Beating the Tax-Man with Dan Thompson

Summary

TLDRIn this episode of the Capital Gains Tax Solutions podcast, host Brett Swartz discusses strategies to defer capital gains tax with guest Dan Thompson, a financial expert with a Wall Street background. They explore the use of Deferred Sales Trusts to exit assets tax-efficiently and the leveraging of life insurance policies to create tax-free income. Thompson shares his insights on equipment leasing for tax deductions and the importance of simplifying complex financial concepts for wealth creation. The conversation also touches on the challenges of 1031 exchanges and the potential of cryptocurrency, offering practical advice for high net worth individuals seeking to preserve their wealth.

Takeaways

- 📈 The podcast focuses on capital gains tax solutions, emphasizing the importance of having a clear plan to defer capital gains tax through strategies like the Deferred Sales Trust.

- 💼 Host Brett Swartz is joined by experts in real estate, finance, wealth, and business to share insights and strategies for wealth creation and preservation.

- 🏦 Guest Dan Thompson has a Wall Street background and discusses his transition from traditional financial planning to alternative wealth-building strategies.

- 💡 Dan emphasizes the importance of simplifying complex financial concepts to help people understand and implement strategies for wealth building.

- 💼 Dan's journey from a stockbroker to an independent financial advisor led him to develop tools and strategies that are tax-advantaged and safer than traditional Wall Street methods.

- 🏦 The number one secret to beating the tax man, according to Dan, is using a foundational investment tool like life insurance policies packed with cash value, which can be leveraged into other tax-advantaged assets.

- 🏠 Real estate is highlighted as a key asset for leveraging and generating tax-free income, with strategies like cost segregation and bonus depreciation to offset taxable income.

- 💼 Dan discusses the use of equipment leasing as a strategy to defer capital gains tax, leveraging small investments into large tax deductions through Section 179.

- 🌳 Conservation easements, previously a strategy for tax benefits, were mentioned as no longer viable due to recent government changes.

- 💡 The podcast also touches on the challenges of 1031 exchanges, such as the requirement for like-kind property and the stress of finding suitable replacements within tight timelines.

- 💸 Dan recommends living well within one's means and saving a significant portion of income as a key to financial success, emphasizing the importance of passive income and asset management.

Q & A

What is the main focus of the 'Capital Gains Tax Solutions' podcast?

-The podcast focuses on helping high net worth individuals and their advisors understand and utilize capital gains tax deferral strategies, such as the Deferred Sales Trust, to exit highly appreciated assets while deferring capital gains tax and preserving wealth.

Who is the host of the podcast and what is his background?

-The host is Brett Swartz, who is joined by experts in real estate, finance, wealth, and business to share their insights and strategies on tax-efficient wealth creation and preservation.

What is Dan Thompson's background and how did he get started in finance?

-Dan Thompson has a Wall Street background with experience in financial planning, mutual funds, and securities. He was intrigued by the potential of making money in the stock market since he was 15 and committed to becoming a part of the finance industry. He started as a stockbroker and later opened his own offices.

What is the 'Deferred Sales Trust' and how does it help in tax deferral?

-The Deferred Sales Trust is a tax deferral strategy that allows individuals to exit highly appreciated assets and defer capital gains tax, providing the opportunity to create and preserve more wealth without an immediate tax liability.

How does Dan Thompson define his gift in the financial field?

-Dan Thompson believes his gift is the ability to explain complex financial concepts in a simple manner that can be understood and implemented by people at various stages of wealth, from seasoned investors to those just starting out.

What foundational investment tool does Dan Thompson recommend for beating the tax man?

-Dan Thompson recommends packing life insurance policies with as much cash value as possible, which can then be leveraged into other income-producing and tax-advantaged assets like real estate or equipment leasing.

What does Dan Thompson mean by 'tax flow' and why is it important?

-Tax flow refers to the strategy of offsetting taxable income with tax deductions to reduce tax liability. It is important because as taxes increase, having an offset can help maintain or improve cash flow.

What is the significance of leveraging life insurance policies in wealth building?

-Leveraging life insurance policies provides access to capital that can be used as a down payment for investments like multi-family properties. This not only helps in building wealth but also produces tax-free income in the future.

How does equipment leasing with Section 179 deduction help in capital gains tax deferral?

