2022 ICT Mentorship Episode 20

Summary

TLDRIn this detailed Forex tutorial, the speaker demonstrates how prior analysis of the Dollar Index can predict movements in the Euro during the London session. By identifying key levels, using short-term charts to spot fair value gaps, and understanding inter-market relationships, traders can anticipate optimal entry points and manage risk effectively. Emphasizing self-reliance, the video encourages viewers to trust their own analysis rather than rely on spoon-fed trades. The tutorial combines practical trade planning with disciplined risk management, highlighting the importance of observation, timing, and market structure to navigate intraday Forex opportunities confidently.

Takeaways

- 📈 The speaker emphasizes that the video is an educational example, not a live trade recommendation or part of a formal trading model.

- 💡 Key level identified for the Dollar Index: 99.92, predicted as the low during the London session.

- 🔄 Inter-market relationships are crucial; the Euro (EUR/USD) typically moves inversely to the Dollar Index.

- 🕑 The London session 'kill zone' is 2:00–5:00 AM New York local time, which is the focus for intraday setups.

- 📊 Fair Value Gaps (FVG) on small timeframes (e.g., 2-minute chart) are used to fine-tune entry points.

- 🎯 Optimal trade entries involve placing limit orders near FVG highs, with stops above recent highs, considering energy and displacement from gaps.

- ⚖️ Risk management is critical: beginners should risk 0.25–1% of their account equity per trade rather than fixed amounts.

- 🔍 Observing market structure and price action allows traders to anticipate false breakouts and market moves.

- 🧠 Viewers are encouraged to trust their own analysis, verify information, and gradually build skill rather than blindly following others.

- 🚫 Not every predicted move needs to be traded; the video emphasizes learning, observation, and understanding over constant trading.

- 💹 The methodology demonstrates practical application of concepts: kill zones, FVGs, intraday highs/lows, and inter-market correlations for informed trading decisions.

Q & A

What is the main focus of the video transcript?

-The video focuses on Forex price action analysis, particularly the Dollar Index and Euro, demonstrating how to anticipate price movements during the London session using technical analysis and inter-market relationships.

What is the significance of the 99.92 level in the Dollar Index?

-The 99.92 level was identified as a key buying opportunity for the Dollar based on the speaker's analysis the previous night, serving as a reference for potential price reactions and trade setups.

How does the Dollar Index relate to the Euro in this analysis?

-The Dollar Index and Euro have an inverse relationship; when the Dollar reaches a bullish level, the Euro tends to rally in the opposite direction, which can be used to anticipate false breakouts or price reversals.

What are 'kill zones' and how are they used in this context?

-Kill zones are optimal trading windows; for the London session, the kill zone is 2:00 AM to 5:00 AM New York local time. During this time, significant price movements often occur, making it ideal for identifying trade setups.

What is a fair value gap (FVG) and how is it used for entries?

-A fair value gap occurs when a candle opens significantly away from the previous candle's close, creating an imbalance. Traders use it to identify potential limit order entries, waiting for price to move away energetically before entering.

Why does the speaker emphasize using your own analysis rather than copying trades?

-The speaker aims to teach viewers to understand market logic, build independent analysis skills, and develop self-reliance, rather than depending on following exact trade setups.

How should stop-loss levels be determined according to the transcript?

-Stop-loss levels should be placed just beyond recent highs or lows near the trade entry point to minimize risk, based on the identified market structure and fair value gaps.

What role does market structure play in determining trades?

-Market structure, including short-term highs and lows, order blocks, and shifts in price behavior, helps identify potential entries, exits, and overall trade direction.

How does the speaker suggest managing risk in Forex trading?

-Risk should be limited to a small percentage of account equity per trade, preferably 1% or less. Beginners should use even smaller amounts (0.25–0.5%) to protect capital while gaining experience.

Why does the speaker reference Fibonacci retracement levels?

-Fibonacci levels are used to determine potential price targets and objectives, helping traders plan where to take profit or assess the strength of price movements.

