Největší podvod na Američany - kreditní karty!

Summary

TLDRIn this video, David explores the truth about credit cards in the United States, focusing on why Americans are heavily reliant on them and how they can impact personal finances. He explains the difference between credit and debit cards, the importance of building a credit score, and the rewards system such as miles and cashbacks. Despite the benefits, David highlights the dangers, including high-interest rates and hidden costs, ultimately suggesting that while credit cards can be a necessary evil, they’re a reflection of the challenges within American capitalism.

Takeaways

- 💳 Credit cards in the U.S. are essentially short-term loans; you borrow money from the bank and repay it later, usually interest-free for about a month.

- 🏦 Debit cards use your own money from your bank account, while credit cards allow you to borrow money and build credit history.

- 📈 Building a credit score is essential in the U.S.; it affects your ability to rent apartments, get loans, and access lower interest rates.

- 🎁 Credit cards offer rewards such as points, miles, and cashback, which can be redeemed for travel, shopping, or exclusive perks like airport lounges.

- 💰 Banks make money through high interest rates on unpaid balances, annual fees, and merchant transaction fees, which can be up to nine times higher than in Europe.

- 🏬 Credit card benefits are often skewed toward wealthier individuals, as merchants indirectly subsidize rewards for those with premium cards.

- 🛒 Americans spend more when using credit cards compared to cash—studies show spending increases by 12–18% due to the disconnection from physical money.

- 📉 Missing credit card payments or carrying high balances can quickly damage your credit score and lead to severe financial consequences.

- 🗽 Credit cards are considered a 'necessary evil' for immigrants in the U.S., providing a way to build credit while accessing essential services like car rentals and housing.

- 🇺🇸 The script highlights the consumer-driven culture in the U.S., where credit cards incentivize spending and support a system of high fees, rewards, and financial dependency.

Q & A

What is the main difference between a debit card and a credit card?

-A debit card uses your own money directly from your bank account to pay for purchases, while a credit card is essentially a loan from the bank, allowing you to borrow money to be repaid later.

Why is it important for Americans to have a credit card?

-Credit cards are important because they help build a credit score, which is crucial for renting apartments, obtaining loans, and determining interest rates. Without a credit score, many financial activities are difficult or impossible in the US.

How do credit card rewards like points, miles, or cashback work?

-When you pay with a credit card, you accumulate points or miles, which can be redeemed for flights, hotel stays, or cash back. Some cards offer special sign-up bonuses after spending a certain amount within a limited time.

What are the main ways banks make money from credit cards?

-Banks earn money from credit cards through high interest rates on unpaid balances, annual fees for holding the card, and merchant transaction fees that are passed on to consumers.

How do merchant fees affect the overall cost of goods?

-Merchant fees for credit card transactions, which can be 1.5–3% in the US, are typically included in the price of goods. This means all consumers pay slightly higher prices, even if they use cash or debit cards.

Why can credit cards encourage people to spend more than they normally would?

-Using a credit card disconnects people from the physical money they are spending. Studies show that consumers pay 12–18% more when using credit cards compared to cash due to this psychological effect.

What is the risk of not repaying a credit card balance on time?

-Failing to repay a credit card balance on time can result in extremely high interest rates, fees, and damage to your credit score, which can affect your ability to rent apartments or get loans.

What are some benefits that richer credit card holders receive?

-Richer individuals often have premium credit cards that offer more points, miles, and exclusive benefits such as airport lounge access, VIP event tickets, and higher cashback rates. These benefits are indirectly subsidized by all consumers through higher merchant fees.

How does the US shopping mall culture differ from Europe?

-US malls, like Century City Plaza, are designed as open-air spaces for leisure and family entertainment. They often host concerts, musicals, and social activities, encouraging visitors to spend longer periods of time there, unlike the primarily functional shopping malls in Europe.

Why does the presenter describe credit cards as a 'necessary evil'?

-The presenter calls them a 'necessary evil' because, while credit cards are essential for building credit and accessing rewards, they come with high interest rates, fees, and the risk of overspending, making them potentially financially dangerous if misused.

