Gain from Stock market? Pay Zero tax | LTCG | STCG | Save Capital Gain Tax on Stock market gain

Summary

TLDRThis video provides valuable tax planning strategies for minimizing capital gains tax on share sales in India. It covers the updated tax rates for both short-term and long-term capital gains for financial years 2024-25 and 2025-26. The video offers practical advice, including how to offset gains with losses from other shares, take advantage of basic exemption limits, and use reinvestment strategies like Section 54F. Through clear examples, viewers are guided on how to reduce their tax liabilities, ensuring that their tax burden remains minimal or even zero. Essential for anyone investing in the stock market and looking to save on taxes.

Takeaways

- 😀 Short-term capital gains tax is applied when shares are sold within 12 months, with a tax rate of 20% starting from July 2024.

- 😀 Long-term capital gains tax applies when shares are sold after holding for more than 12 months, with a tax rate of 12.5%.

- 😀 The government introduced a basic exemption limit for capital gains, which is ₹3 lakh in FY 2024-25 and ₹4 lakh in FY 2025-26.

- 😀 Section 54F allows capital gains tax exemption if the proceeds from selling shares are reinvested in a residential property.

- 😀 Tax planning can help investors minimize or eliminate taxes on capital gains by adjusting gains with losses.

- 😀 Losses from certain shares can be offset against capital gains from other shares, reducing taxable profits.

- 😀 Investors can carry forward capital losses for up to 8 years to offset against future capital gains.

- 😀 The basic exemption limit only applies to individuals without other significant sources of income.

- 😀 Long-term capital gains (LTCG) can be offset by losses from other long-term shares, but not from short-term capital gains.

- 😀 It's crucial for investors to track their portfolio regularly, especially in fluctuating markets, to optimize their tax planning strategies.

- 😀 The video encourages viewers to subscribe to the channel for more tax-saving strategies and financial tips, especially around tax season.

Q & A

What are the main tax rates for capital gains on shares for financial years 2024-25 and 2025-26?

-For the financial years 2024-25 and 2025-26, the tax rate for short-term capital gains on shares is 20%, and for long-term capital gains, it is 12.5%. These rates were effective from July 23, 2024, and remain the same for both years.

What is the basic exemption limit for short-term and long-term capital gains in the new tax regime?

-In the new tax regime, the basic exemption limit for short-term and long-term capital gains is ₹3 lakh for financial year 2024-25 and ₹4 lakh for financial year 2025-26.

How can you save tax on short-term capital gains from shares?

-You can save tax on short-term capital gains by utilizing the set-off rule. If you have incurred losses on other shares, you can sell those to offset the short-term capital gains, reducing or eliminating the tax liability.

What is the set-off rule in income tax and how does it work for capital gains?

-The set-off rule allows you to adjust short-term capital losses against short-term or long-term capital gains. For example, if you have a profit of ₹2 lakh from one share and a loss of ₹2 lakh from another, you can offset the gain with the loss, resulting in zero tax liability.

Can you carry forward your capital losses if they are not set off in the same year?

-Yes, if your capital losses are not set off in the current financial year, you can carry them forward for up to 8 years and use them to offset capital gains in those future years.

What happens if you sell shares at a loss and how can it benefit you?

-If you sell shares at a loss, you can use those losses to offset capital gains from other shares. This can help reduce your taxable income, resulting in lower or zero taxes owed for the year.

What is the exemption limit for long-term capital gains in the new tax regime?

-For long-term capital gains in the new tax regime, the exemption limit is ₹1.25 lakh. This means you can exclude gains up to ₹1.25 lakh from being taxed, and only the amount exceeding that is taxable at 12.5%.

How does the exemption limit for long-term capital gains work in practice?

-For example, if your long-term capital gain is ₹1.5 lakh, you can subtract the exemption limit of ₹1.25 lakh, leaving ₹25,000, which will be taxed at 12.5%.

Is there any tax rebate under section 87A for capital gains in the new tax regime?

