Bitcoin price about to hit HISTORIC $100,000! (How Much Higher Can It Go?)

Summary

TLDRBitcoin has recently surpassed the $100,000 mark, marking a major milestone in the crypto space. Experts predict this could be just the beginning, with prices possibly reaching $250,000 by the end of 2025. Key factors driving this surge include a shift in political and regulatory stance, with potential support from the U.S. government under future leadership, as well as growing institutional adoption. The launch of Bitcoin ETFs and the idea of Bitcoin becoming a strategic reserve asset further fuel optimism. Despite the volatility, many see Bitcoin's future growth as inevitable, positioning it as a key digital asset in the years ahead.

Takeaways

- 😀 Bitcoin has reached the historic $100,000 price point, with some exchanges already reporting it as surpassed, signaling a major psychological milestone in the crypto market.

- 😀 There is significant optimism that Bitcoin could reach $125,000 by Christmas 2024, driven by increasing media attention and crypto-related news during the holiday season.

- 😀 The $100,000 Bitcoin price is seen as a paradigm shift, signaling a transformation in the crypto space after recent challenges like the FTX collapse and regulatory crackdowns.

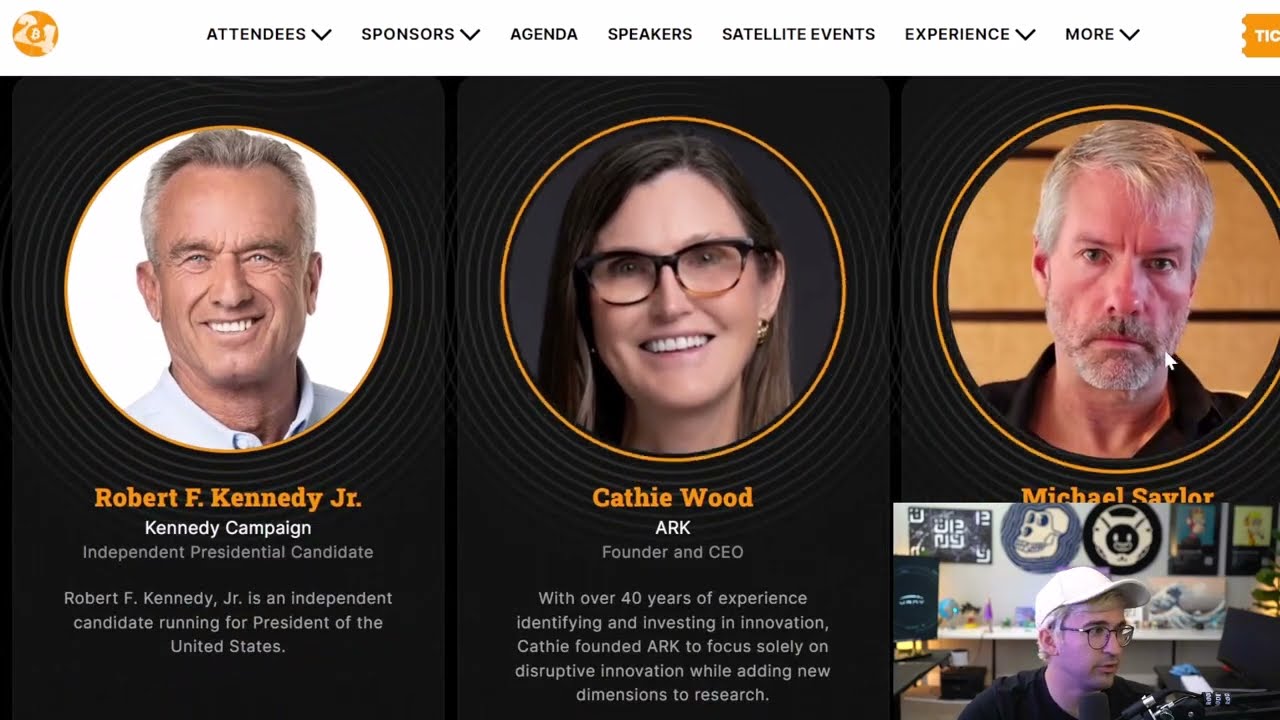

- 😀 Trump's pro-crypto stance, including a potential strategic Bitcoin stockpile and a friendly approach to digital assets, is seen as a key catalyst for Bitcoin's rise.

- 😀 Senator Cynthia Lumis proposes a bill to create a U.S. Bitcoin Reserve, potentially increasing Bitcoin's legitimacy and value as a reserve asset, with the government potentially acquiring up to 1 million Bitcoin.

