A Major Shock is about to Hit | -69%

Summary

TLDRIn this video, Meet Kevin breaks down the current market turbulence, highlighting the impact of tariffs, yield curve spreads, and economic indicators like ISM and S&P manufacturing reports. He explains how gold and oil ratios signal short-term market moves, while inventory buildup, legal tariff changes, and flat wages create deflationary pressures. Kevin emphasizes the importance of upcoming jobs data to determine whether a soft landing is possible or a recession looms. He also touches on the effects on rate-sensitive stocks and real estate, providing actionable insights for investors navigating both short-term volatility and long-term opportunities.

Takeaways

- 📊 ISM and S&P manufacturing reports show mixed signals: headlines suggest growth, but underlying data indicate weak demand, inventory buildup, and layoffs.

- ⚠️ Tariff uncertainty and potential Supreme Court rulings could reverse inflationary effects, creating deflationary pressures in the near term.

- 💰 Gold is rising as a short-term flight to safety, potentially reaching $4,000, but historically collapses during actual recessions.

- 🛢️ Gold/oil ratio is at a historically high level, suggesting either gold may drop or oil may spike; oil spike seems unlikely due to oversupply and recession risks.

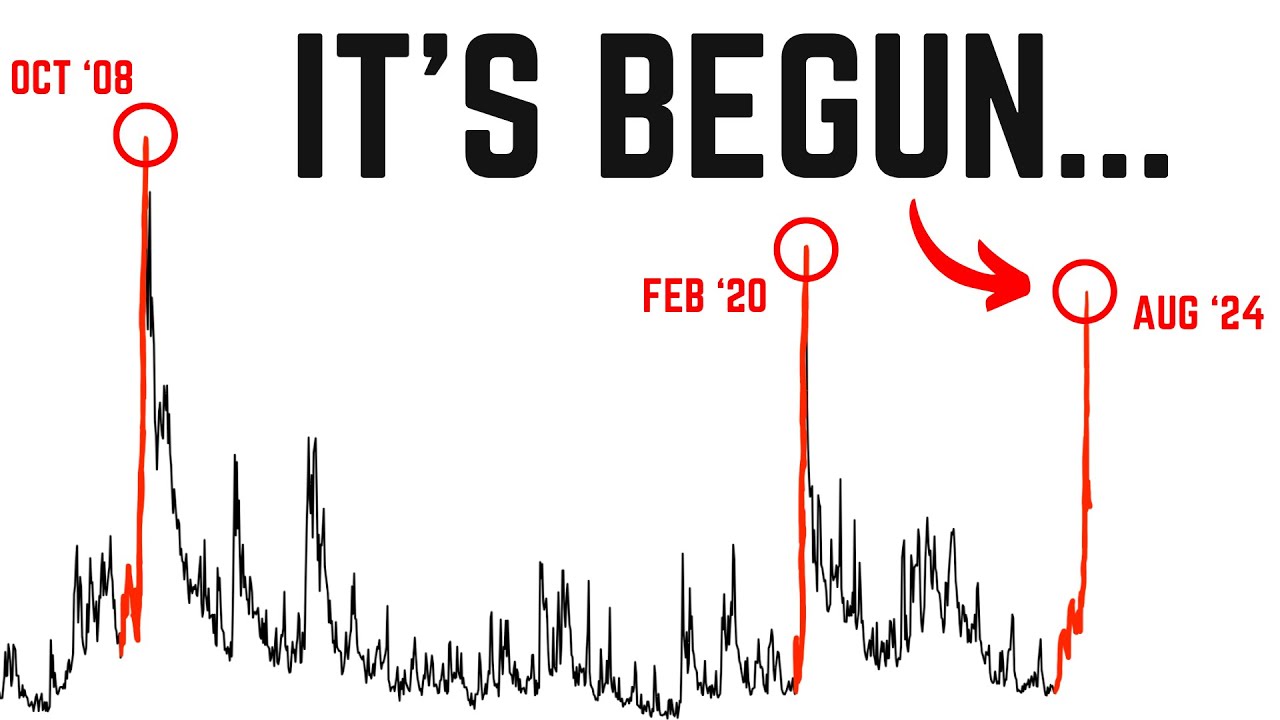

- 📈 The 2-10 year yield curve is at levels historically associated with market stress and potential recessions, signaling caution for investors.

