BAGAIMANA PRABOWO AKAN HADAPI "BUMN" BEBAN USAHA MILIK NEGARA ?! ERICK TOHIR LAGI?! - Mardigu Wowiek

Summary

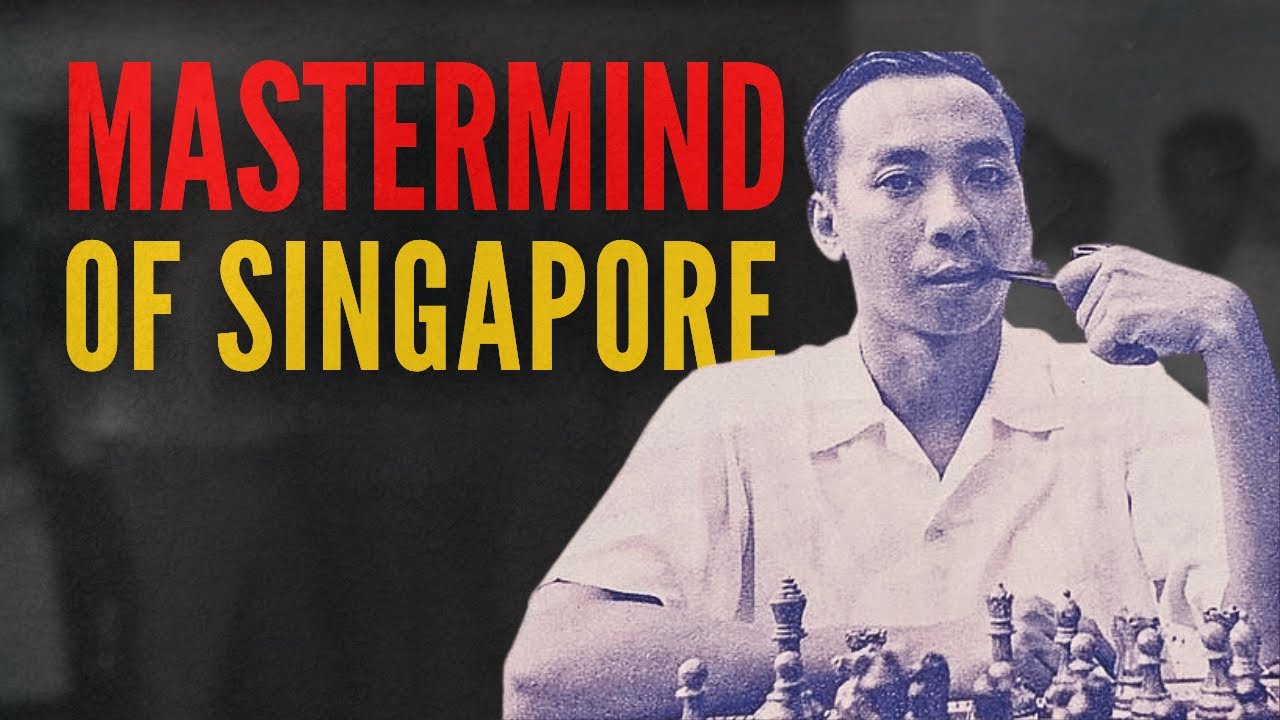

TLDRThis transcript compares the economic success of Singapore with Indonesia, highlighting how Singapore's transformation into a wealthy nation can serve as a model for Indonesia. It emphasizes Singapore's success in eliminating corruption, restructuring state-owned enterprises (SOEs), and creating Temasek, a highly profitable investment company. The script suggests that Indonesia could replicate this success by creating a similar holding company, PT Nuswantara, to manage SOEs and focus on global investments. By doing so, Indonesia could see substantial growth, potentially surpassing its current economic standing and joining global corporate giants in the future.

Takeaways

- 😀 Singapore's wealth has surpassed that of the United States in terms of GDP per capita within 40 years.

- 😀 Singapore's per capita income in 2014 was significantly higher than the United States, with citizens earning $88,000 annually compared to the U.S. average of $66,000.

- 😀 A key to Singapore's success is the elimination of corruption, which remains a major challenge in Indonesia.

- 😀 Indonesia should follow Singapore's example by privatizing state-owned enterprises (BUMN) and transitioning them to a non-operating holding structure.

- 😀 BUMN should be restructured into an independent holding company called PT Nuswantara, with no direct involvement in business operations.

- 😀 PT Nuswantara would serve as an investor and owner, focusing on long-term investments rather than operating businesses.

