DERIVATIVES in Stock Market - Explained | Mission Options E01

Summary

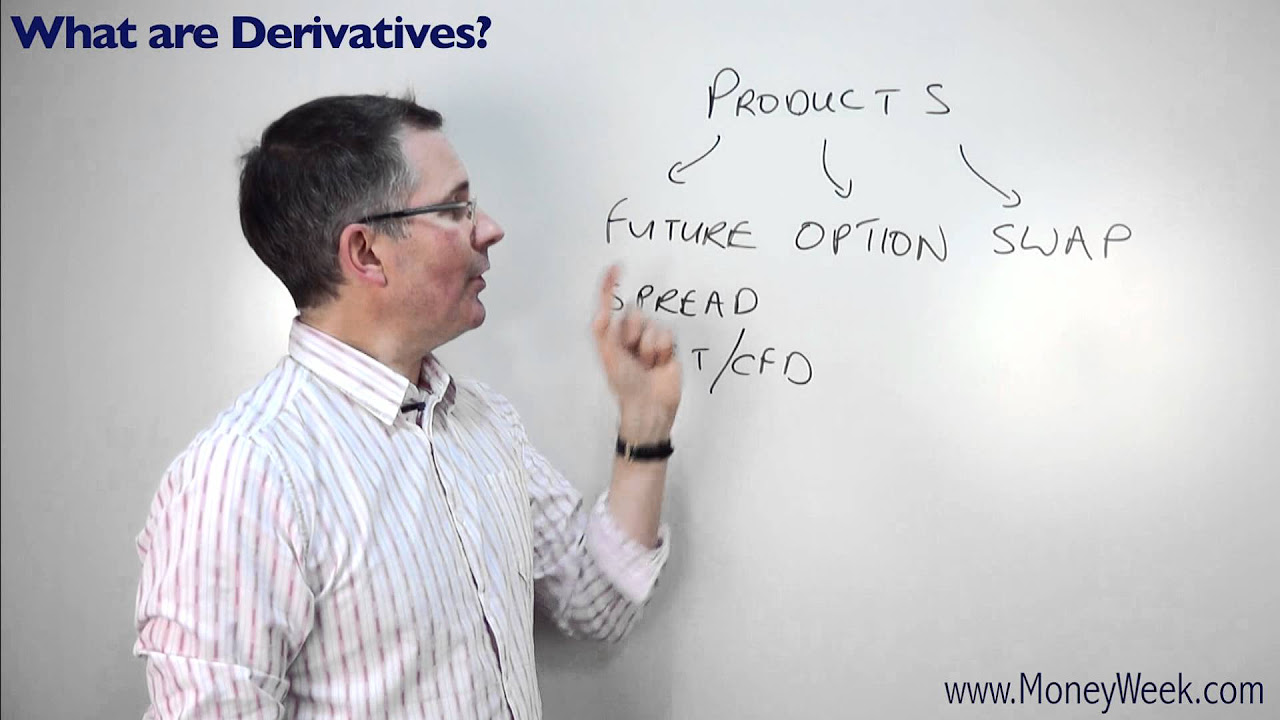

TLDRThis video explores the concept of derivatives in finance, emphasizing their significance in agricultural commodities and financial markets. It explains how derivatives, like futures and options, function as financial securities that derive their value from underlying assets. Through relatable examples involving everyday commodities such as milk and petrol, the video illustrates the practical applications and importance of derivatives in managing risk and revenue in the stock market. Additionally, it highlights the evolution of derivatives since their inception and their critical role in modern financial practices.

Takeaways

- 😀 Derivatives are financial securities that derive their value from an underlying asset.

- 📈 The most common types of derivatives include futures and options, which are used in financial markets.

- 🌾 Derivatives originally started in agricultural commodities before expanding to financial markets after 1978.

- 📊 The National Stock Exchange of India (NSE) is the largest derivatives exchange, with Nifty futures being a significant product.

- 💰 A forward contract is a simple agreement between two parties to exchange an asset at a predetermined price at a future date.

- 🤝 An example of a forward contract is a parent promising to give a specific amount of money to a child after a certain period.

- 🛢️ Derivatives can also be linked to commodities like crude oil, where petrol and diesel prices are influenced by derivatives.

- 🤑 Understanding derivatives can significantly impact trading and investment strategies in the stock market.

- 📉 The use of derivatives in financial markets allows for risk management and speculation on price movements.

- 🔍 The discussion emphasizes the importance of being educated about financial instruments for better financial decision-making.

Q & A

What are derivatives?

-Derivatives are financial securities that derive their value from an underlying asset, such as commodities or stock indices.

How did derivatives originate?

-Derivatives started with agricultural commodities and became more widespread in financial markets after 1978.

What are the main types of derivatives mentioned?

-The main types of derivatives discussed are futures, options, and forward contracts.

How are derivatives used in agriculture?

-Derivatives are used by farmers to hedge against price fluctuations in agricultural products, ensuring stable income.

What is the significance of the National Stock Exchange of India?

-The National Stock Exchange of India is noted as the largest derivatives exchange, where various financial instruments are traded.

Can you provide an example of how derivatives affect everyday items?

-An example is the price of petrol and diesel, which are influenced by the derivatives of crude oil, impacting consumer costs.

What is a forward contract?

-A forward contract is an agreement between two parties to buy or sell an asset at a predetermined price at a future date.

Why are derivatives important for financial markets?

-Derivatives are crucial for managing risk and enabling revenue generation in financial transactions.

How do derivatives help in price stabilization?

-By allowing producers to lock in prices for their products, derivatives help stabilize income against market volatility.

What are some real-life applications of derivatives discussed in the video?

-The video discusses real-life applications such as hedging against price changes in commodities like milk and mobile phones.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

History of Derivatives Trading

What are derivatives? - MoneyWeek Investment Tutorials

What is Financial Market? | Types of Financial Markets

O que são commodities em 3 minutos

Apa itu Instrumen Keuangan? - Dr. Erwinna Chendra

Investment Banking Interview Questions and Answers for software testing/Investment banking project/

5.0 / 5 (0 votes)