- 🏦 Rate-sensitive stocks, including real estate, are under pressure from rising bond yields, but could become buying opportunities if rates decline later.

- 📉 Deflationary forces are mounting: inventory clearing, tariffs becoming illegal, weak wage growth, and potential recessionary impacts.

- 👷♂️ Upcoming jobs data (ADP and Payroll reports) is critical: numbers above 100,000 could confirm a soft landing; numbers below 50,000 are concerning.

- 💼 Manufacturing jobs are shifting: high-skilled roles are being lost in favor of lower-skilled, lower-paid positions, impacting long-term economic stability.

- 📰 Headlines can be misleading: production surges are often fueled by inventory building, not actual demand growth, setting up potential deflation later.

- 🏡 Real estate is impacted short-term by higher rates but could perform well in a long-term recession scenario due to falling interest rates and asset preservation.

- 🔔 Investors should watch both bullish catalysts (jobs reports, temporary gold rallies) and deflationary forces to navigate market volatility effectively.

Q & A

What are the key takeaways from the ISM and S&P manufacturing reports mentioned in the transcript?

-Headlines suggest growth, but underlying details reveal declining orders, tariff-related uncertainty, stagnant domestic sales, and layoffs in high-skilled roles, indicating mixed signals and potential stagflation.

How does the gold-to-oil spread serve as an economic indicator?

-The gold/oil ratio indicates potential market moves: historically, when the spread is high, either gold prices fall or oil prices rise. Currently, the spread is 58, suggesting a near-term gold rally, but a future correction is likely.

What is the significance of the 210 yield curve spread in the transcript?

-The 210 spread, currently at 63 basis points, is near historical levels that precede economic stress. A rise above one indicates potential recessionary pressures and a market prone to shocks.

What deflationary forces are identified in the video?

-Deflationary forces include inventory building, potential tariff refunds, flat wages, job losses, and the impact of any future recession, all of which can reduce prices over time.

How might tariffs being declared illegal affect the markets?

-If tariffs are ruled illegal, the government would need to refund tariff revenues, causing bond yields to rise, markets to whipsaw, and temporary price increases to reverse, adding deflationary pressure.

What are the expected job data figures, and why are they important?

-ADP employment is expected at 80,000 and the payroll report at 75,000 jobs. Stronger-than-expected figures could confirm a soft landing and boost markets, while lower numbers may indicate recession risks.

How is gold expected to behave in the near term versus during a recession?

-In the near term, gold may rally toward 4,000 due to tariff fears and market uncertainty. During a recession, however, gold typically collapses as deflationary pressures take hold.

What is the impact of rising bond yields on rate-sensitive stocks and real estate?

-Rising bond yields negatively affect mortgage-related and rate-sensitive stocks, such as Rocket Mortgage, and put short-term pressure on real estate prices. Long-term, falling rates during a recession could create buying opportunities.

What are some bullish catalysts for the market mentioned in the transcript?

-Bullish catalysts include strong jobs reports confirming a soft landing, short-term gold rally, and insights from the Meet Kevin membership, including trades, courses, and alpha reports.

What does the transcript suggest about the current market condition?

-The market shows a short-term boom fueled by inventory building and headline optimism, but underlying signals—such as tariff uncertainty, slowing orders, layoffs, and high yield spreads—point to potential deflationary pressures and recession risks.

Why does the speaker emphasize analyzing the 'devil in the details' of reports?

-The speaker highlights that headlines can be misleading; true market conditions are revealed by deeper commentary and metrics, such as slowed purchasing activity, inventory-driven production, and concerns about near-term demand.

What personal anecdotes does the speaker include, and what purpose do they serve?

-The speaker shares experiences from visiting a lazy river, Nintendo World, and breaking Meta Glasses. These anecdotes humanize the content, making it relatable and maintaining an engaging, conversational tone.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

5.0 / 5 (0 votes)