- 😀 The number of BUMNs in Indonesia should be reduced to no more than 50 entities, and their operations should be privatized through public IPOs.

- 😀 PT Nuswantara's long-term goal should be to build an international portfolio, with a focus on global investments and revenue generation from foreign markets.

- 😀 Temasek, Singapore's sovereign wealth fund, is an example of successful state-owned investment management, growing its portfolio from $350 million in 1974 to $389 billion in 2024.

- 😀 Temasek's success is attributed to professional management, separation of politics from business, and a focus on investing in a diverse set of industries globally.

- 😀 By following Temasek's model, Indonesia could see significant growth in its investment holdings, with potential future investments in companies like Tesla, Google, and Nvidia, benefiting future generations.

Q & A

How did Singapore manage to surpass the wealth of the United States in terms of GDP per capita?

-Singapore surpassed the United States in terms of GDP per capita due to a combination of factors including efficient governance, the eradication of corruption, and a strong focus on economic development. Additionally, Singapore adopted a model of investing in global assets through entities like Temasek, which allowed for wealth generation beyond national borders.

What is the current GDP per capita in Indonesia, and how does it compare to Singapore and the United States?

-As of the current year, Indonesia's GDP per capita is approximately $4,500 per year, which is around 70 million IDR annually, or 8.5 million IDR per month. In comparison, Singapore's GDP per capita is approximately $88,000 annually, while the United States stands at around $66,000 per capita.

What role does corruption play in the economic challenges faced by Indonesia?

-Corruption in Indonesia has hindered its economic development, as it creates inefficiency and mismanagement. The transcript suggests that political elites are often unwilling to tackle corruption because they fear becoming victims of asset confiscation or punishment, which makes real reform difficult.

What is the proposed solution to improve Indonesia's economic situation by reforming state-owned enterprises (BUMN)?

-The proposed solution involves transforming Indonesia’s state-owned enterprises (BUMN) into independent, non-operating holding companies. These entities would no longer be involved in daily operations but would focus on managing investments and ownership stakes in various industries. This would separate political influence from economic decision-making, potentially boosting efficiency and profitability.

How does the restructuring of BUMN aim to improve Indonesia's economy?

-Restructuring BUMN into independent holding companies like 'PT Nuswantara' is designed to eliminate political interference in business operations. This move would allow BUMN to focus purely on investments, improving their financial performance, and enabling a more transparent and competitive business environment.

What would be the benefits of IPO-ing state-owned enterprises (BUMN) in Indonesia?

-IPO-ing BUMN would bring several benefits, including increased transparency, public participation in ownership, and access to capital markets. It would also align state enterprises more closely with market forces, reduce corruption, and potentially open up the sector to more foreign investment.

What is Temasek, and how does it serve as a model for Indonesia's economic reform?

-Temasek is Singapore's state investment company, founded in 1974, that operates as a non-operating holding company. It manages a portfolio of investments in various industries globally. Its success, growing from an initial $350 million to $389 billion today, showcases the potential of a professional, profit-driven investment entity as opposed to state-run enterprises heavily influenced by political figures.

What are some key differences between how Temasek operates compared to traditional state-owned enterprises?

-Unlike traditional state-owned enterprises that are often involved in day-to-day operations, Temasek is a purely investment-focused company. It operates with a mindset aimed at long-term growth and profitability, with professional managers rather than politicians at the helm. Temasek also prioritizes investments in high-growth sectors like digitalization, healthcare, and sustainable industries.

What is the long-term vision for PT Nuswantara, according to the script?

-The long-term vision for PT Nuswantara is to transform it into a global investment holding company that focuses on acquiring foreign companies and expanding Indonesia’s wealth beyond its borders. The goal is for PT Nuswantara to generate 75% of its revenue from international investments by 2070.

How does the success of Temasek inspire the potential future of PT Nuswantara?

-Temasek’s success serves as a model for PT Nuswantara by demonstrating the power of a state-backed, professional investment entity. PT Nuswantara could follow in Temasek's footsteps by diversifying its portfolio, focusing on long-term investments, and eventually acquiring major global companies like Tesla, Google, or Nvidia, thus driving national wealth creation.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

BAGAIMANA NEGARA SINGAPURA BISA BEBAS DARI MASALAH SAMPAH?

Smart Cities: Singapore

Dynamic Governance dalam Sistem Birokrasi di Singapura

Why is the Philippines still Poor? | The Hard Truth

The Man Lee Kuan Yew Would Be Lost Without

If we don't want the 5Cs, what's the new Singapore dream? | Heart of the Matter podcast

5.0 / 5 (0 votes)