ANALISIS DANA,ANALISIS ARUS KAS DAN PERENCANAAN KEUANGAN

Summary

TLDRThis presentation by Group 4 covers financial analysis topics, including cash flow analysis, financial planning, and forecasting. The speakers discuss various aspects such as cash flow statements, sources of funds (short, medium, and long-term), and their significance for financial managers. They explore the differences between cash flow statements and financial reports, emphasizing the importance of operational cash flow. The discussion also highlights forecasting techniques for cash flow and the creation of financial reports like income statements and balance sheets, offering insights on how companies manage liquidity and make informed financial decisions.

Takeaways

- 😀 A cash flow statement summarizes the changes in a company's financial position from one period to another, highlighting the sources and uses of funds.

- 😀 There are three main categories of sources of funds: short-term, medium-term, and long-term, each suited for specific financial needs.

- 😀 A cash flow statement helps managers assess whether a company has sufficient funds to meet its liabilities when due and to take advantage of investment opportunities.

- 😀 The analysis of cash flows provides valuable insights for financial managers to plan long-term and medium-term financing needs and detect imbalances in fund usage.

- 😀 Cash flow statements can be prepared using either the direct or indirect method, with both methods offering insights into operational, investing, and financing activities.

- 😀 The operating activities section of the cash flow statement includes cash inflows from sales, loans, and dividends, while outflows include payments for inventory, wages, and interest.

- 😀 Investing activities involve cash flows related to the purchase and sale of assets such as property, equipment, and securities.

- 😀 Financing activities show cash inflows from loans or equity sales, and outflows related to repaying loans, buying back equity, or paying dividends.

- 😀 The cash flow statement, especially with the direct method, offers detailed insights into a company's operational, investing, and financing activities, helping to assess financial strengths and weaknesses.

- 😀 Financial forecasting, including cash flow estimates, is essential for understanding potential deviations in cash balances and ensuring the company remains financially stable even in uncertain conditions.

Q & A

What is the main purpose of a cash flow statement?

-A cash flow statement provides a summary of the changes in a company's financial position from one period to another, focusing on cash changes, sources, and uses of funds. It helps determine if a company can meet its financial obligations and seize investment opportunities.

What are the three categories of sources of funds mentioned in the transcript?

-The three categories of sources of funds are short-term, medium-term, and long-term. Each category is suited for specific needs depending on the duration of the financial requirement.

Why is cash flow analysis important for financial managers?

-Cash flow analysis helps financial managers plan for long-term and medium-term funding, detect imbalances in fund usage, and make quick, informed decisions to resolve potential financial issues.

What is the difference between a cash flow statement and a cash flow forecast?

-A cash flow statement reports historical cash inflows and outflows over a period, while a cash flow forecast estimates future cash flows, helping managers plan for potential cash shortages or surpluses.

What are the primary activities categorized in a cash flow statement?

-The primary activities in a cash flow statement are: operational activities (e.g., sales, payments to suppliers), investment activities (e.g., buying and selling assets), and financing activities (e.g., borrowing, issuing equity, paying dividends).

What is the purpose of using the direct and indirect methods in cash flow reporting?

-The direct method reports cash inflows and outflows explicitly, while the indirect method adjusts net income to reflect cash flows. The indirect method is more commonly used by companies due to its simplicity.

What are the key components of an income statement forecast?

-An income statement forecast includes estimates of revenue, cost of goods sold, operating expenses, and taxes. It calculates the expected net income for a future period.

How does a company forecast its financial position?

-A company forecasts its financial position by estimating assets (e.g., cash, receivables), liabilities (e.g., loans, payables), and equity (e.g., shareholder investments), ensuring the balance between total assets and liabilities + equity.

How does forecasting cash flows improve financial management?

-Forecasting cash flows allows companies to anticipate shortfalls or surpluses, determine financing needs, and optimize the use of cash, ensuring smoother operations and better financial stability.

