IPO KYC | Vishal Mega Mart's ₹8,000 Cr IPO Opens On December 11 | N18V | CNBC TV18

Summary

TLDRIn this interview, Ginder Kapoor, CEO of Vishal MegaMart, discusses the company’s 8,000 crore IPO, a pure offer for sale, with its major PE investor Kadara Capital. The conversation covers Vishal MegaMart's growth, including a valuation increase from 5,000 crore in 2018 to 37,000 crore, driven by strong same-store sales growth and robust financials. Kapoor outlines the company’s strategy to maintain affordability for customers amidst inflation, its increasing focus on private labels, and plans for expanding its store footprint. The company also explores scaling up its e-commerce presence through quick commerce, targeting incremental customer engagement.

Takeaways

- 😀 Vishal MegaMart's IPO is a massive offer for sale, with an 8,000 crore rupee size and a private equity-backed promoter stake dilution from 98.77% to 76.2%.

- 😀 Despite the large stake sale, the promoters (Kadara Capital) remain committed to the business with a long-term focus and no significant concerns over further dilution in the near future.

- 😀 The company has shown impressive growth since Kadara Capital's investment in 2018, increasing its valuation from 5,000 crore rupees to 37,000 crore rupees in just six years.

- 😀 Vishal MegaMart has achieved strong performance with double-digit same-store sales growth, including a 13.6% growth in FY24, and has maintained a healthy financial profile, including a debt-free status and 700 crore rupees in cash reserves.

- 😀 The company is cautiously optimistic about its near-term growth, despite experiencing some consumption slowdown. They aim for consistent revenue and same-store sales growth, even if it requires more efforts, such as price adjustments.

- 😀 To ensure affordability amid inflation, Vishal MegaMart fine-tunes its pricing strategy, sometimes absorbing inflationary pressures and deferring price hikes, which impacts margins but helps maintain customer loyalty.

- 😀 The company's focus is on maintaining gross margins around 28% and EBITDA margins in the 13-14% range, with operating leverage expected to deliver margin improvements as the business scales.

- 😀 Private brands play a significant role in Vishal MegaMart's offering, contributing to 70% of general merchandise and 100% of clothing, helping them provide better value and affordability to customers.

- 😀 Despite having high private brand penetration, Vishal MegaMart's strategy is to maintain price stability, absorbing inflation when needed to protect customers from rising costs, without significantly compromising on margins.

- 😀 The company is expanding its digital footprint with a pilot of quick-commerce, offering delivery within 2 hours from local stores in 375 cities, aiming to scale this model efficiently with minimal margin impact.

- 😀 Vishal MegaMart plans to continue its aggressive expansion, opening 80-100 new stores annually, while focusing on strategic geographic diversification into high-growth areas like Kerala, Tamil Nadu, Maharashtra, and Gujarat.

- 😀 The company maintains a healthy cash reserve of 700 crore rupees, with a substantial portion allocated to store expansion and growth initiatives. However, dividends have not been paid yet, as the focus remains on reinvestment for growth.

Q & A

Why is Vishal MegaMart launching an Offer for Sale (OFS) in its IPO, and how does this affect its ownership structure?

-Vishal MegaMart is launching an IPO worth ₹8,000 crore entirely as an Offer for Sale (OFS) to reduce the stake of its private equity investor, Kedara Capital, from 98.77% to 76.2%. Despite this, Kedara will remain a promoter and a significant shareholder, continuing its long-term commitment to the business.

What has been the financial performance of Vishal MegaMart in recent years?

-Vishal MegaMart has shown strong financial growth, including a 13.6% same-store sales growth in FY24, generating ₹8,900 crore in revenue. The company is debt-free, with a 14% EBITDA margin, a 5.8% PAT margin, and a 71% return on capital employed. Over the last three years, it has generated free cash flow of ₹2,900 crore.

How does Vishal MegaMart plan to handle the current consumption slowdown in the market?

-Despite the slowdown, Vishal MegaMart has maintained double-digit same-store sales growth by adjusting its offerings to remain affordable, absorbing inflation when necessary, and focusing on customer satisfaction through value-oriented products.

How has Vishal MegaMart managed its pricing strategy in light of inflation?

-Vishal MegaMart has deferred price increases during inflationary periods to ensure that products remain affordable for consumers. For example, during the Ukraine crisis, the company chose not to pass on significant price hikes to customers, even if it impacted its margins.

What is the role of private label brands in Vishal MegaMart's business, and how have they contributed to its success?

-Private label brands are a key focus for Vishal MegaMart, contributing to 72-74% of total sales. The company offers private labels across categories like clothing, general merchandise, and FMCG. These brands help meet customer aspirations affordably while maintaining competitive margins.

What are the company's plans for its online presence and e-commerce initiatives?

-Vishal MegaMart is expanding into quick commerce, allowing delivery within 2 hours for orders over ₹299 in 375 cities. The company plans to scale this initiative gradually, with a focus on capital-efficient expansion and providing digital access to its offline retail network.

