Zillow releases ultimate Housing Market SELL Signal. 700+ cities where prices will correct.

Summary

TLDRZillow has downgraded its housing forecast, predicting home prices to drop in every major metro area across the U.S. over the next year. While Zillow anticipates a 1.7% national drop, some markets are expected to see significant declines, like San Francisco. In contrast, Reventure forecasts a smaller decline of 0.4%. The housing market faces a downturn as rising inventory and price cuts signal a shift. Despite some areas like New York and Midwest cities seeing price increases, buyers should be cautious, as many markets are still overpriced compared to long-term averages. The key is understanding when markets transition from overvalued to undervalued.

Takeaways

- 😀 Zillow has downgraded its housing forecast, predicting a 1.7% drop in home prices nationwide over the next year, with San Francisco expected to see the largest decline at 5.2%.

- 😀 Other major forecasters, including Bloomberg and Altos Research, are also predicting a downturn in the housing market, citing factors like discouraged home buyers, wage concerns, and rising unemployment.

- 😀 While home prices are still expensive, the market is beginning to shift, and prices are expected to continue dropping over the next 12 months.

- 😀 Reventure's forecast predicts a 0.4% national decline, but they disagree with Zillow's broader market predictions, forecasting price drops in cities like Denver (8.6%) and Austin (6.3%).

- 😀 The housing market is still facing high prices, with some listings, even after price cuts, still being much higher than their 2020 purchase prices.

- 😀 Inventory levels in the housing market have tripled in the last three years, returning to pre-pandemic norms, contributing to a slowdown in price growth.

- 😀 A significant 23% of home sellers are reducing prices, the highest rate in a decade, signaling a shift toward more affordable pricing.

- 😀 To determine when it's a good time to buy, two key metrics are used: overvaluation rate and mortgage payment as a percentage of income, which reflect whether prices are sustainable and affordable.

- 😀 California's housing market is the most overvalued, with a mortgage payment-to-income ratio of 61%, far above the long-term average of 43%, making it a poor time to buy.

- 😀 Markets like Texas and Florida are also experiencing high mortgage payments relative to income, indicating that these areas are still not at the right price point for buying.

- 😀 The Reventure App's overvaluation rate shows which cities are overpriced, such as Knoxville (36% overvalued), while others like Pittsburgh (9% overvalued) present more reasonable buying opportunities.

- 😀 Austin, Texas, after experiencing a 20% price drop, is approaching a more balanced market and may soon be a good place to buy as it shifts from overvalued to fairly valued.

- 😀 Rust belt cities like Pittsburgh and New York are showing more stability, with less overvaluation compared to cities in the South and West, offering a more favorable buying environment.

Q & A

What recent prediction did Zillow make about the US housing market?

-Zillow downgraded its housing forecast, predicting a national home price drop of 1.7% over the next 12 months. They expect price declines in every major metro area, with the biggest drop expected in San Francisco at 5.2%.

How does the Reventure forecast differ from Zillow's housing predictions?

-Reventure predicts a smaller national price drop of 0.4% over the next year, compared to Zillow's 1.7% decline. Additionally, Reventure forecasts price increases in certain cities like New York, while Zillow expects declines in those areas.

Which markets are expected to experience significant declines in home prices according to Reventure?

-Reventure forecasts significant declines in markets like Denver (-8.6%), Austin (-6.3%), Tampa (-5.8%), Phoenix (-5%), and Dallas (-6%).

Why is it still not considered a good time to buy a home despite predicted price drops?

-Even with predicted price drops, many homes are still overpriced compared to their long-term values, and buyers may feel they are overpaying. Additionally, mortgage payments and overall affordability remain high.

What is the current state of inventory in the US housing market?

-Inventory in the US housing market has nearly tripled over the past three years, returning to pre-pandemic levels. This has contributed to the slowdown in home price growth.

What does the data show about the rate of price cuts in the US housing market?

-Sellers are reducing their prices at the highest rate in a decade. In March 2025, 23% of sellers cut their listing prices, compared to the long-term average of 17%.

How can mortgage payments as a percentage of income help determine if it's a good time to buy?

-The mortgage payment as a percentage of income helps assess affordability. If mortgage costs are significantly higher than long-term averages, it indicates that homes are overpriced, making it a less favorable time to buy.

