How to Trade Breaker Blocks | 100% winrate | ICT Simplified

Summary

TLDRThis video offers an in-depth look at advanced trading strategies, focusing on concepts like liquidity sweeps, order blocks, market structure shifts, and inducements. It emphasizes the importance of understanding institutional trading patterns and accurately identifying high-probability trade setups. By targeting fair value gaps, recognizing break blocks, and managing trade risk with precision, traders can improve their chances of consistent success. The video guides viewers through the process of recognizing key market events and executing trades with structured risk management to achieve a higher probability of profitable outcomes.

Takeaways

- 😀 Liquid sweep is a critical concept in the ICT strategy, where liquidity is swept from swing lows and old lows to confirm market movement.

- 😀 The last opposite color candle before a liquidity sweep is essential for identifying potential order blocks.

- 😀 Waiting for the failure of the opposite color candle after a sweep is a key step in confirming the market's direction.

- 😀 A market structure shift occurs when the market breaks previous trends, providing a signal for potential entries.

- 😀 Inducements help confirm an entry point after a market structure shift, ensuring a higher probability of success.

- 😀 Setting a safe stop loss above the recent high minimizes risk while ensuring a safer trade execution.

- 😀 Aiming for a 1:3 risk-to-reward ratio provides a solid foundation for consistent profitability in trades.

- 😀 Entry points should be based on limit orders, specifically at the opening price of a breaker block, for better execution.

- 😀 Timing is crucial in ICT trading. Entering during the ‘kill zone’ ensures that trades are made at optimal times for maximum efficiency.

- 😀 Breaker blocks are powerful and should never be ignored. The more liquidity a breaker block sweeps, the stronger and more reliable it becomes.

- 😀 Patience is key. It’s important to wait for the right conditions—such as liquidity sweeps, opposite color candles, and inducements—before making a trade.

Q & A

What is the main concept behind high-probability breaker blocks in market trading?

-High-probability breaker blocks are formed after multiple liquidity sweeps and a shift in market structure. These setups increase the likelihood of a successful trade as they identify key market levels where price action tends to reverse or continue.

What are liquidity sweeps and why are they important in the ICT strategy?

-Liquidity sweeps refer to the market moving past significant highs or lows to 'sweep' liquidity. These are important because they help identify key market levels and signals for potential reversals or continuations, forming the foundation for high-probability setups.

How does the concept of 'Last Opposite Color Candle' contribute to identifying potential trade setups?

-The 'Last Opposite Color Candle' is the most recent candle that moves against the prevailing market direction, signaling a potential order block. Identifying this candle is crucial because it helps traders find key points where price action may reverse.

What does waiting for the failure of an order block mean, and how does it impact the trading decision?

-Waiting for the failure of an order block means waiting for the price to move beyond the order block without reversing, confirming the setup. This is important because it confirms that the market has broken a key level and is likely to continue in the expected direction.

Can you explain the significance of the 'Market Structure Shift' in the ICT strategy?

-The 'Market Structure Shift' indicates a change in the market's behavior, either from bullish to bearish or vice versa. This shift is crucial because it provides confirmation of the trade direction after the failure of an order block.

What is the concept of 'Inducement' in trading, and why is it necessary to wait for it?

-Inducement refers to a price action setup that signals potential entry into a trade. It is necessary to wait for inducement because it confirms that the market is ready for a move in the desired direction, reducing the risk of false breakouts.

What is a Breaker Block, and how is it different from an Order Block in the ICT strategy?

-A Breaker Block is an expanded form of an Order Block after its failure. It signals a more powerful trade opportunity, as the price action has proven the previous order block's failure, confirming the market's new direction.

Why is the entry point based on the opening price of the breaker block important in the ICT strategy?

-Entering based on the opening price of the breaker block is important because it represents the price level at which the market confirms a new trend. This is the optimal point to enter a trade with reduced risk.

What role does risk management play in implementing ICT's trading strategy?

