Weekly Market Outlook | Index Futures & Forex Livestream (Audio Starts At 10:31)

Summary

TLDRIn this comprehensive stream, the speaker dives deep into advanced trading concepts, focusing on the importance of timing and price action. They emphasize the need to recognize key levels on charts and understand market patterns, particularly when identifying reversals or breakouts. A significant portion of the stream also touches on the personal aspect of trading, sharing lessons from a period of serious health issues. The speaker reflects on the importance of balancing goals with personal well-being, urging viewers to remain grounded, live with gratitude, and stay focused on their own journey amid challenges.

Takeaways

- 😀 The importance of understanding time and price when analyzing markets is emphasized—these two factors are essential in predicting market behavior and making informed trading decisions.

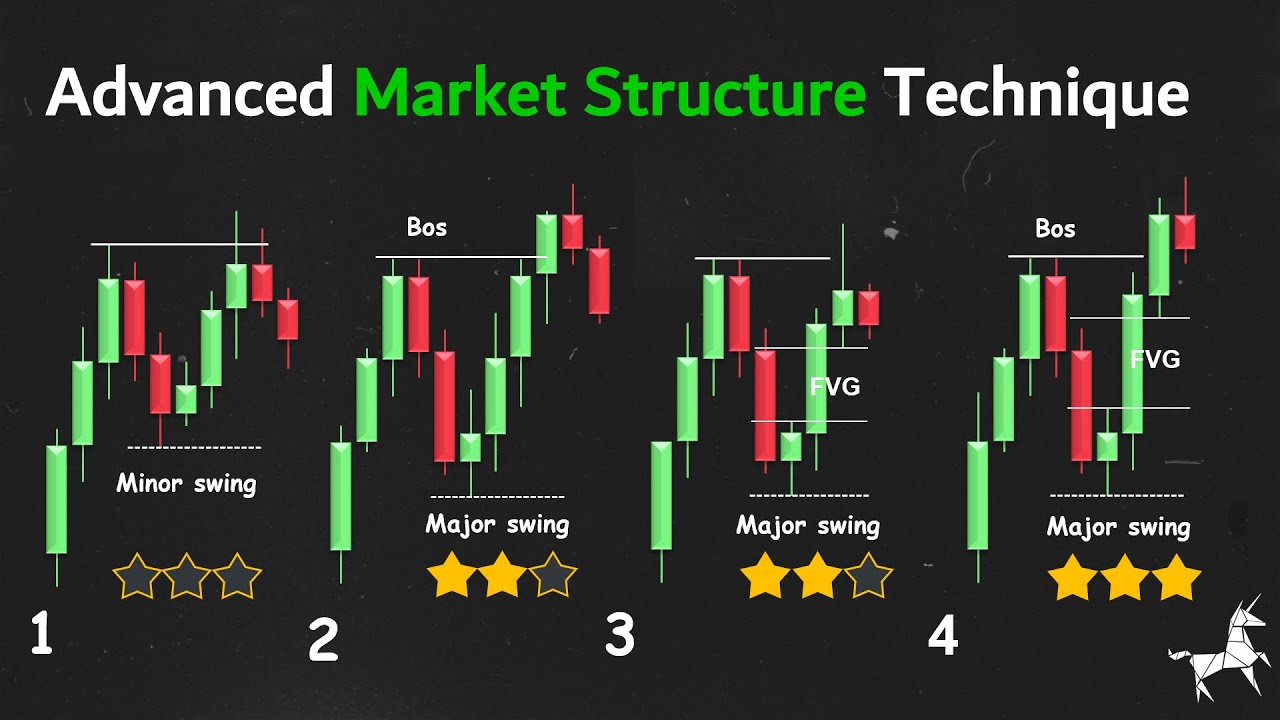

- 😀 Trading strategies should anticipate price swings before they happen, with a focus on market imbalances and liquidity pools.

- 😀 The speaker encourages traders to think independently, rather than following mainstream news headlines or relying on others' opinions, which often result in delayed reactions to market movements.