Why is it important for companies to estimate deviations from cash flow forecasts?

-Estimating deviations from cash flow forecasts helps companies identify potential financial risks early, allowing them to make adjustments and secure additional funding if needed to avoid operational disruptions.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

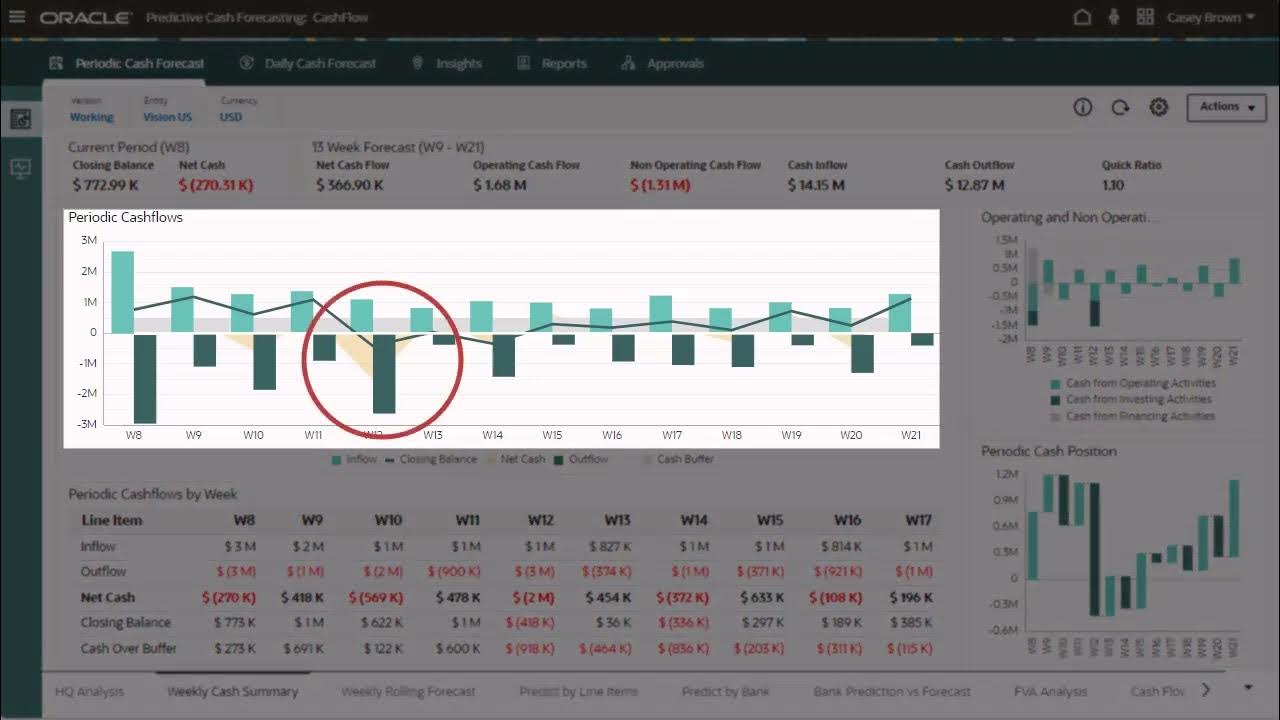

Predictive Cash Forecasting Product Tour

ANGGARAN KAS DAN MANAJEMEN KAS-MKS 4D

Webinar On AI-Enhanced DCF Model - Basics & Industry-Specific Perspectives by Mr. Murali Raman

Vid # 5 BUSINESS MANAGEMENT ACCOUNTING Module 3 Part 1

11 Financial Analyst Interview Questions - Concepts to Practical Implications | Conceptual Interview

GESTÃO FINANCEIRA EMPRESARIAL: ENTENDA A IMPORTÂNCIA PARA O SUCESSO DE SEU NEGÓCIO

5.0 / 5 (0 votes)