Disambut Pajak Anjlok! Tahun Fiskal Pertama Presiden Prabowo, Menkeu Sri Mulyani: Bukan Krisis!

Summary

TLDRIn this segment of Kompas Bisnis, Putri Oktaviani discusses Indonesia's fiscal challenges in 2025, focusing on the significant tax shortfall and its impact on the national budget. Despite President Prabowo Subianto's promises of various programs like free nutritious meals and discounts on electricity and airline fares, the tax revenue has dropped by over 30%. This has led to a budget deficit, the first since 2021. Finance Minister Sri Mulyani addresses concerns, attributing the issues to global pressures and defending government measures to stabilize the economy, including price reductions to maintain household purchasing power.

Takeaways

- 😀 President Prabowo Subianto's fiscal year 2025 is marked by many campaign promises being implemented, such as free nutritious meals, electricity rate discounts, and other social support programs.

- 😀 One major focus of President Prabowo’s administration is budget refocusing, with efforts to increase the affordability of daily expenses for Indonesians, such as discounted electricity rates and affordable airplane tickets.

- 😀 However, there are concerns regarding Indonesia’s tax revenue in 2025, which has dropped significantly—falling more than 30% compared to the previous year.

- 😀 The tax revenue shortfall has led to a fiscal deficit of IDR 31.2 trillion, marking the first deficit since 2021, in contrast to a surplus in February 2024.

- 😀 Despite the deficit, the government maintains that the decline in tax revenue is due to global economic factors, such as commodity price drops, rather than any internal financial mismanagement.

- 😀 The government is facing challenges with the country’s financial position, with tax revenue failing to meet projections and creating a gap between expected and actual receipts.

- 😀 Finance Minister Sri Mulyani acknowledged the financial challenges but emphasized that the government is using tools like pricing adjustments to stabilize the economy, including lowering administered prices.

- 😀 The government has taken action to cushion economic pressures, including reducing prices for essential goods and services to protect household consumption and improve public purchasing power.

- 😀 Measures like the electricity discount and the lowering of toll rates are designed to help reduce the financial burden on Indonesian households and promote economic resilience.

- 😀 Despite the deflation observed in early 2025, the government maintains that these are the result of deliberate policy actions like lowering electricity rates and not an indication of an economic crisis.

Q & A

What is the key topic discussed in the transcript?

-The transcript discusses Indonesia's fiscal year 2025 under President Prabowo Subianto's leadership, focusing on government programs, budget challenges, tax revenue decline, and fiscal deficit issues.

What significant programs were introduced by President Prabowo Subianto?

-The programs introduced include free nutritious food programs, subsidies for electricity and flight tickets, salary increases for judges, and bonuses for public service workers.

What is the fiscal situation of Indonesia as of February 2025?

-As of February 2025, Indonesia's tax revenue is significantly lower than expected, and the country's budget (APBN) is in a deficit of IDR 31.2 trillion, which marks the first fiscal deficit since 2021.

What was the tax revenue shortfall in February 2025 compared to the previous year?

-In February 2025, tax revenue dropped by 30.19% compared to the same period in the previous year, reaching only 8.6% of the tax target for 2025.

How did the government address the economic challenges in early 2025?

-The government introduced measures like discounts on electricity rates and flight tickets, as well as reductions in taxes for specific goods and services to help stabilize the economy and maintain household purchasing power.

What is the impact of the tax revenue decline on the Indonesian economy?

-The significant decline in tax revenue suggests that the Indonesian economy might be facing difficulties, potentially leading to an increased national debt to cover the budget deficit and ongoing programs.

What was the fiscal surplus situation in February 2024 compared to February 2025?

-In February 2024, Indonesia's budget had a surplus of IDR 26.04 trillion, while in February 2025, the budget faced a deficit of IDR 31.2 trillion.

Why does Sri Mulyani, the finance minister, attribute the fiscal issues to global factors?

-Sri Mulyani explains that the fiscal issues are due to global factors that have impacted commodity prices, affecting the country's revenue. She also emphasized that the deflation observed in early 2025 was a result of government-designed interventions, not a crisis.