What is a false breakout and how is it identified in the transcript?

-A false breakout occurs when price temporarily moves beyond a key level but fails to continue in that direction. In the transcript, it is identified when the Euro moves above the previous week's high while the Dollar hits its bullish objective, signaling a potential reversal.

Why does the speaker choose not to show live trading sessions for viewers to copy?

-The speaker wants viewers to learn the analysis process and think independently rather than rely on copying trades, emphasizing skill development over short-term gains.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

How to use Asia zones to trade

ICT Charter Price Action Model 6.2 - Amplified Lesson

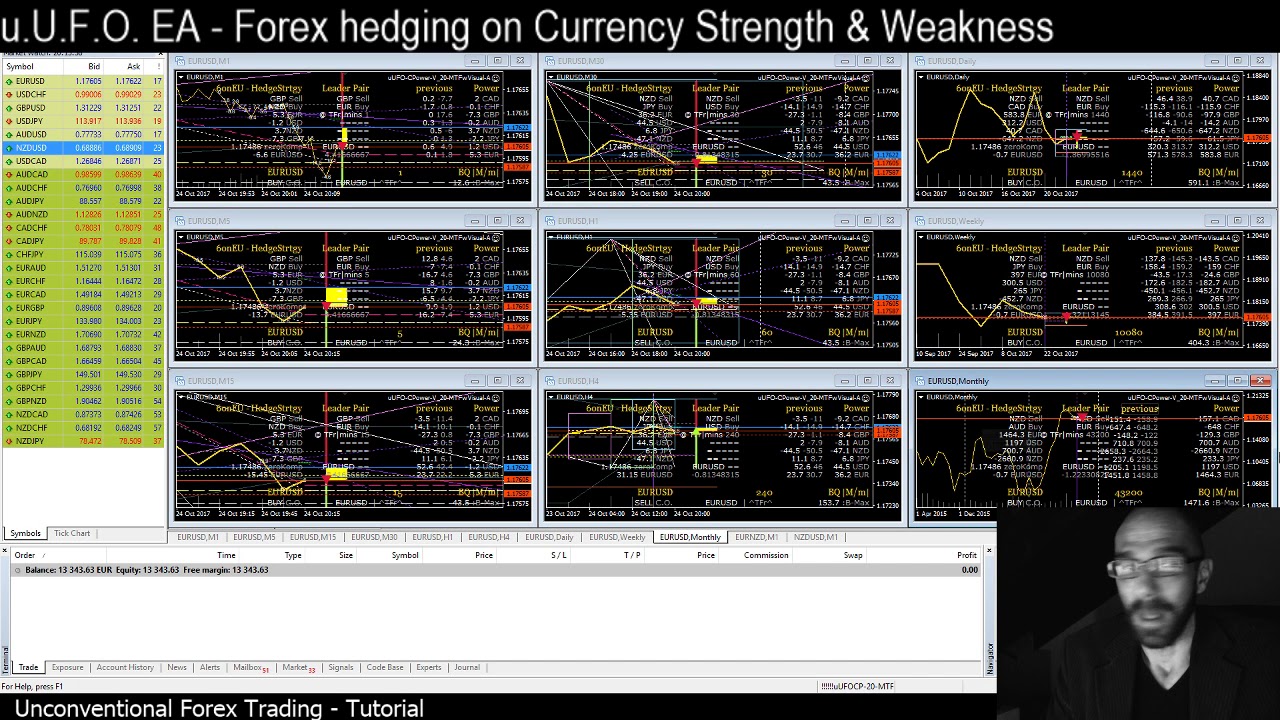

Forex math based formula application - MT4 - uUFO-EA: foreign currency hedging strategy explained.

ICT Forex & Futures Market Review October 4, 2025

How To Tell If News Will Be Positive Or Negative (Forex)

ICT Mentorship Core Content - Month 05 - Using 10 Year Notes In HTF Analysis

5.0 / 5 (0 votes)