-No, tax rebates under section 87A do not apply to capital gains under the new tax regime. This means you won't get a rebate on long-term or short-term capital gains, even if your total income is within the exempted limit.

How can you avoid paying tax on long-term capital gains from shares?

-You can avoid paying tax on long-term capital gains by using the set-off rule with long-term capital losses. If you have losses from other long-term investments, you can offset those against your gains, reducing or eliminating the tax liability.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

The only TAX SYSTEM VIDEO you will ever need. | INDIAN TAX SYSTEM EXPLAINED | Aaditya Iyengar

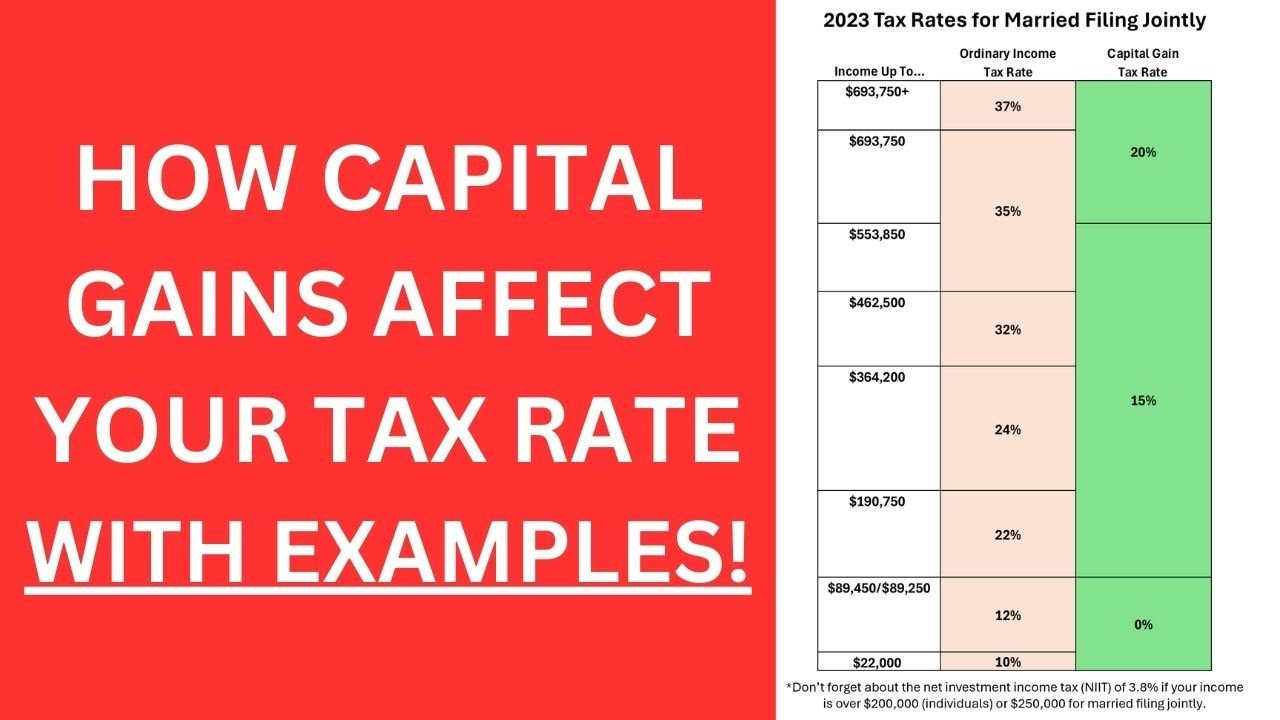

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

How to Smartly Save Taxes on Stock Market Gains? | CA Rachana Ranade

1 1 5 Different Direct Tax Laws 2

Beating the Tax-Man with Dan Thompson

Good News For NRIs - Capital Gains Tax Exemption On Sale Of Mutual Fund Units In India.

5.0 / 5 (0 votes)