ANALISIS REGRESI DUMMY VARIABLE

Summary

TLDRThis video explains the concept of regression analysis using dummy variables, focusing on stock types and dividend prediction. The speaker introduces categorical variables in regression models, where stock types (common vs. preferred) are represented numerically. Using an example with dividends from these stocks, the video demonstrates how to apply a regression formula and analyze results with Excel. It also highlights the importance of statistical significance in the results, particularly t-statistics and p-values. The speaker hints at future lessons involving more complex regression models with multiple categories, such as different industries.

Takeaways

- 😀 Dummy variables are used in regression models to represent categorical data with binary values, such as 0 and 1.

- 😀 The script explains the concept of regression analysis with dummy variables, specifically analyzing the impact of stock type on dividends.

- 😀 Common stock and preferred stock are categorized using dummy variables: 1 for common stock and 0 for preferred stock.

- 😀 The regression equation to predict dividends based on stock type is: Y = β0 + β1X, where Y is the dividend, β0 is the intercept, and β1 is the coefficient for common stock.

- 😀 The intercept (β0) represents the average dividend for preferred stock, while β1 measures the difference in dividends between common and preferred stocks.

- 😀 The script demonstrates how to use Excel functions like INTERCEPT and SLOPE to compute the regression equation and coefficients.

- 😀 Statistical significance of the regression model is assessed using t-statistics and p-values. A p-value less than 0.05 indicates a significant difference in dividends between the stock types.

- 😀 The example shows that the dividend difference between common and preferred stocks is statistically significant if the p-value is small.

- 😀 The analysis can be extended to multiple categories, such as comparing dividends across different industries like manufacturing, mining, and banking.

- 😀 The use of dummy variables in regression helps quantify the impact of qualitative factors (e.g., stock type or industry) on quantitative outcomes like dividends.

- 😀 The script emphasizes that understanding regression with dummy variables is crucial for analyzing the effects of categorical data on financial metrics like dividends.

Q & A

What is the main topic of the lecture in the transcript?

-The main topic of the lecture is regression analysis using dummy variables to predict dividends based on categorical variables such as the type of stock (common or preferred).

What are dummy variables in regression analysis?

-Dummy variables are used to represent categorical data in a numerical format. They assign numerical codes (e.g., 0 or 1) to different categories, allowing them to be included in regression models.

How are dummy variables applied to categorical data in the example provided?

-In the example, dummy variables are used to represent different types of stocks (common and preferred) by assigning the code 1 to common stocks and 0 to preferred stocks.

Why are dummy variables important for regression analysis?

-Dummy variables are important because they enable categorical data to be used in regression models, which typically require numerical data for analysis. This helps in understanding how different categories influence the dependent variable.

How is the regression model structured in the lecture?

-The regression model is structured as: Y = β0 + β1X, where Y represents the dividend (dependent variable), β0 is the constant (average dividend for preferred stocks), and β1 is the coefficient representing the difference in dividends between common and preferred stocks.

What does β1 represent in the regression equation?

-β1 represents the coefficient that indicates the difference in dividends between common and preferred stocks. It quantifies how much higher or lower the dividend for common stocks is compared to preferred stocks.

How does Excel assist in performing regression analysis in this context?

-Excel is used to calculate the regression coefficients, where functions like INTERCEPT and SLOPE are applied to the data. The model predictions and error residuals can also be analyzed within Excel.

What is the significance of statistical testing in regression analysis?

-Statistical testing is used to determine whether the relationship between the independent and dependent variables is statistically significant. The t-statistic and p-value are used to assess whether the observed differences, like the difference in dividends, are meaningful or due to random chance.

What does a significant t-statistic and a small p-value indicate in this context?

-A significant t-statistic and a small p-value (less than 0.05) indicate that the difference in dividends between common and preferred stocks is statistically significant, meaning that stock type (common vs. preferred) has a meaningful impact on the dividend amount.