What does the term 'administered prices' refer to in the context of this script?

-'Administered prices' refer to prices set or controlled by the government, such as the reduced rates for electricity and flight tickets, which contributed to the observed deflation in early 2025.

How did the government try to maintain household consumption during early 2025?

-The government implemented policies like reducing the VAT on tickets and toll prices, as well as providing discounts on essential services like electricity to support household consumption despite deflation.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

[FULL] Bahas Pertumbuhan Ekonomi Melambat, Pengangguran 'Pecah': Apa Saja Sinyalnya?

बजेट २०२५ चे महत्वाचे मुद्दे | शेअर बाजारावरील परिणाम | CA Rachana Ranade

Anggaran Pendapatan dan Belanja Negara (APBN) 2025

Why Indonesia's new government should aim to increase its tax revenue

RAPBN 2025 KOK BEGINI !! otw utang tambah banyak - komentar

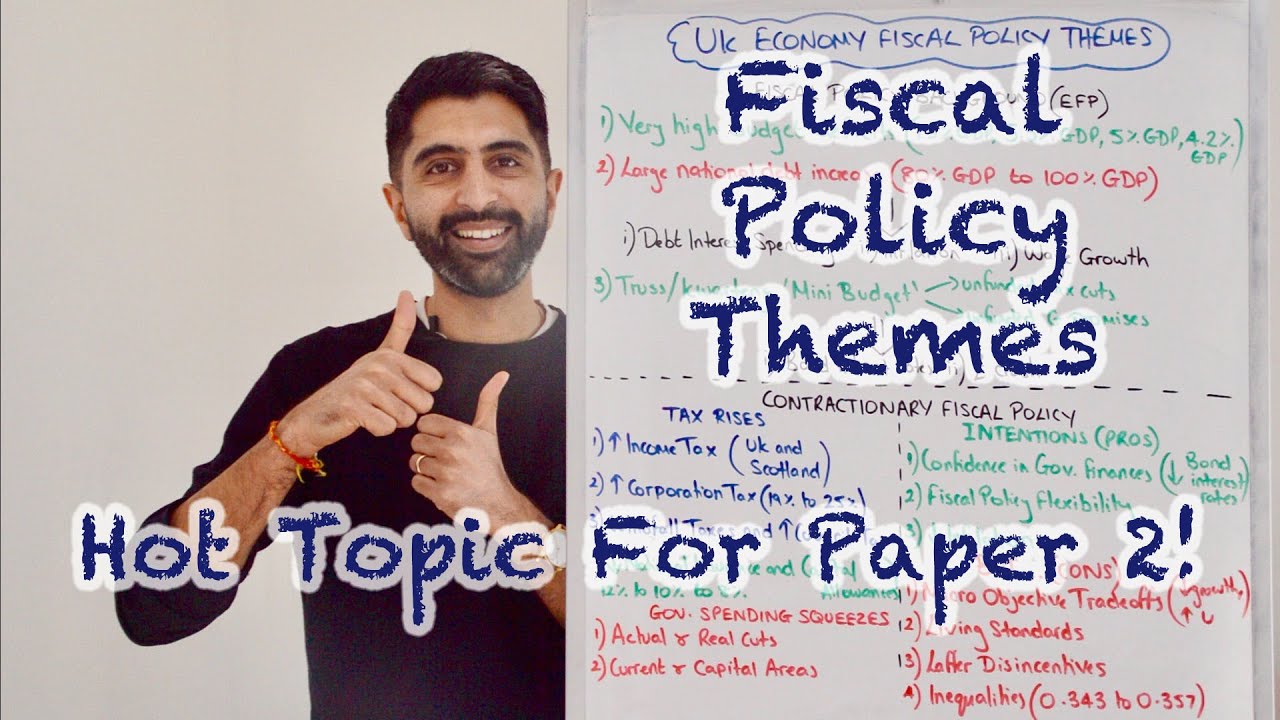

UK Fiscal Policy Themes - HOT TOPIC for Paper 2! Must Watch 🔥

5.0 / 5 (0 votes)