Business 101

Summary

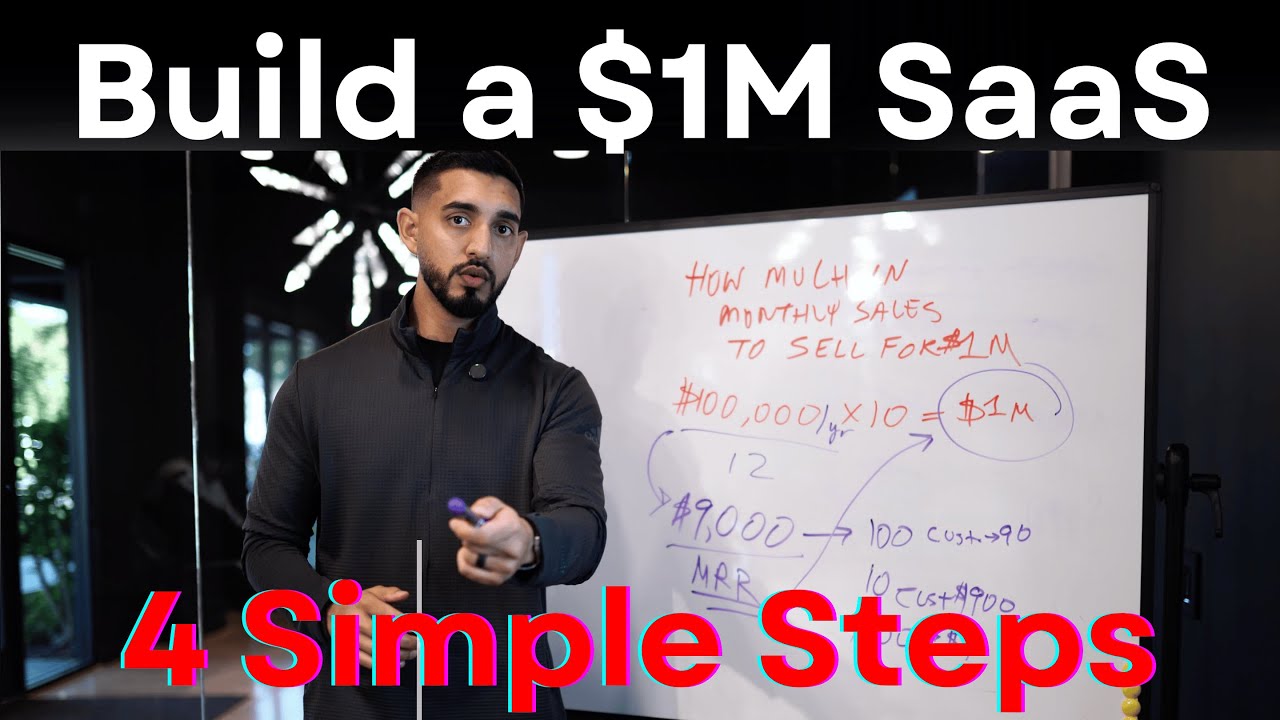

TLDRThis video emphasizes the importance of focusing on profit, valuation, and recurring revenue when building a business. It explains the benefits of subscription-based models over one-time sales, highlighting how subscriptions can ensure consistent revenue, stabilize cash flow, and increase company valuation. The speaker shares insights on how operational efficiency, intellectual property, and long-term growth are essential for a business to thrive and become a sellable asset. The key takeaway is that focusing on profit and long-term valuation leads to more sustainable success and a higher exit value.

Takeaways

- 😀 A CISO must balance cybersecurity with business strategy to support the company's growth and security.

- 💡 Understanding both **capital** and **operational expenses** is crucial for a CISO to manage security and business effectively.

- 📊 A true business must make a profit, operate without the founder, and have a sellable asset.

- 💰 **Profitability** is more important than revenue for long-term business success.

- 🔁 Transitioning from one-time product sales to **subscription models** ensures recurring revenue and boosts business stability.

- 📈 Companies with subscription-based models tend to have higher **valuations** due to their stable, predictable revenue streams.

- 💸 Relying solely on **one-time sales** can lead to financial instability, as businesses start fresh every month with no guarantee of income.

- 🚀 Focus on building a **profitable** business first, then work on **valuation**, and finally prioritize **revenue**.

- 📉 A company operating in the red with no profitability may look like it has high revenue, but it doesn’t have a solid valuation.

- 💼 A business with recurring revenue (e.g., multi-year subscriptions) is far more valuable and easier to grow compared to a one-off sales model.

- 🎯 To achieve sustainable growth, it’s essential to build a business that maintains recurring revenue, not just high one-time sales.

Q & A

What is the difference between capital and operational expenses?

-Capital expenses are long-term investments in assets, such as property or equipment, that provide value over time. Operational expenses, on the other hand, are the day-to-day costs required to run the business, like salaries and utilities.

Why is it important to understand the difference between capital and operational expenses?

-Understanding the difference allows a business owner to manage their finances more effectively, ensuring they can make decisions that optimize both immediate costs and long-term investments for growth.

What does it mean for a business to be 'sellable'?

-A business is considered 'sellable' when it can operate independently, making profits without the owner's direct involvement. It has sustainable processes and valuable assets, such as intellectual property, that make it attractive to potential buyers.

What is the significance of profit in business?

-Profit is crucial because it indicates the financial health of the business. A business must generate profits to stay viable, pay for future growth, and ensure that it remains attractive to potential investors or buyers.

Why is recurring revenue considered more valuable than one-time sales?

-Recurring revenue, like subscriptions, provides stability and predictability in cash flow. It allows businesses to plan for the future, making them more attractive to investors and buyers because the revenue is ongoing, unlike one-time sales that generate revenue only once.

What role does intellectual property play in the valuation of a business?

-Intellectual property, such as patents or proprietary technology, significantly increases the value of a business. It represents unique assets that are difficult for competitors to replicate and can generate long-term revenue.

How does subscription-based revenue impact business growth?

-Subscription-based revenue allows businesses to build a reliable and growing revenue stream. As each new customer adds to the subscription base, the business gains momentum, making it easier to achieve consistent growth without starting from zero each month.

Why is valuation important when building a business?

-Valuation is critical because it determines how much a business is worth in the market. A higher valuation means the business can attract more investors, secure funding, and ultimately sell for a higher price when the owner decides to exit.

What are the key factors that affect a business's valuation?

-The key factors influencing a business's valuation include profitability, recurring revenue, intellectual property, customer retention, and market position. A company with strong profits, loyal customers, and valuable assets tends to have a higher valuation.

Why should business owners focus on profitability before revenue?

-Focusing on profitability ensures the business is sustainable in the long term. Without profit, high revenue becomes meaningless, as it indicates that the business is not efficiently converting sales into actual financial gains. Profitability is a sign of a healthy business.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Build a $1M SAAS Software Company in 2025 (COPY THESE 4 STEPS)

I Built a $50 Million Business in 6 Minutes

How to Print ENDLESS Money and Get Rich Forever

How to Build a $2,167/Day SaaS with No Code (for Free)

What is a Business? | Introduction to Business

Basic Accounting Terms | Class 11 | Accountancy | Lecture 1

5.0 / 5 (0 votes)