Uang

Summary

TLDRThis video delves into the concept of money in macroeconomics, exploring its definition, history, functions, and classifications. Money is defined as a liquid asset used to buy goods, services, and settle debts. The history of money traces its evolution from barter systems to commodity money, and ultimately, to fiat money issued by governments. The core functions of money include being a medium of exchange, a store of value, and a unit of account. The video also covers various forms of money supply, such as M0, M1, and M2, and discusses their liquidity levels, providing a comprehensive understanding of money's role in the economy.

Takeaways

- 😀 Money is defined as an asset that can be used to buy goods and services or settle debts, and it must be liquid, meaning easily converted into cash.

- 😀 The history of money began with barter, but the double coincidence of wants made this system inefficient, leading to the use of commodity money like gold, silver, or even tobacco.

- 😀 Fiat money emerged as a system where money is not backed by physical commodities, but by the government's decree, meaning it has value because society agrees upon it.

- 😀 The three main functions of money are: as a medium of exchange (facilitating transactions), a store of value (preserving wealth), and a unit of account (providing a standard measure for pricing).

- 😀 For money to function effectively, it must be widely accepted, scarce, standardized, durable, portable, and divisible into smaller units.

- 😀 The monetary base consists of physical money (coins and paper currency) and the reserves held by the central bank, which is the starting point of the money supply.

- 😀 M1 is a narrow definition of the money supply, consisting of physical money and checking deposits, while M2 includes M1 plus savings deposits, representing a broader scope of the money supply.

- 😀 Liquidity is a key factor in money supply; M1 is more liquid than M2 because it includes only the most readily accessible forms of money.

- 😀 The value of fiat money is determined by trust and agreement within society, meaning it works because people believe in its ability to facilitate transactions.

- 😀 Money supply definitions like M1 and M2 reflect different levels of liquidity, with M1 being the most liquid (cash and checking deposits) and M2 including savings accounts and time deposits.

- 😀 The shift from commodity money (like gold) to fiat money reflects economic growth and the increasing complexity of economies, allowing for more efficient and flexible transactions.

Q & A

What is the definition of money?

-Money is an asset that can be easily used to purchase goods and services or to pay off debts. It must be liquid, meaning it should be easily convertible into cash or usable for transactions.

Why is liquidity an important characteristic of money?

-Liquidity ensures that money can be easily used in transactions, without delays or complications, making it effective as a medium of exchange.

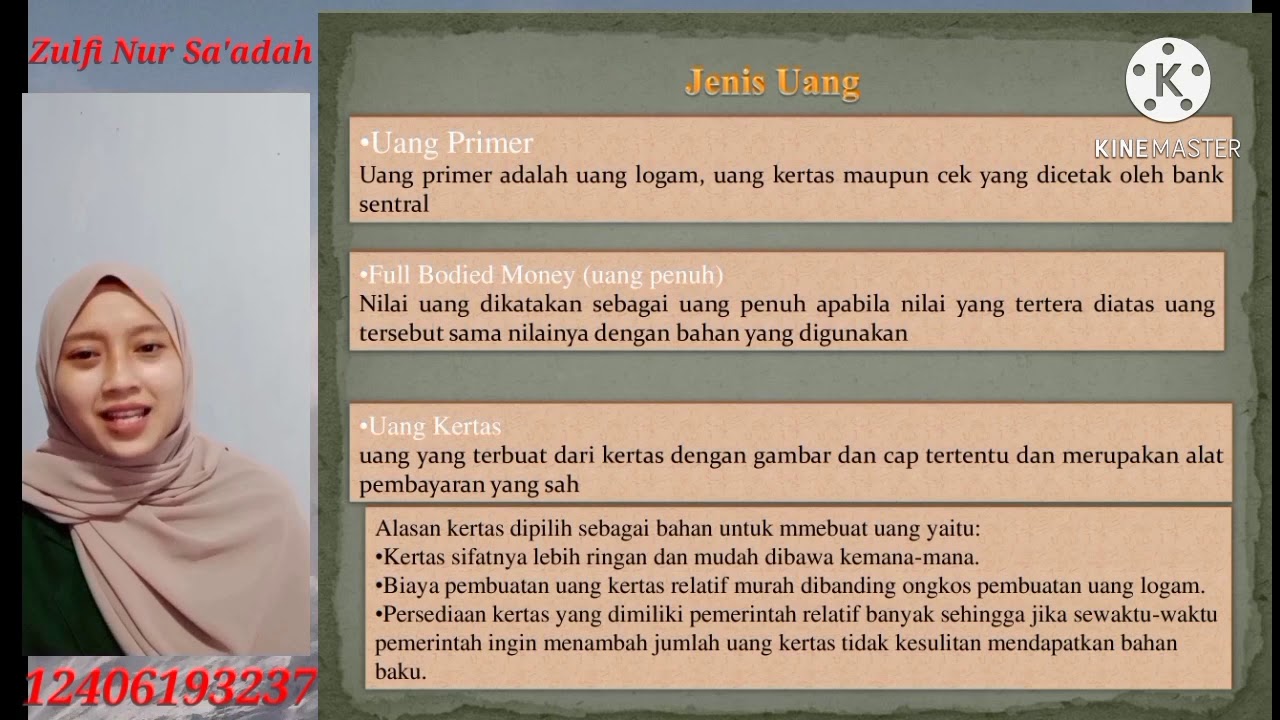

What are some forms that money can take?

-Money can exist in various forms, including commodity money (such as livestock or gold), paper money (banknotes), coins, and even digital forms like bank account balances.

What problem did the barter system face that led to the creation of money?

-The barter system required a 'double coincidence of wants,' meaning both parties had to have what the other needed, which made trade inefficient and difficult.

What is commodity money and how did it work?

-Commodity money refers to physical goods that have intrinsic value and are used as money, such as gold, silver, or even tobacco. These items were used to facilitate trade before the invention of paper currency.

What is fiat money, and how does it differ from commodity money?

-Fiat money is currency that has no intrinsic value and is not backed by a commodity like gold. Its value is derived from government decree and public trust in its usability for transactions.

What are the three primary functions of money?

-Money serves as a medium of exchange (for buying goods and services), a store of value (for preserving wealth over time), and a unit of account (for measuring and comparing the value of goods and services).

Why must money be standardized in quality?

-Money must be standardized to ensure that it has a consistent value across different regions and transactions. This prevents issues like discrepancies in quality or value between different pieces of money.

What is the significance of the monetary base (M0)?

-The monetary base (M0) refers to the total amount of physical currency in circulation, including both paper money and coins. It is issued by the central bank and serves as the foundation for the broader money supply.

What is the difference between M1 and M2 in monetary aggregates?

-M1 is the narrowest measure of the money supply, including physical currency and demand deposits (checking accounts). M2 is broader, adding savings accounts and time deposits (like certificates of deposit) to M1.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)