- 😀 News headlines can be used as a tool to manipulate retail traders, with positive news often preceding bearish market reversals and negative news following bullish movements.

- 😀 Recognizing the delivery profiles of different asset classes, such as Forex pairs and indices, is key to understanding market structure and predicting price movements.

- 😀 Analyzing the reaction of markets to specific levels, like support and resistance, is crucial in anticipating future price behavior and forming a roadmap for trades.

- 😀 Intermarket relationships (such as between the Dollar and Euro or the GBP) can help confirm market sentiment and guide trading decisions based on the correlation between different assets.

- 😀 Mastering the concept of Smart Money Techniques (SMT) can allow traders to spot reversals and capitalize on them before retail traders notice the shift.

- 😀 It's important to be prepared for a variety of scenarios, such as bullish, bearish, or consolidating markets, by setting up clear strategies for each potential outcome.

- 😀 The speaker shares a personal story about health struggles, underscoring the importance of balancing career-driven goals with personal well-being and being grateful for the present moment.

- 😀 Traders should aim to surround themselves with individuals who are further along in their journey, as this will help elevate their standards and improve their own trading abilities.

Q & A

What is the importance of time and price in market analysis?

-Time and price are fundamental because the formation of specific highs and lows is more important when you consider the timing at which they occur. The speaker emphasizes that understanding these key moments is critical for anticipating future market movements.

What is the significance of relative vehicle highs and lows in trading?

-Relative vehicle highs and lows are important because they represent key liquidity levels in the market. These levels are often revisited, making them crucial for identifying future market behavior and potential price movements.

How does intermarket analysis play a role in trading decisions?

-Intermarket analysis allows traders to understand relationships between different asset classes, such as currencies and indices. By monitoring these relationships, traders can anticipate market reversals and make more informed decisions about potential price movements.

What does the speaker mean by 'engineered liquidity'?

-Engineered liquidity refers to the liquidity pools that are deliberately created by smart money at specific price levels. These pools are used to influence market behavior and can be tapped into when market conditions align, providing opportunities for reversal trades.

What role do market imbalances play in trading strategies?

-Market imbalances represent areas where price movement has been skewed or disrupted. These imbalances are critical for identifying zones where significant price reversals or expansions are likely to occur. Traders can target these zones when prices are expected to revert.

Why is it important to monitor previous week's lows in the market?

-Previous week's lows serve as reference points for identifying whether the market is likely to continue its current trend or reverse. Breaking below these lows can signal a continuation of bearish momentum, while failure to break them could indicate a potential reversal.

How does the speaker view retail traders in relation to market movements?

-The speaker suggests that retail traders often react to market news and headlines, which can cause them to chase trends. Smart money, on the other hand, anticipates these moves and positions itself accordingly, often exiting positions before the retail crowd catches on.

What does the speaker mean by 'smart money' and how does it influence markets?

-Smart money refers to institutional traders and investors who have more advanced strategies and resources compared to retail traders. They manipulate the market by creating liquidity pools and using news as a tool to influence retail traders' behavior.

Why is the speaker critical of retail traders chasing market headlines?

-The speaker is critical because retail traders often allow market news to dictate their trading decisions, leading them to buy during market rallies or sell during declines. This emotional reaction leads to poor timing and decisions, while smart money positions itself ahead of these moves.

How does the speaker recommend handling market volatility and uncertainty?

-The speaker advises being proactive in anticipating market moves by understanding key price levels and patterns in advance. By preparing for various scenarios, traders can make informed decisions and avoid being caught off guard by market volatility.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Weekly Market Outlook | Index Futures & Forex Livestream

ICT Mentorship Core Content - Month 04 - ICT Rejection Block

I Discovered Best Market Structure Analysis (Premium Video)

SMT Exposed (Unlock Time In Trading)

ICT Concepts - Immediate Rebalance (Strongest Signature) 🤫

Wick Size Matters: The Key to Understanding Reversal and Expansion Candles

5.0 / 5 (0 votes)