-Risk management is crucial in the ICT strategy, as it involves setting appropriate stop losses and taking profits at reasonable levels (typically at a 1:3 risk-to-reward ratio). A safe stop loss ensures that traders minimize losses in case of market fluctuations.

What is the significance of 'Timing' and 'Kill Zones' in market entry, according to the ICT strategy?

-Timing and Kill Zones are critical in the ICT strategy because they refer to specific periods during the day when market liquidity is ideal for making high-probability entries. Entering during these times ensures that the trader is aligning their position with optimal market conditions.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

My List of Top ICT Concepts for Successful Trading

Overview of the FREE Price Action Smart Money Concepts toolkit | BigBeluga

How To Spot the Bottom of ICT's Market Maker Model

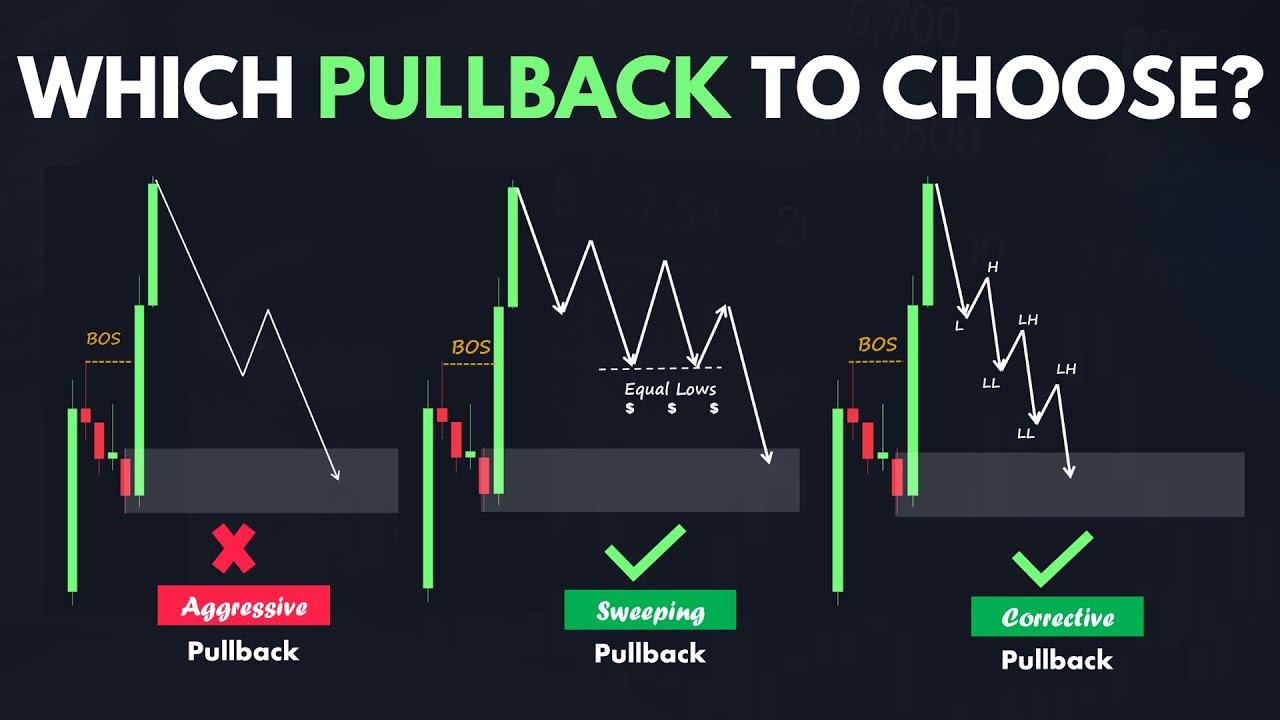

Best Pullback Trading Strategies In Forex - The Pullback Mastery Guide

Backtesting a Simple ICT Entry Model Using FX Replay!

ICT Mentorship 2023 - Deep Dive Into Institutional Order Flow

5.0 / 5 (0 votes)