Don't Lose Your CRYPTO Gains! TOP TIPS When Exiting!!

Summary

TLDRThe video script discusses the complexities of cashing out cryptocurrency profits, especially during peak times when transaction volumes surge. It highlights potential issues such as high transaction fees, exchange outages, fund freezes, tax implications, and regulatory challenges. The speaker suggests strategies to mitigate these risks, like using multiple exchanges, preparing for taxes, and considering decentralized options. The script serves as a cautionary guide for crypto investors on planning their exit strategies amidst an increasingly scrutinized and volatile market.

Takeaways

- 🚀 Cryptocurrency prices are reaching new highs, prompting concerns about exit strategies and potential obstacles when cashing out profits.

- 🕒 Timing the market might be easier than dealing with the logistical challenges of realizing gains, especially as more people get involved in the crypto space.

- 💡 The presenter suggests that issues such as exchange outages and high transaction fees can disrupt the process of selling cryptocurrencies at peak times.

- 💼 The strain on wallets, exchanges, banks, tax authorities, and regulators could cause significant problems for investors looking to cash out.

- 🔄 Transaction fees can vary significantly depending on network congestion, and it's crucial to ensure you have enough cryptocurrency to cover these fees.

- 📱 Using a wallet that allows manual setting of transaction fees can help ensure timely transactions even during network congestion.

- 🤔 The importance of having accounts on multiple exchanges is highlighted to mitigate risks associated with exchange outages.

- 🔒 There is a risk of funds being frozen on exchanges, which can be due to various reasons including regulatory compliance and account verification.

- 🏦 Banks may also freeze funds or accounts due to suspicious activities, so it's recommended to communicate with your bank before transferring large amounts of money.

- 📊 Regulatory issues, such as potential security classifications for cryptocurrencies, can impact the ability to cash out and should be monitored closely.

- 📝 The presenter advises against giving financial or investment advice without proper qualifications, as this could lead to legal issues.

Q & A

What challenges might one face when trying to cash out cryptocurrency gains during a bull run?

-During a bull run, challenges include high transaction fees, exchange outages, potential freezing of funds, regulatory issues, and possible bank account freezes due to suspicious activities.

Why are high transaction fees a concern when selling cryptocurrency?

-High transaction fees can occur when the blockchain is busy, potentially costing hundreds of dollars to move crypto out of a wallet to an exchange, which can significantly impact profits.

How can one ensure their cryptocurrency transaction goes through during network congestion?

-One can move their cryptocurrency to a wallet that allows setting the transaction fee manually and ensure they have enough cryptocurrency to pay for inflated fees.

What is the role of DEXes like Uniswap and PancakeSwap in the process of cashing out cryptocurrency?

-DEXes can be used to trade tokens for stablecoins when centralized exchanges are down or if the specific token is only available on a particular exchange that is experiencing issues.

Why is it recommended to have accounts on multiple reputable exchanges?

-Having multiple exchange accounts allows for flexibility and the ability to transfer crypto if the primary exchange goes down or experiences issues.

What is the significance of EIP 1559 in the context of Ethereum transaction fees?

-EIP 1559 is a proposal aimed at making Ethereum transaction fees more predictable and potentially lower, but its effectiveness during high-demand periods is still uncertain.

How can one prepare for potential issues with cryptocurrency exchanges when cashing out?

-By familiarizing oneself with the withdrawal process, checking for any suspended withdrawals, and considering alternative trading platforms like DEXes.

What steps can be taken to mitigate the risk of bank account freezes when depositing crypto gains?

-One can inform the bank in advance about the incoming funds, consider opening additional bank accounts, and potentially use cryptocurrency debit cards for instant cash access.

What regulatory issues might impact the process of cashing out cryptocurrency?

-Regulatory issues could include potential security classifications for certain cryptocurrencies, KYC requirements for wallets, and increased scrutiny on transactions for suspicious activity.

Why is it important to consider the tax implications when cashing out cryptocurrency gains?

