Cara Grow FOREX MODAL 50 RIBU DENGAN CEPAT di Tahun 2025

Summary

TLDRThis video tutorial offers practical strategies for quickly growing a small trading account with just IDR 50,000. The presenter shares valuable insights on trading in the Forex and crypto markets, emphasizing techniques such as identifying continuation patterns, using SL+ (stop loss plus) to protect profits, controlling emotions, and executing sniper entries. Viewers are guided through proven methods for reducing risks, managing emotions, and maximizing profits, with an emphasis on disciplined and calculated approaches to trading. The content is tailored for beginners eager to start trading with minimal capital while mitigating significant losses.

Takeaways

- 😀 Focus on continuation patterns to understand market trends and predict future price movements.

- 😀 Use the SL Plus (Stop Loss Plus) strategy to lock in profits and avoid losses once a trade is in your favor.

- 😀 Control your emotions while trading to prevent greed and fear from influencing your decisions.

- 😀 Set clear profit and loss targets based on percentages, not amounts, to maintain discipline in trading.

- 😀 The sniper entry technique involves entering trades at optimal moments, such as when price touches key support or resistance levels.

- 😀 Start with small capital, like IDR 50,000, and use strategic methods to grow your account gradually without unnecessary risk.

- 😀 Use technical analysis like trendlines and market structure to identify the best moments to buy or sell.

- 😀 Avoid trading out of excitement or for fun; focus on financial gains rather than making trading an emotional experience.

- 😀 To grow a small account quickly, you must accept higher risks, but also understand that rapid growth requires caution and careful planning.

- 😀 When using platforms like Octa for trading, consider using workarounds like minimal deposits to access larger trades with small capital.

- 😀 Identify market trends first (bullish or bearish) and only trade in the direction of the trend for better profitability.

Q & A

What is the main idea of this video?

-The video is aimed at people who want to make significant profits from trading without investing large amounts of capital. The presenter shares strategies for growing a small trading account and emphasizes the importance of understanding key trading principles.

What is the 'continuation pattern' mentioned in the video?

-A continuation pattern in trading refers to a market structure that suggests a trend will continue after a brief consolidation or pullback. In the video, the presenter explains that understanding whether the market is in a bullish or bearish structure helps identify these patterns and trade accordingly.

Why is the presenter cautious when trading with small capital?

-The presenter mentions that trading with a small capital, like Rp50,000, can be risky, especially when entering larger trades. He advises focusing on smaller trades first to build confidence and avoid major losses.