What are the company's store expansion plans in the coming years?

-Vishal MegaMart plans to open 80-100 new stores per year, with a focus on choosing the right locations and ensuring the success of each new store. The company is expanding beyond its stronghold in North India into South and West India, including regions like Kerala, Maharashtra, Tamil Nadu, and Gujarat.

How has Vishal MegaMart's capital expenditure been performing in terms of store openings?

-The company has a strong track record of store openings, with a payback period of just 19 months on new store capital expenditure. This quick return on investment has helped drive Vishal MegaMart’s expansion efforts across India.

How does Vishal MegaMart plan to utilize its cash reserves of ₹700 crore?

-Vishal MegaMart plans to allocate 30-40% of its ₹700 crore cash reserves towards growth initiatives, including new store openings and expanding its e-commerce and quick commerce capabilities. The company has not paid dividends yet, as its primary focus is on reinvesting in its growth.

What is Vishal MegaMart’s strategic goal for serving Indian consumers, and how does it plan to achieve this?

-Vishal MegaMart’s primary strategic goal is to make people's aspirations affordable, especially for the middle and lower-middle-income groups in India. The company aims to achieve this by offering value-oriented products, focusing on private label brands, and leveraging digital commerce to enhance accessibility.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Have Bid For Projects Worth ₹30,000 Cr, Typical Order Win Strike Rate Around 10%: Transrail Lighting

Q3FY25 : Brainbees Solutions & Vishal Mega Mart

Hyundai Motor India Limited IPO Review | CA Rachana Ranade

Hyundai Motors IPO | ભરવો જોઈએ કે નહિ? | Ek Vaat Kau

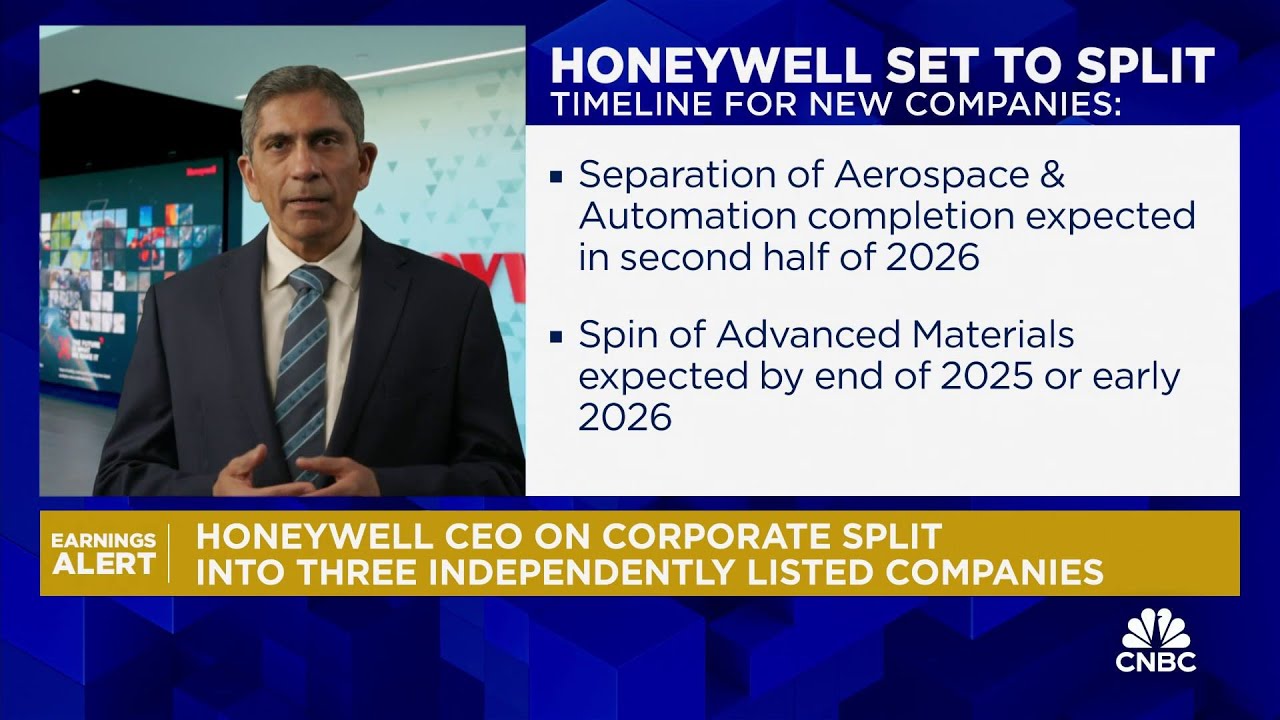

Honeywell CEO: Separation of Aerospace & Automation completion expected in second half of 2026

Vishal Mega Mart IPO - Analysis | Vishal Mega Mart IPO | Nifty and Bitcoin analysis | 9/12/2024

5.0 / 5 (0 votes)