TUTORIAL INVESTASI DARI NOL UNTUK PEMULA

Summary

TLDRThis video guides beginners on building an investment portfolio from scratch. It covers the importance of understanding your risk profile, investment goals, and how they shape your asset allocation. The video emphasizes that everyone's portfolio should align with their personal circumstances and objectives, whether short-term or long-term. It discusses different financial goals, from marriage plans to children's education, and recommends suitable investment products based on risk tolerance. Viewers are encouraged to start small and adjust their allocations as they learn more about investment options.

Takeaways

- 😀 Understand your risk profile before investing: People’s risk tolerance varies, and knowing yours will help guide your investment decisions.

- 😀 Assess your financial goals: Determine when you want to achieve your goals (e.g., buying a house, funding education) and tailor your investments accordingly.

- 😀 Start with self-awareness: Knowing yourself, your financial situation, and your investment knowledge is crucial for building the right portfolio.

- 😀 Diversification vs. Concentration: Beginners should focus on diversification to manage risk, while those financially secure may choose more concentrated investments.

- 😀 Adjust your portfolio based on life changes: As your circumstances change (e.g., marriage, children), your risk profile and investment strategy may need to shift.

- 😀 Financial goals should be time-based: Categorize goals into short-term (under 1 year), medium-term (1-5 years), and long-term (5+ years).

- 😀 Use investment calculators for clarity: Tools like investment calculators can help you determine how much to invest monthly to reach your financial goals.

- 😀 Emergency funds are essential: Set aside an emergency fund (e.g., 6x monthly expenses) before investing, especially in uncertain times.

- 😀 Consider a mix of investment products: Balance between fixed income mutual funds, stocks, gold, and peer-to-peer lending based on your knowledge and risk profile.

- 😀 Investment allocations are dynamic: Your investment allocation will evolve as your understanding deepens and your financial goals progress.

- 😀 Small investments can grow over time: Even with a small monthly commitment, such as in stocks or mutual funds, long-term investments can accumulate significant returns.

Q & A

What is the first step to building an investment portfolio?

-The first step is 'knowing yourself.' This involves understanding your risk profile, which is based on your personal characteristics, financial situation, and goals.

How can you measure your risk profile?

-You can measure your risk profile by answering five simple questions: 1) Your marital status. 2) Your understanding of investments. 3) Your prior investment experience. 4) Your investment timeline (less than 5 years or more than 5 years). 5) Your reaction if the value of your investments drops by 20%.

What is the difference between a conservative and an aggressive risk profile?

-A conservative risk profile typically involves low risk tolerance, where an investor may get anxious if investments lose value. An aggressive risk profile, on the other hand, is suitable for those who are financially secure and can tolerate higher risks with the potential for higher returns.

Can your risk profile change over time?

-Yes, your risk profile can change based on life circumstances. For example, if you get married or have dependents, you may shift to a more conservative profile. Also, gaining more knowledge about investments can lead you to adopt a more aggressive approach.

What are the three time frames for financial goals mentioned in the script?

-The three time frames for financial goals are: 1) Less than one year, 2) More than one year but less than five years, and 3) Over five years.

How do investment goals affect the types of investments you choose?

-The time frame of your investment goals determines the type of investment products you should consider. Short-term goals may require more stable investments like fixed-income mutual funds, while long-term goals may involve riskier options like stocks or crypto.

What is the role of an investment calculator in planning?

-An investment calculator helps you determine how much money you need to invest each month to reach your financial goals. It can also show you how different investment options can impact your returns over time.

How should you decide between different investment products (e.g., RDPT, P2P lending, gold)?

-Your decision should depend on your understanding of each product. Start with the investment options you understand well, and gradually diversify as you become more knowledgeable. You can begin with smaller amounts and increase your investments as you gain confidence.

What is the importance of an emergency fund in investment planning?

-An emergency fund is crucial because it provides financial security during unforeseen situations. It's generally recommended to save enough to cover 6 months of basic expenses before investing in riskier assets.

How can the allocation of investments change over time?

-Your investment allocation can evolve as your financial situation, goals, and risk profile change. For example, as you get closer to achieving a goal, you may shift from more volatile assets like stocks to safer options like bonds or savings accounts.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Montando uma carteira do zero com R$ 20 mil

O melhor PLANO para começar a INVESTIR em 2025!

How to Learn Javascript in 2023 (From ZERO)

Cara Merakit Komputer Dari Awal Sampai Akhir

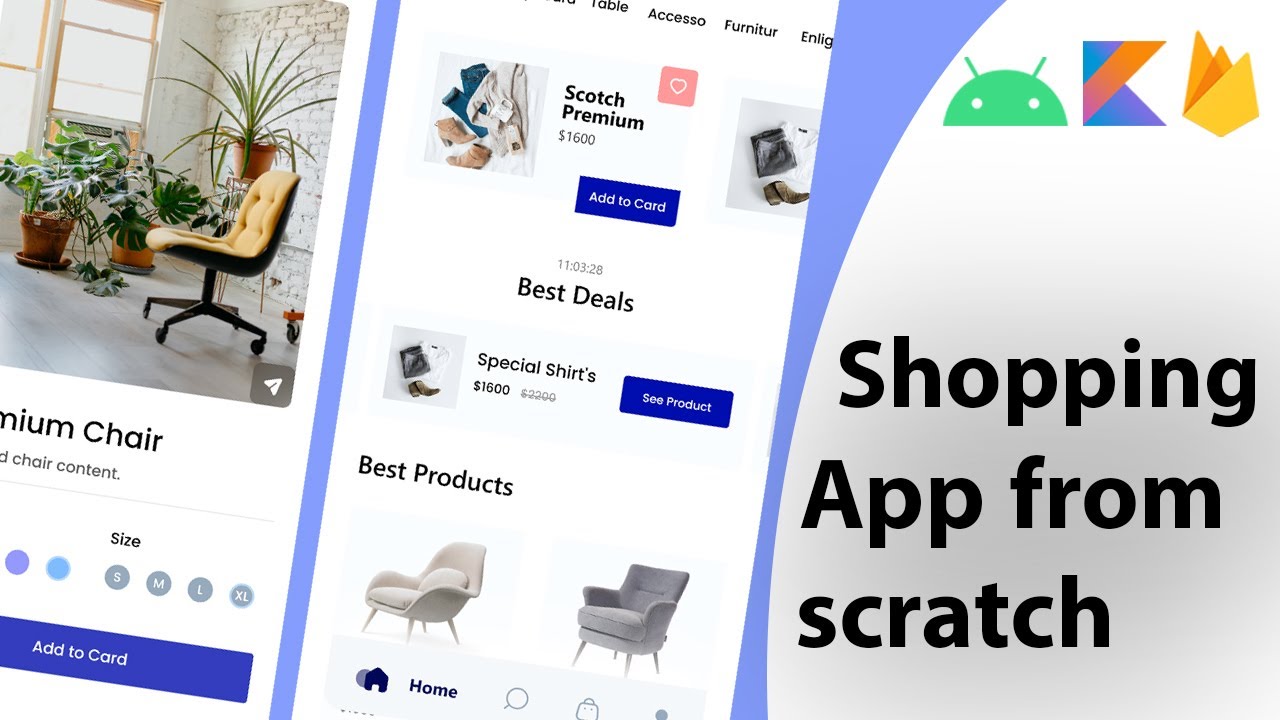

Build a modern android ecommerce app from scratch | Kotlin, Firebase, MVVM

Belajar Membuat Website Portal Berita dengan Codeigniter 3 - #1

5.0 / 5 (0 votes)