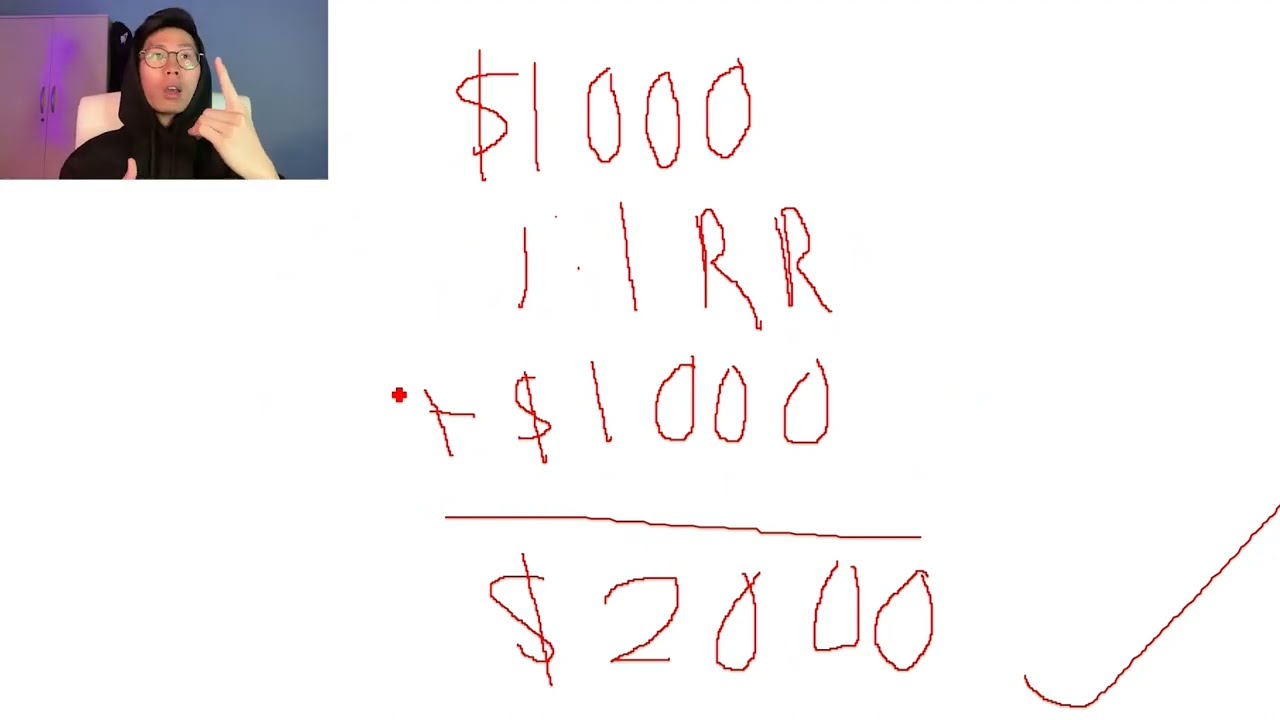

How does the presenter grow his small capital in trading?

-The presenter discusses starting with a small amount, like Rp50,000, and using strategies such as finding continuation patterns and using Stop Loss Plus (SL Plus) to manage risks and let profits run. He also highlights using a trading app like Octa to leverage small amounts effectively.

What is 'SL Plus' and how is it used in trading?

-SL Plus, or Stop Loss Plus, is a strategy where you adjust your stop loss as the market moves in your favor, locking in profits while allowing the trade to continue running. It helps avoid closing trades too early and protects against turning a profitable position into a loss.

How does emotional control play a role in trading success?

-Emotional control is crucial in trading because many traders fail by not knowing when to stop. The presenter advises setting clear profit and loss limits based on percentages, not nominal amounts, to prevent emotional decisions that can lead to significant losses.

What are the key principles behind successful trading according to the presenter?

-The key principles include understanding continuation patterns, using SL Plus for risk management, controlling emotions, and sticking to a plan that limits both profit-taking and losses. The presenter emphasizes the importance of not getting caught up in the excitement and making decisions based on logic.

What does 'BOS' mean in the context of the video?

-BOS stands for 'Break of Structure.' It refers to when a trend breaks its previous high (in an uptrend) or low (in a downtrend), signaling a continuation of the trend. A BOS indicates a potential entry point for further trades in the same direction.

Why is 'sniper entry' mentioned in the video?

-Sniper entry refers to entering a trade at the most optimal point, typically when the price touches key levels like a trendline or support/resistance levels, and shows signs of rejection. The presenter suggests this method for more precise and successful trades.

What is the significance of setting a target profit and loss percentage?

-Setting a target profit and loss percentage helps traders stay disciplined and avoid emotional decisions. By defining when to stop trading based on these percentages, traders prevent losses from spiraling out of control and avoid the trap of chasing more profits recklessly.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Simple $100 SWING TRADING Strategy | Beginner Guide 2025

How I Gained 50,000 Followers In 1 Month (9 Easy Steps)

CARA TRADING CRYPTO 100 RIBU DI 2025 (PEMULA LANGSUNG PRAKTEK)

How to Grow SMALL Forex Account with little money (No Bullsh*t Guide)

Top 3 Options Trading Strategies for Small Accounts

Can A Beginner Make Money In Options? - ZeroDayMark

5.0 / 5 (0 votes)