What is the next topic the instructor plans to discuss regarding dummy variables?

-In the next session, the instructor plans to explain how dummy variables can be used when there are more than two categories, such as different sectors of a company (e.g., manufacturing, mining, banking).

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

REGRESI DENGAN DUMMY VARIABEL DUA KATEGORI Oleh Agus Tri Basuki Part 1

Penjelasan Singkat Analisis Regresi (Linier) dengan Variabel Dikotomi

REGRESI DENGAN DUMMY VARIABEL LEBIH DARI 2 KATEGORI Oleh Agus Tri Basuki Part 2

Dasar Analisis Regresi: Apa itu regresi dan jenis-jenis regresi

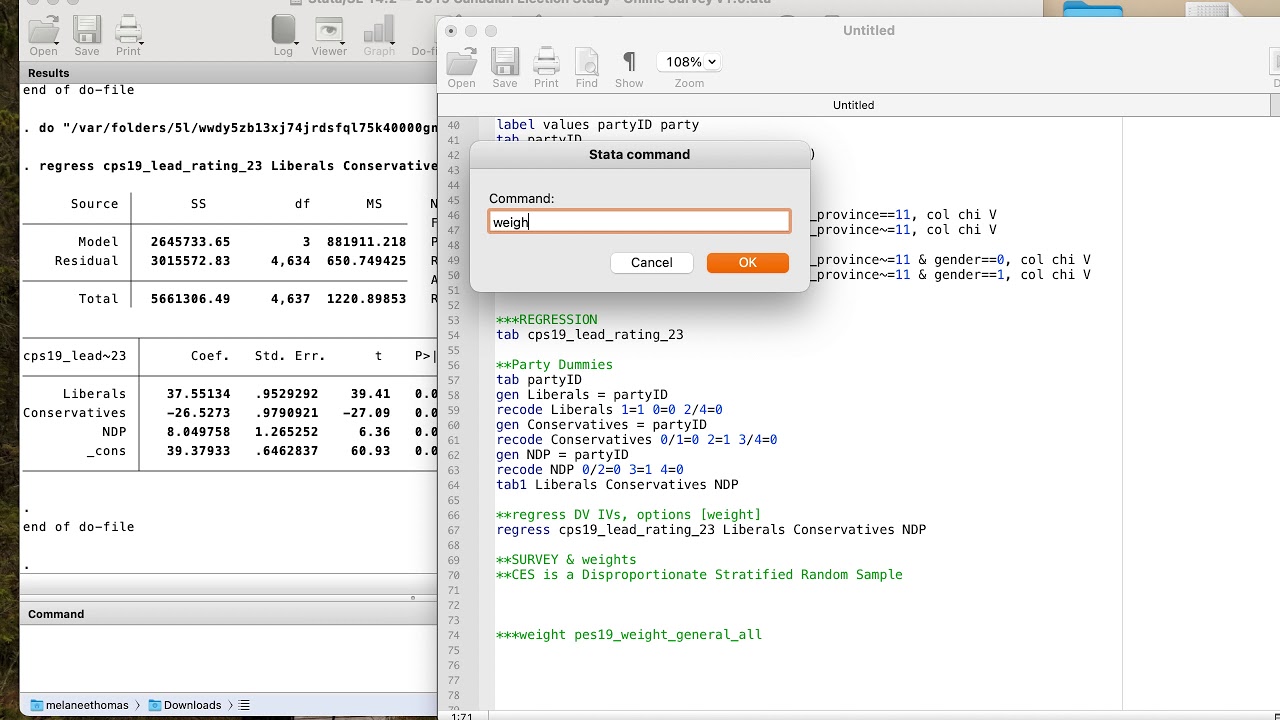

Tutorial #7 Regression + Survey weights

Machine Learning Tutorial Python - 6: Dummy Variables & One Hot Encoding

5.0 / 5 (0 votes)