Boot Camp Day 32: Execution pt.2

Summary

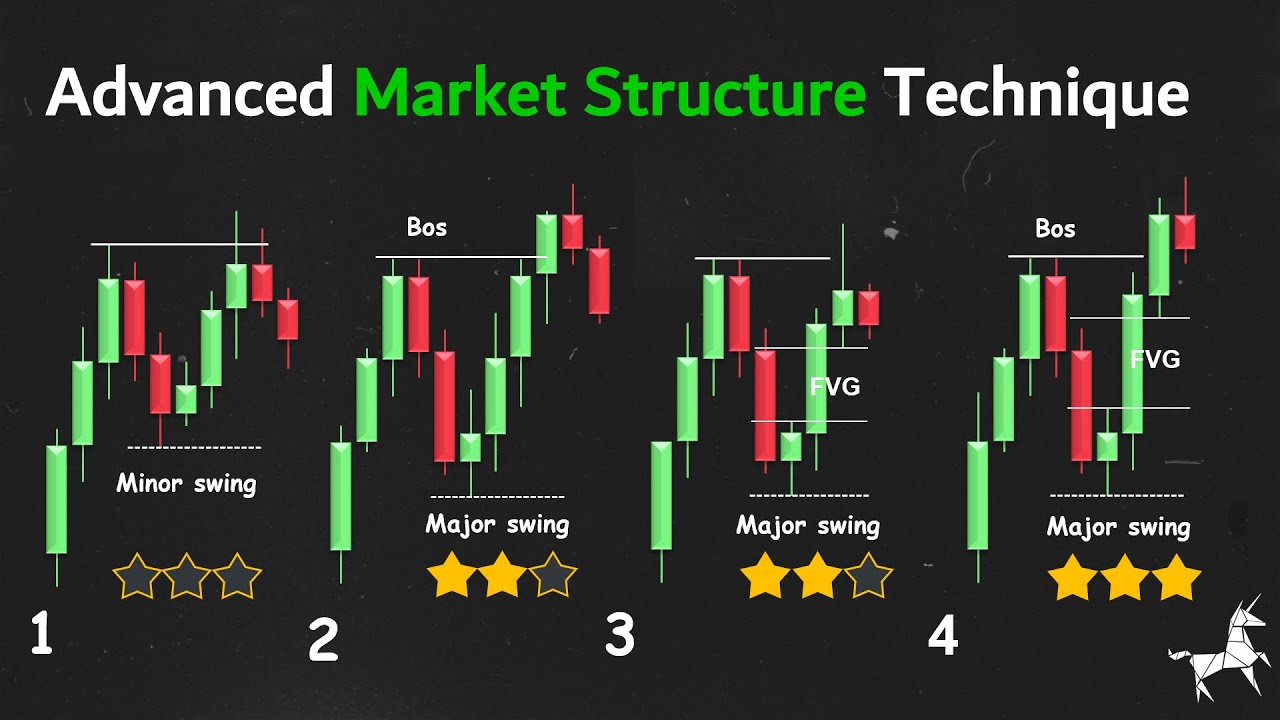

TLDRIn this video, the speaker discusses various entry and execution techniques in trading, focusing on liquidity sweeps and break of structure. The core idea revolves around identifying key liquidity areas, understanding the importance of structure breaks, and executing trades based on these insights. The speaker emphasizes building confidence through consistent practice and analysis, providing examples and exercises for viewers to deepen their understanding. Additionally, the speaker highlights the significance of mastering these basic strategies before progressing to more advanced topics, like daily bias and order block entries, offering a foundation for successful trading execution.

Takeaways

- 😀 Liquidity Sweep: This is the action of clearing liquidity around certain price levels, often seen before significant price moves.

- 😀 Break of Structure: A key concept where the market changes direction, signaling either a reversal or continuation of the trend.

- 😀 Order Blocks: These are price levels where institutional orders are likely filled, causing significant price movements once revisited.

- 😀 Execution Points: Identifying specific moments when liquidity sweeps or breaks of structure happen provides optimal opportunities for trade entries.

- 😀 Homework for Traders: Practicing identifying liquidity sweeps and break of structure examples on charts is crucial for reinforcing the strategy.

- 😀 The Strategy is Not the Whole Picture: The provided strategy is the foundation, but success also depends on other factors, including psychology and discipline.

- 😀 Confidence Building: Regularly identifying and executing trades based on liquidity sweeps and structure breaks helps build the confidence needed to trade effectively.

- 😀 Watch for Multiple Timeframes: Liquidity sweeps, breaks of structure, and order block entries are valid across all timeframes. Practice is key.

- 😀 Simple but Risky: The liquidity sweep and break of structure strategy is simple but has lower confluence, making it riskier. Additional tools and techniques can improve accuracy.

- 😀 Consistency and Practice: Repetition of these patterns and execution techniques is essential. The more you practice, the more 'robotic' the execution becomes, enabling quick and confident trades.

Q & A

What is a liquidity sweep in trading?

-A liquidity sweep refers to a price action pattern where the market targets and sweeps out stop losses or orders placed at key levels such as lows or highs. It occurs when a market manipulates price to trigger these orders before moving in the intended direction.

What is a break of structure (BoS) in the context of the strategy?

-A break of structure occurs when the market makes a significant move that disrupts the prior trend, such as breaking a recent high or low. This change in market structure signals that the current trend is shifting, which is essential for executing trades.

How can a break of structure signal an execution point?

-After a break of structure, the market may retrace to areas where orders were previously filled, such as an order block. These retracement levels serve as potential execution points where traders can enter the market with higher confidence.

What role do order blocks play in this strategy?

-Order blocks are areas on the chart where significant price movements originated. They are marked by the candles that caused a break of structure. These zones are crucial for trade execution, as the price tends to revisit these areas after a break in structure, presenting an ideal entry point.

What is the importance of practicing liquidity sweep and break of structure setups?

-Practicing liquidity sweep and break of structure setups is essential for developing confidence and skill in identifying market trends. Repetition allows traders to recognize these patterns more easily and execute trades with greater precision.

What is the suggested homework after watching this video?

-The homework involves identifying at least 10 examples of liquidity sweep and break of structure, followed by identifying where order blocks can be used for execution. Traders should also practice executing trades based on these patterns and record their results for analysis.

How does daily bias relate to the strategy discussed?

-Daily bias helps traders understand the broader market context, providing insight into whether the market is likely to go up or down. This knowledge enhances the execution of trades based on liquidity sweeps and break of structure, as it aligns the trade with the overall market trend.

Why is it emphasized that the strategy alone will not guarantee profitability?

-The strategy is a foundational framework, but success in trading requires more than just identifying setups. Time, practice, understanding risk management, and psychological discipline are all critical components for turning strategy into consistent profitability.

What should traders focus on when first starting to use this strategy?

-Traders should first focus on recognizing liquidity sweeps, break of structure, and order blocks. Once they can identify these patterns, they should practice executing trades without worrying about take profits or stop losses immediately. Building confidence in these basics is crucial before adding complexity.

How do traders know when to execute a trade after identifying a liquidity sweep and break of structure?

-Once a liquidity sweep and break of structure are identified, traders should wait for the price to return to the order block that caused the break in structure. This is the optimal execution point, as it aligns with the original market movement that created the structural change.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)