continuation and reversal setups using real-time chart analysis, with a focus on patient, well-timed entries. Key points include the importance of avoiding FOMO, understanding the significance of session highs and lows, and utilizing specific trading models for high probability setups. The trader shares insights into the value of time in trading and how a disciplined approach can lead to more consistent results.

Takeaways

- 😀 Patience is crucial when trading; avoid chasing price in volatile conditions without a clear setup.

- 😀 The trader emphasizes sticking to a model, particularly the 'Macro Power of 3', and not deviating from it in the heat of the moment.

- 😀 FOMO (Fear of Missing Out) can be a major pitfall in trading; always wait for a valid setup instead of jumping in impulsively.

- 😀 A shallow stop hunt is less reliable than a deeper one, especially in strong trends. Wait for deeper, more meaningful reversals.

- 😀 Time-based windows, like the 10 a.m. red-folder news, are important for confirming setups and preventing entry at high-risk times.

- 😀 The 'Macro Power 3' continuation trade works best when price shows clear directional bias and the liquidity levels are engineered (like relative equal highs).

- 😀 Using indicators that show session highs and lows can significantly aid in identifying valid entry points and understanding price movement.

- 😀 Analyzing price through the lens of dealing range highs and lows helps with timing entries and identifying high-probability setups.

- 😀 The trader stresses the importance of waiting for confirmation of a price move before taking action, particularly when reversals are expected.

- 😀 The two-chance model in trading allows for risk management and helps avoid jumping into trades prematurely when price action is unclear.

Q & A

What is the speaker's main focus in the video?

-The speaker focuses on explaining their trading model and how it applies to real market situations, specifically discussing the importance of patience, understanding market behavior, and recognizing high probability setups.

What is the significance of the 'macro power of three' model in the speaker's strategy?

-The 'macro power of three' model is a core part of the speaker's trading strategy, helping identify high-probability continuation and reversal setups. The model is used to determine when to enter or avoid trades based on price patterns and trends.

What mistake did the speaker admit to making at the beginning of the video?

-The speaker admitted to making the mistake of forgetting their typical microphone while traveling, resulting in a less-than-ideal audio quality for the video.

How does the speaker approach situations where the market moves rapidly right after the open?

-The speaker emphasizes the importance of not chasing price movements when the market opens strongly. They recommend waiting for a setup that aligns with their model, rather than jumping in due to FOMO (fear of missing out).

Why did the speaker consider the 9:50 macro low probability for a trade setup?

-The speaker considered the 9:50 macro low probability due to several factors, including the shallow stop hunt, the upcoming 10 a.m. red folder news, and the overall strength of the market's upward movement. They prefer to wait for clearer setups after significant news events.

What is the concept of 'dealing range' in the speaker's trading model?

-The 'dealing range' refers to the high and low levels of price within a given timeframe. The speaker uses these levels to define key areas for potential market reversals or continuations. A price movement into the 'dealing range' low or high can signal opportunities for trades.

How does the speaker identify a continuation trade in a strong bullish market?

-The speaker identifies a continuation trade by looking for key indicators, such as relative equal highs and session highs that suggest buy-side liquidity. They focus on confirming that price is likely to continue in the direction of the trend before entering a trade.

What is the importance of 'session highs' and 'session lows' in the speaker's strategy?

-Session highs and lows are crucial for identifying key levels of support and resistance. The speaker uses them to spot buy-side or sell-side liquidity, helping to predict where price might reverse or continue. These levels are plotted by the speaker's custom indicator for accuracy.

Why does the speaker avoid trading before a 10 a.m. red folder news event?

-The speaker avoids trading before a 10 a.m. red folder news event because of the potential market volatility and unpredictability that can occur. They prefer to wait for the news event to pass before making a trade decision, as it increases the chances of a clearer setup.

What is the speaker's view on overcomplicating trading strategies?

-The speaker believes in keeping trading simple and removing unnecessary complexities. They emphasize focusing on the essential concepts and tools that can consistently lead to profitable outcomes, rather than overloading oneself with excessive information or strategies.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Weekly Forecast - January 4th, 2026

⚡⚡The Secret to Profitable Counter Trend Trading - ICT CONCEPTS⚡⚡

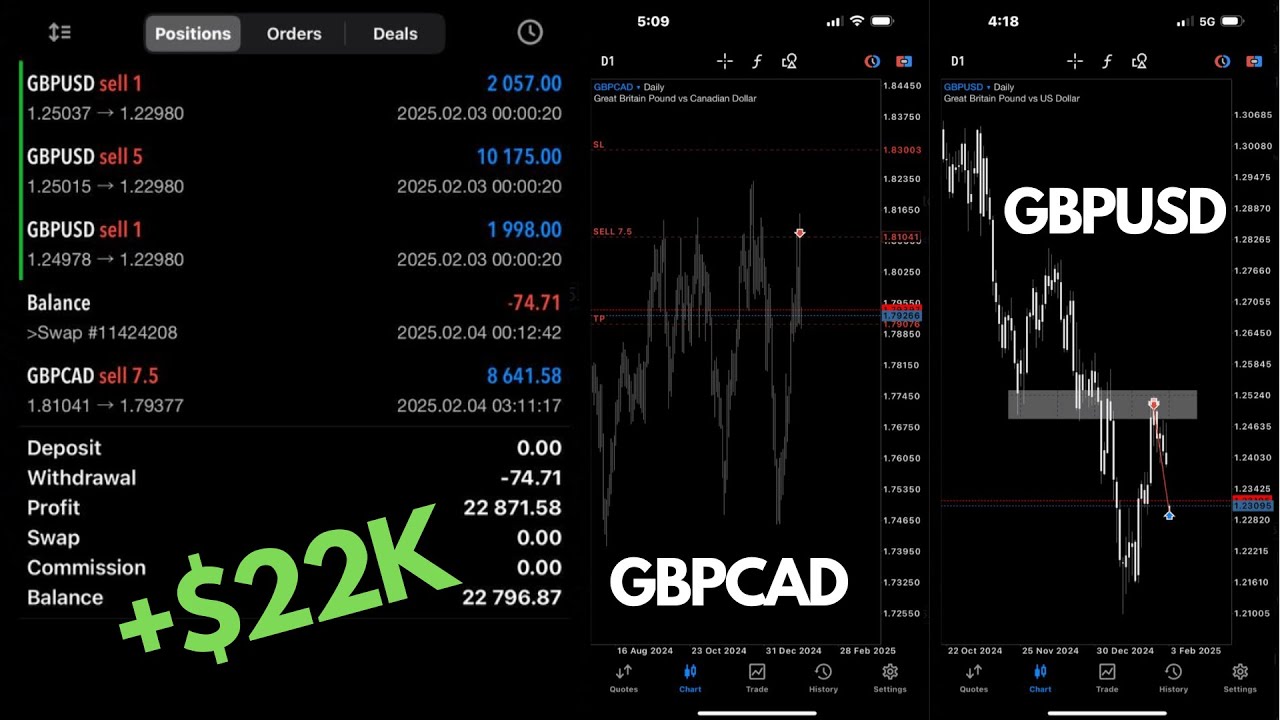

+$22,000 This Week Trading Forex (My Simple Analysis)

Important Update for Daytradertelugu

Learn the Basics of Elliott Wave | How to Start Count 12345 : Step-by-Step

How to Trade the ICT Market Maker Model (LIVE)

5.0 / 5 (0 votes)