Can immigrants or foreigners use credit cards in the US effectively?

-Yes, but they need to use them carefully. Credit cards are often required for renting apartments, car rentals, and other services, but mismanagement can lead to high debt and damage to their credit score.

What unusual payment methods are mentioned in the transcript?

-Some US stores have advanced payment methods, such as paying with a palm scan, which further disconnects consumers from physical money and increases convenience and spending potential.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

TARJETA CMR Como Funciona PERU

7 Passive Income Gw (2024)

Reality Of Credit Cards

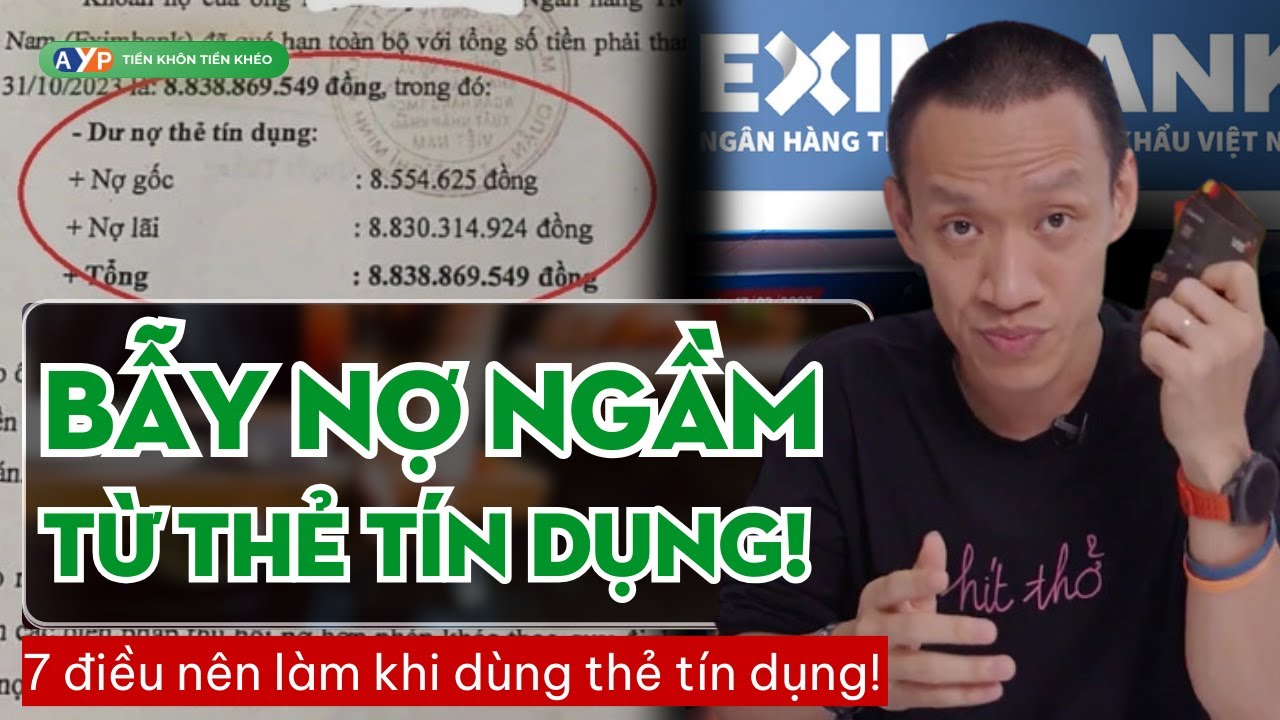

Sau vụ nợ từ 8,5 triệu thành 8,8 tỷ: NÊN và KHÔNG NÊN làm gì khi xài THẺ TÍN DỤNG!| Nguyễn Hữu Trí

Credit Cards 101 (Credit Card Basics 1/3)

You May Be Getting the 30% Credit Utilization Rule Wrong - How it Works & How to Improve It

5.0 / 5 (0 votes)