November 15, 2024

Summary

TLDRThis video provides a detailed walkthrough of accounting procedures, including posting journal entries to the general ledger, preparing financial statements such as the income statement and balance sheet, and closing entries. It covers key steps like transferring transactions from the journal to the ledger, adjusting trial balances, calculating net income, and preparing cost of goods sold and inventory reports. The video also explains how to close temporary accounts by resetting them for the next period, ensuring the accuracy of financial records for the upcoming cycle.

Takeaways

- 😀 The general ledger is updated by transferring entries from the general journal, such as cash transactions and investments.

- 😀 The owner's investment of ₱500,000 is recorded in the general ledger, increasing the cash balance.

- 😀 The purchase of equipment for ₱150,000 is recorded as a cash disbursement, reducing the available cash balance.

- 😀 Sales and disbursements are recorded in specialized journals such as the sales journal and cash disbursement journal.

- 😀 Cash receipts of ₱43,719 and disbursements of ₱149,429 are recorded to track business cash flow.

- 😀 The adjusted trial balance is used to prepare the income statement, including details of merchandising inventory and net income.

- 😀 The income statement shows a gross profit of ₱6,966 after accounting for sales, purchases, and cost of goods sold.

- 😀 The balance sheet is derived from the adjusted trial balance, summarizing the company's assets, liabilities, and equity.

- 😀 Closing entries ensure all temporary accounts (sales, expenses, income summary) are reset to zero for the next accounting period.

- 😀 The final step in the process involves transferring the balances from the income summary and resetting accounts for the new period.

Q & A

What is the purpose of posting to the general ledger?

-Posting to the general ledger serves to transfer journal entries to their respective ledger accounts, helping organize and track financial transactions for the preparation of financial statements.

What are the different types of journal entries mentioned in the script?

-The script mentions several types of journal entries: cash investment by the owner, purchase of equipment, receipt of cash, and disbursement of cash.

How is the cash investment from the owner recorded?

-The cash investment is recorded as a debit in the general journal with an amount of 500,000, reflecting the owner’s contribution to the business.

What does the script mention about the purchase of equipment?

-The purchase of equipment is recorded as a credit in the general journal, indicating a cash outflow of 150,000 for the acquisition, leaving a balance of 300,000.

How is the receipt of cash recorded in the journal?

-The receipt of cash is recorded in the sales journal, showing a debit entry for the amount of 43,719.

What is the purpose of the sales journal in this context?

-The sales journal is used to record cash receipts and disbursements, including amounts such as 43,719 for cash received and 149,429 for cash disbursements.

What happens in the adjusted trial balance step?

-In the adjusted trial balance step, amounts from the income statement and balance sheet are copied from the adjusted trial balance to ensure that financial statements reflect accurate totals.

How is the merchandising inventory calculated in the income statement?

-Merchandising inventory is calculated by taking the beginning inventory and adding purchases, then subtracting any purchase discounts, resulting in the goods available for sale. The ending inventory is subtracted to determine the cost of goods sold.

What is the net income reported in the income statement?

-The net income reported in the income statement is 3,982, which is derived after subtracting expenses from the gross profit.

What is the significance of the closing entries in accounting?

-The closing entries reset the temporary accounts (like revenues and expenses) to zero, transferring their balances to the income summary and preparing the accounts for the next period.

How is the income summary used in the closing entries process?

-The income summary account is used to aggregate the net income or loss by closing out the revenue and expense accounts. The balances are then transferred to permanent accounts, like retained earnings.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

