Worried about stock market crash? We have an investing secret!

Summary

TLDRIn this video, the focus is on navigating the uncertainty of stock market fluctuations, especially during chaotic times like market crashes or political turmoil. The key message is to stay invested in equities, particularly in India's stock market, which has shown resilience despite numerous setbacks. The importance of controlling what you can—consistent, long-term investing—is emphasized, supported by data showing the rewards of disciplined investment. For risk management, the video suggests diversifying portfolios with stocks, bonds, and gold to minimize risk and maintain steady growth, encouraging viewers not to panic during market corrections.

Takeaways

- 😀 The stock market may face short-term bloodbaths, but investing in equity over the long term can lead to substantial growth.

- 😀 India's stock market has consistently soared over the decades, even through major global events and cataclysmic events.

- 😀 If you believe India's economy will collapse and companies will fail, you shouldn't be invested in the stock market.

- 😀 In an uncertain world, focus on controlling the controllables – consistent investment and long-term strategies.

- 😀 It's impossible to predict when market corrections will happen, so accept them as part of the process.

- 😀 By investing diligently month after month, you can reap substantial benefits, as seen in historical examples.

- 😀 Over the past 15 years, a monthly investment of 10,000 rupees in a Nifty index fund would have grown from 18 lakh to 55 lakh rupees.

- 😀 Market corrections and downturns should be accepted rather than feared, as long as you're invested sensibly.

- 😀 For a safer approach, consider diversifying investments across stocks, gold, and bonds to reduce volatility.

- 😀 A balanced portfolio with 50% in stocks, 30% in debt, and 20% in gold helps reduce risk and minimizes losses during downturns.

- 😀 Despite short-term volatility, India's economy is resilient, and it's important to avoid being overly pessimistic about the market's future.

Q & A

Why is the stock market experiencing a bloodbath according to the script?

-The bloodbath in the stock market is attributed to events influenced by political factors, particularly Trump's actions.

What advice does the video provide for people looking to manage their investments during uncertain times?

-The advice is to buy equity and invest consistently. The script emphasizes long-term investment in stocks, particularly in India's market, despite short-term volatility.

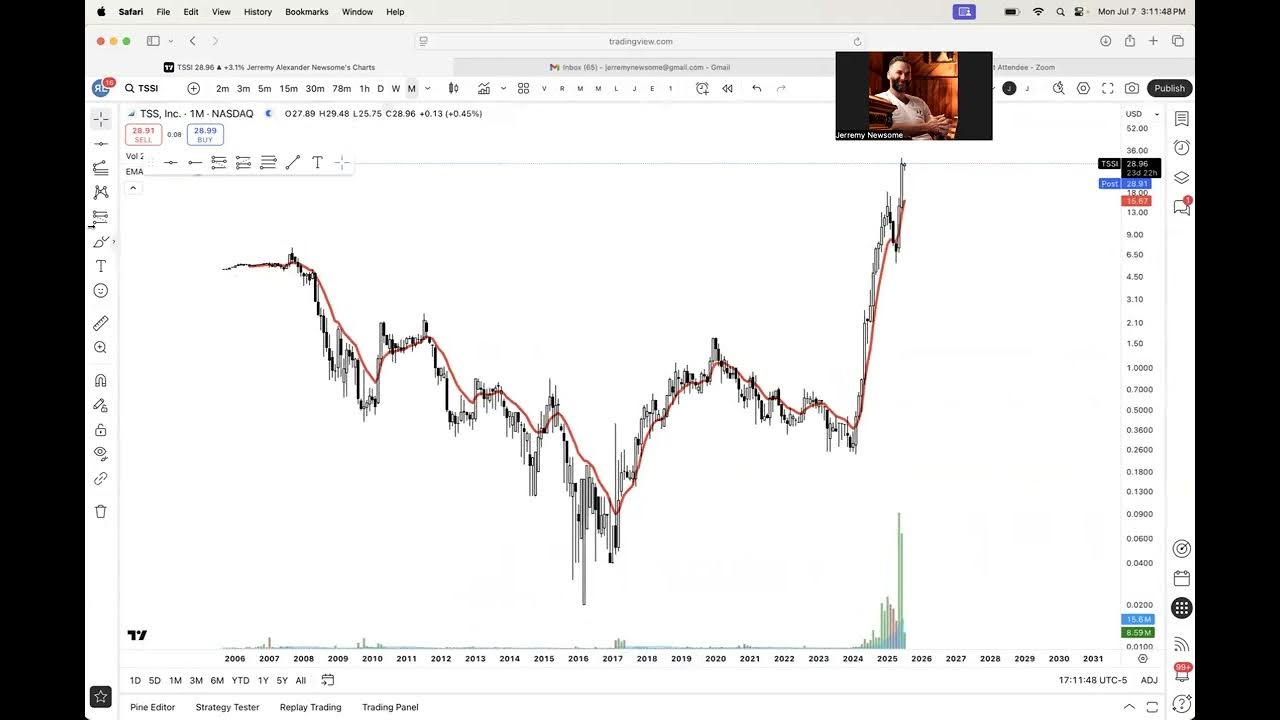

What key message is conveyed through the chart of India's stock market over the past few decades?

-The chart demonstrates that despite major global disruptions, the Indian stock market has consistently risen over the long term, highlighting the resilience of the market.

What is meant by 'control the controllables' in the context of investing?

-'Control the controllables' means focusing on what you can manage, such as consistent investments, rather than trying to predict market fluctuations or external events.

What are the major events mentioned that have impacted the market, and how should investors respond?

-Major events like the 2013 rupee taper tantrum, the 2018 market fall, and the COVID-19 pandemic are mentioned. Investors should remain calm and continue investing consistently during such events.

How did investing consistently in a Nifty index fund perform over the last 15 years?

-Investing 10,000 rupees per month in a Nifty index fund since 2010 would have grown an investment of 18 lakh rupees to 55 lakh rupees, demonstrating the benefits of long-term, disciplined investing.

What should an investor do if they find market drops stressful?

-If market drops are stressful, the suggestion is to diversify investments across stocks, gold, and bonds. This helps smooth out volatility and reduces the impact of steep declines in any one asset class.

How did a diversified portfolio of stocks, debt, and gold perform over the past two decades?

-A diversified portfolio consisting of 50% in Nifty 500, 30% in debt, and 20% in gold would have kept losses under 20%, offering a more stable return with less risk compared to a single asset class.

What is the importance of patience when investing in the stock market?

-Patience is crucial because the market rewards long-term commitment, even though it can be scary during periods of market corrections or downturns.

What does the script suggest about India's economy and its stock markets?

-The script suggests that India's economy is not on the brink of collapse and that the country and its stock markets are strong and resilient, making them a good option for long-term investments.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

How I Made $150K in the Last Stock Market Crash (And What I’m Doing Now)

TRUMP MENANG !!! IHSG RONTOK !!! CUTLOSS….

Top Tuesday Trade Ideas for July 8th, 2025

ES IST SOWEIT!!! VERSAUT NICHT DIESE LETZTE CHANCE! [BTC ALLZEITHOCH, ALTCOINS & MEHR]

Stock Market Crash? Don’t Panic, Get Rich Instead

Zee Entertainment: Big Buying Opportunity or Wait and Watch? | Insights by Sushil Kedia

5.0 / 5 (0 votes)