- 😀 Bitcoin’s potential as a reserve asset is growing, with other nations possibly following the U.S.'s lead if it begins treating Bitcoin as a strategic reserve asset.

- 😀 Trump’s proposed digital asset policy shift, including the creation of a new White House position dedicated to managing crypto regulations, signals a broader governmental embrace of Bitcoin.

- 😀 There is a growing belief that Bitcoin could surpass $250,000 by the end of 2025, as Bitcoin becomes a necessary asset for global transactions and as ETFs bring retail investors into the market.

- 😀 The Bitcoin market is becoming more stable as key exchange tokens are being bought up, reducing floating supply and making it increasingly harder for the price to drop significantly.

- 😀 Analysts suggest that Bitcoin is entering a ‘banana zone,’ where major dips become buying opportunities, and prices will continue to rise in the long term, with predictions for $500,000 by 2027.

- 😀 The overall market sentiment is highly bullish on Bitcoin, with any price drop considered a buying opportunity, as long-term holders believe the asset will only continue to appreciate.

Q & A

What is the significance of Bitcoin surpassing $100,000?

-Surpassing $100,000 is a major psychological milestone for Bitcoin. It signals a paradigm shift, marking Bitcoin's transition from a speculative asset to a more mainstream and recognized store of value. It also attracts greater attention from retail investors, media, and governments.

Why is there speculation that Bitcoin could reach $250,000 by the end of 2025?

-The speculation arises from several factors, including growing institutional interest, favorable regulatory changes under a potential Trump administration, and the increasing recognition of Bitcoin as a reserve asset. Additionally, the market is reacting to the idea of the U.S. government building a 'strategic Bitcoin stockpile,' which could drive demand.

How has the U.S. government's stance on Bitcoin evolved recently?

-The U.S. government has shifted from a strict regulatory approach under the Biden administration to a more pro-crypto stance under Trump's proposed policies. Trump has hinted at creating a Bitcoin reserve, which would support Bitcoin’s role as a strategic asset for the country, similar to the strategic petroleum reserve.

What role does the idea of a 'strategic Bitcoin stockpile' play in the price predictions?

-The concept of a 'strategic Bitcoin stockpile' proposed by Trump and Senator Cynthia Lummis is a key factor driving bullish sentiment. If the U.S. government buys up to 1 million Bitcoin, it would reduce available supply, which could lead to a significant price increase. The idea that other nations may follow suit adds to the optimism.

What is the impact of Bitcoin ETFs on the market?

-Bitcoin ETFs are seen as a major factor in retail investors' ability to gain exposure to Bitcoin in a more traditional financial setting. They make Bitcoin more accessible and easier to trade for people who may not want to deal with direct ownership of the cryptocurrency, thus driving demand and price up.

Why is the $100,000 mark seen as a psychological barrier in Bitcoin's price?

-The $100,000 mark is a key psychological barrier because it represents a whole number that many investors and market participants view as a symbolic threshold. Breaking this barrier brings increased visibility and media attention, which often results in more buying activity and further price increases.

What role do government policies, like those proposed by Trump, play in Bitcoin's future price?

-Government policies, especially those involving crypto regulation and adoption, can significantly impact Bitcoin’s price. Trump’s proposed policies, such as the creation of a Bitcoin reserve and a more crypto-friendly regulatory environment, could lead to more institutional and government interest, driving demand and increasing Bitcoin’s value.

How might the idea of other nations following the U.S. in adopting Bitcoin affect the price?

-If other nations adopt similar Bitcoin reserve policies as the U.S., it could create a global demand for Bitcoin. This would reduce the available supply, increase competition among countries to acquire Bitcoin, and likely push the price up as a result.

What factors are contributing to Bitcoin’s increasing adoption by institutions and nation-states?

-Key factors include the growing recognition of Bitcoin as a store of value and a hedge against inflation, its potential as a settlement mechanism, and the U.S. government's increasingly favorable stance. The idea of Bitcoin becoming part of a nation's strategic reserves adds to its credibility and long-term stability.

What are the potential risks or challenges to Bitcoin reaching the predicted $250,000 by 2025?

-While the potential for Bitcoin to reach $250,000 by 2025 is high, risks include regulatory crackdowns, market volatility, competition from other cryptocurrencies, and macroeconomic factors such as inflation or global financial instability. Additionally, any unforeseen technological challenges could also impede its growth.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)