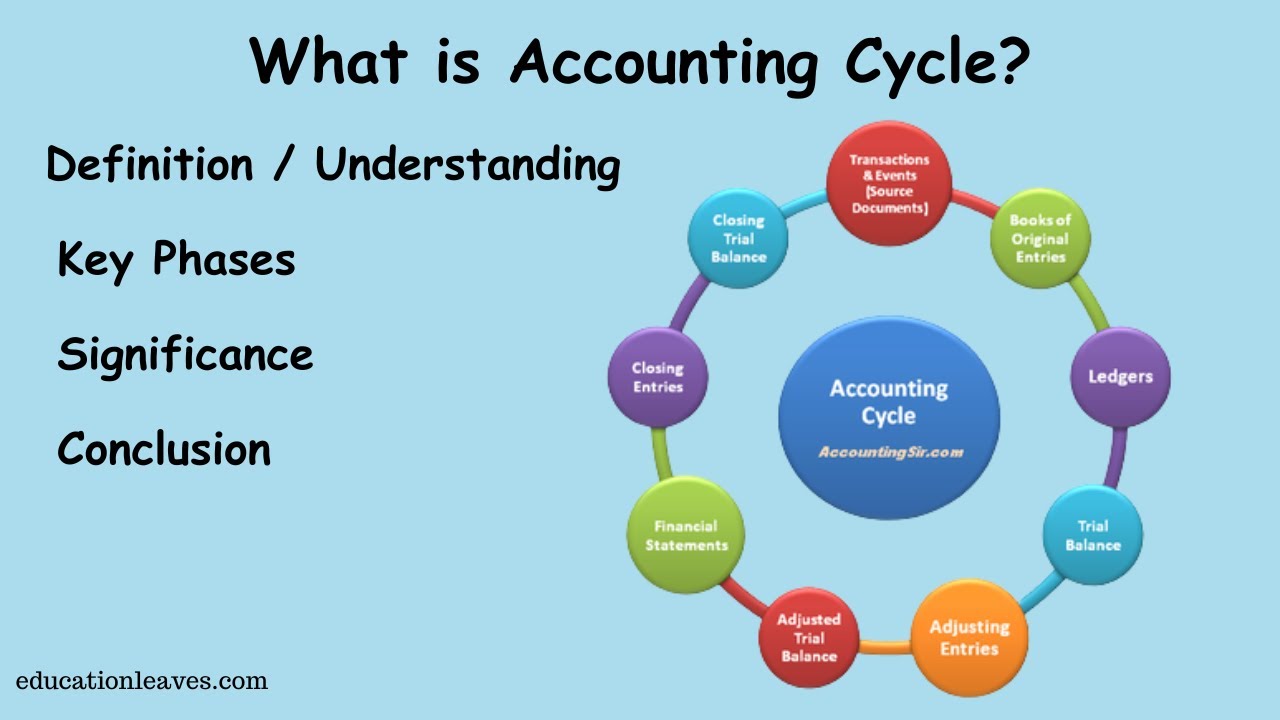

What is Accounting cycle? | Key phase, Significance of Accounting cycle

Trial balance explained

Myob : UD. Buana || Memorial Evidence & Financial Statements || Parts. 6

Prepare Journal Entries Part 1 (Filipino)

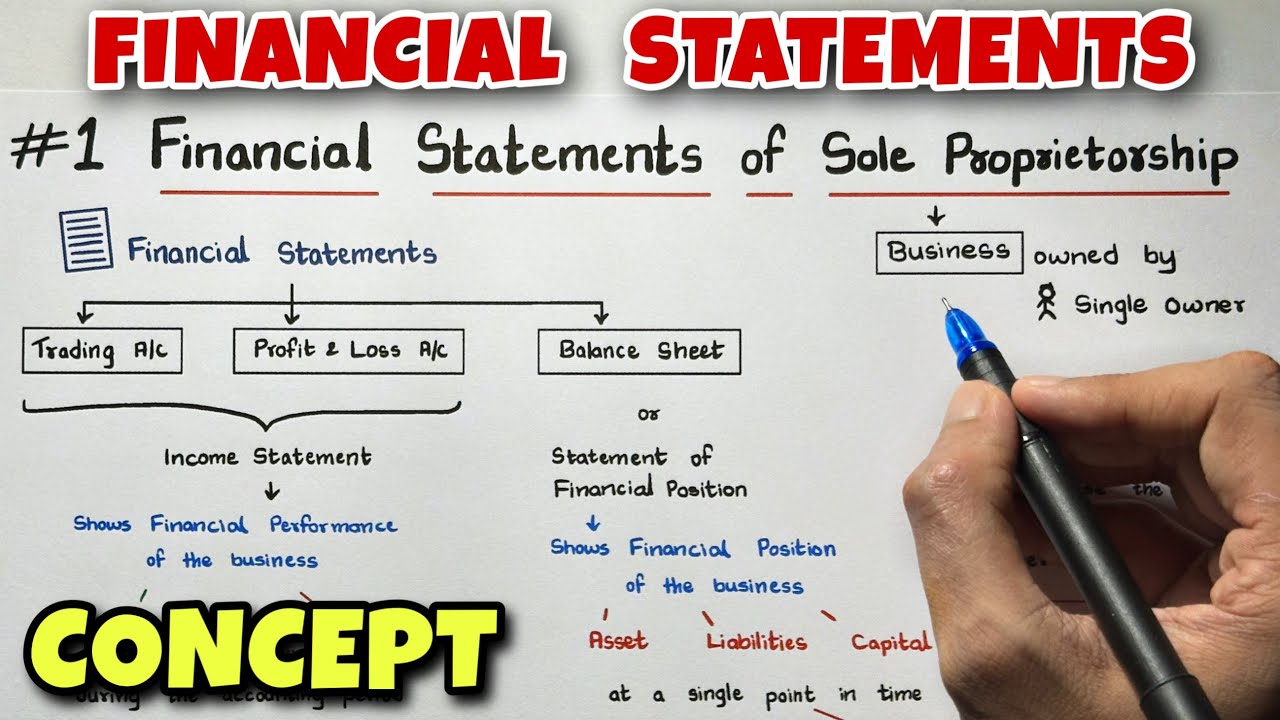

#1 Financial Statements - Concept - Easiest Way - Class 11 - By Saheb Academy

Accounting Cycle Step 1: Analyze Transactions

5.0 / 5 (0 votes)