-Significant gains from cryptocurrency can be subject to taxes, and understanding the tax implications can help in planning and avoiding potential legal issues.

How can one avoid providing unintended financial or investment advice when discussing cryptocurrency?

-By clearly stating that any discussions or content shared are for educational purposes only and not financial advice, and by not making specific recommendations.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Crypto Trading Strategy: Ultimate Guide To Max Gains!

Cardano SHOCKWAVE Is Near! (ADA Plotting EXPLOSIVE Move!)

Most Physically Demanding Job (🇨🇳 China's Hardest Job?)

TRUMP COIN VERPASST?! SO MACHT IHR JETZT RIESEN GEWINNE!!! [Verpasst nicht diese RIESEN CHANCE]

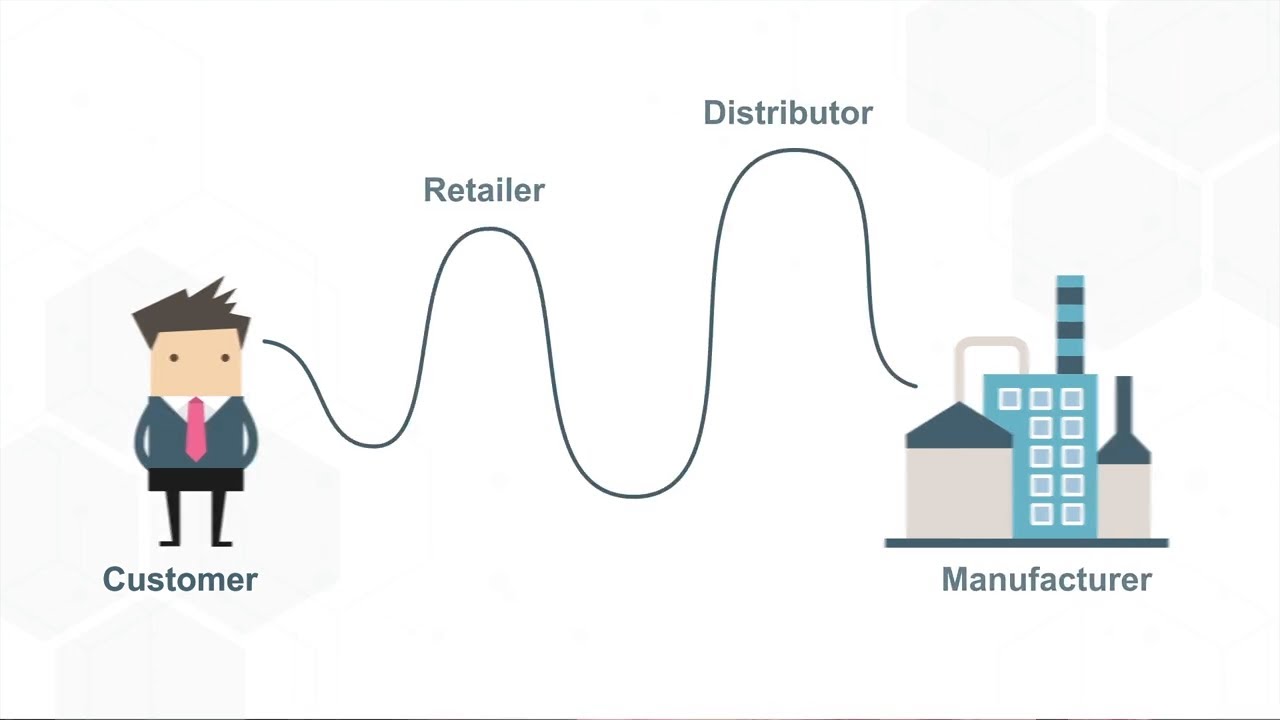

What is the Bullwhip Effect and What Causes It?

JE FONCE ACHETER CES 10 CRYPTOS EN SEPTEMBRE

5.0 / 5 (0 votes)