-Equipment leasing allows for significant tax deductions under Section 179, which can be used to offset capital gains tax liabilities. By investing in equipment and leasing it out, one can receive substantial tax write-offs that can defer or even eliminate tax on capital gains.

What are some of the challenges with the 1031 exchange in terms of capital gains tax deferral?

-The 1031 exchange requires like-kind properties of equal or greater value, which can be a burden when someone wants to reduce their asset load or exit a certain investment space. It also involves a lack of control, liquidity, and diversification.

What is the 'lightning round' and what insights does Dan Thompson share during it?

-The lightning round is a quick series of questions aimed at gaining personal insights and advice from the guest. Dan Thompson shares his advice for his younger self, his favorite book, his leadership theme, his current curiosity about crypto, and his practice of living well within his means.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Gain from Stock market? Pay Zero tax | LTCG | STCG | Save Capital Gain Tax on Stock market gain

1 1 5 Different Direct Tax Laws 2

Good News For NRIs - Capital Gains Tax Exemption On Sale Of Mutual Fund Units In India.

Budget 2024 impact on financial planning - Latest Income tax changes | Tax on stocks & mutual funds

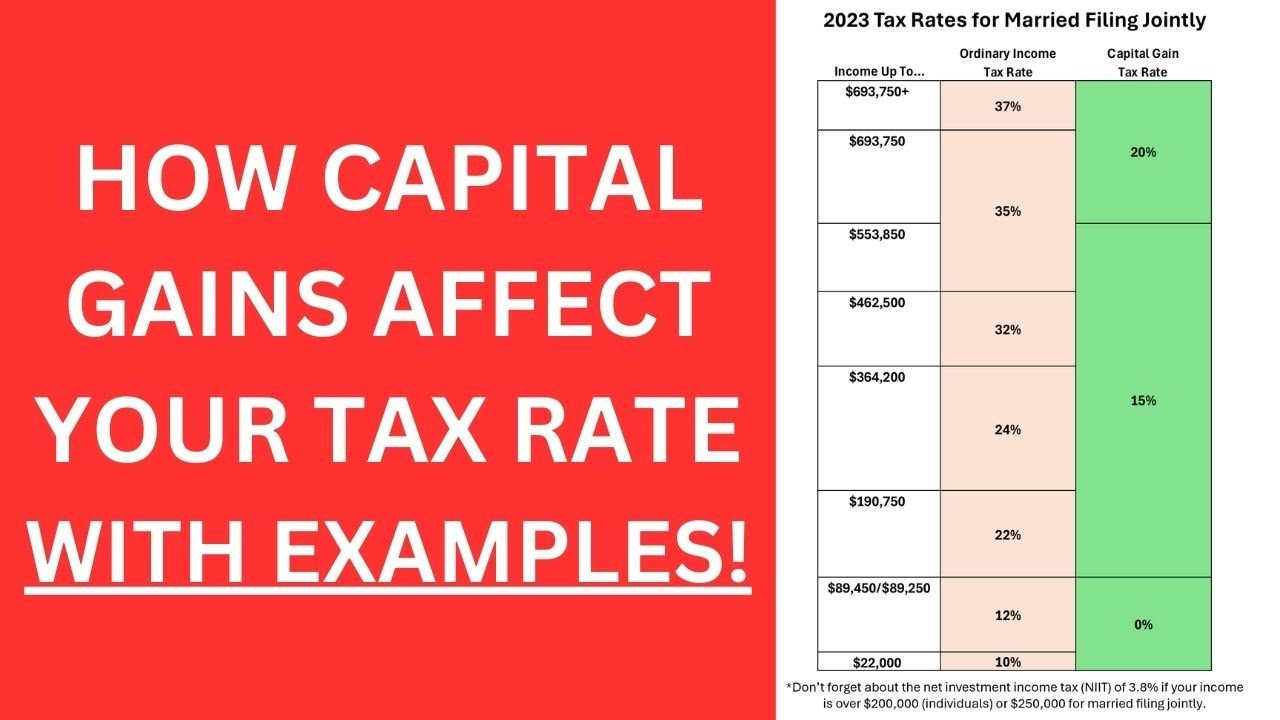

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

Print, Pump, Tax, Repeat

5.0 / 5 (0 votes)