What are the mortgage payment to income ratios in California, Texas, and Florida?

-In California, the ratio is 61%, significantly above the long-term average of 43%. In Texas, it is 33%, above the long-term average of 23%. In Florida, the ratio is 39%, above the long-term average of 27%.

What historical data supports the idea that current housing prices are overvalued?

-Inflation-adjusted home prices are currently higher than in 2006, indicating that we are in the largest housing bubble in US history. The home price to income ratios today are also at historically high levels, similar to previous housing bubbles.

What is the 'overvaluation rate' and how does it help potential homebuyers?

-The overvaluation rate is a metric that compares the current home value to income ratio in a market to its long-term average. It helps homebuyers assess whether a market is overvalued or undervalued, guiding decisions on when to buy.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Holy Sh*t…Did The Housing Bubble Just Pop?!

Zillow Makes Sneaky Smart Deal with Buffett's Real Estate Business

Press Briefing: Severe Tropical Storm #PepitoPH{Man-yi} at 5:00 PM | Nov 18, 2024-Monday

Mortgage Interest Rates to be 5.75% to 6.25% in 2025 (Housing Market Update)

Housing Market 2.0: How Lower Interest Rates Will Change The Market

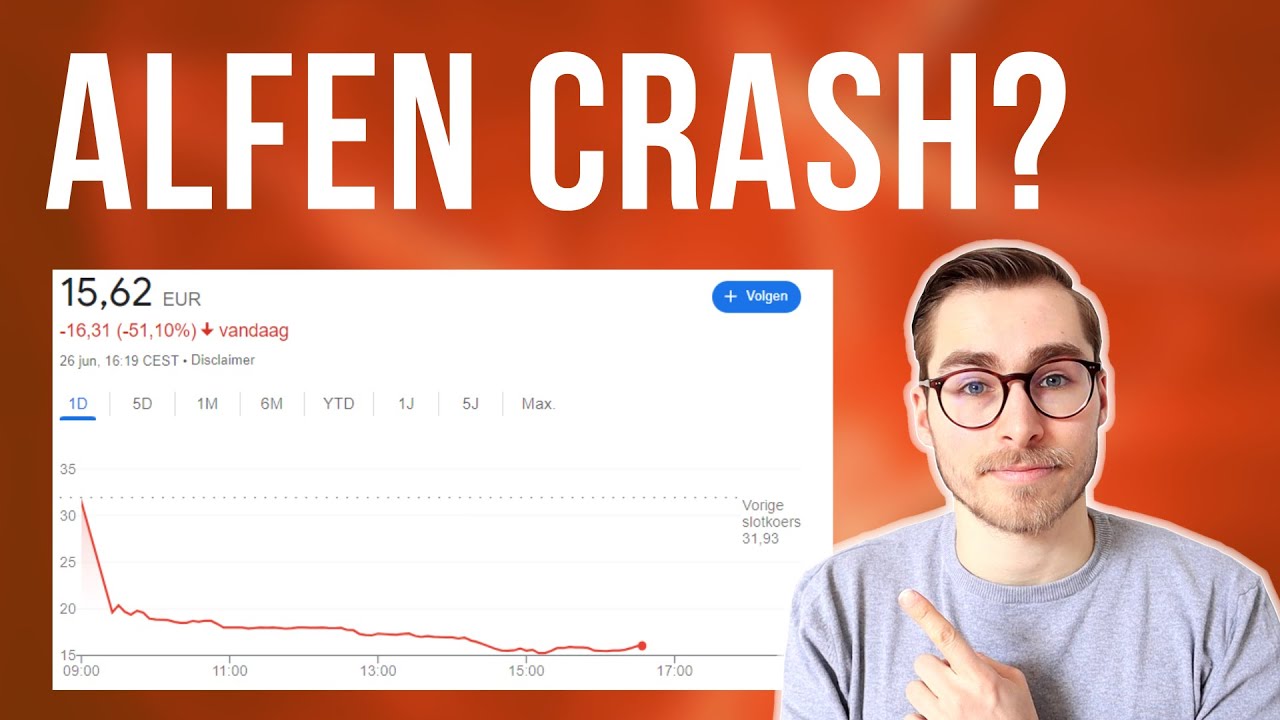

Wat is er aan de hand met ALFEN?

5.0 / 5 (0 votes)