Cash vs accrual

Summary

TLDRIn this insightful discussion, the speakers delve into the crucial differences between cash and accrual accounting, emphasizing their relevance within the Profit First methodology. They highlight how cash basis accounting provides a clear picture of real-time cash flow, essential for making informed financial decisions. Conversely, accrual accounting may lead to inflated revenue perceptions due to uncollected invoices. The conversation stresses the importance of focusing on cash movements rather than balance sheet totals, ensuring business owners can effectively manage their finances and maximize profitability. This practical approach aids bookkeepers and accountants in delivering valuable insights to their clients.

Takeaways

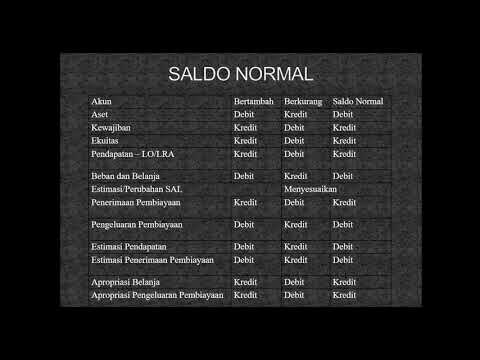

- 😀 Understanding the difference between cash basis and accrual basis accounting is crucial for effective financial management.

- 💵 Cash basis accounting focuses on actual cash transactions, providing a clear view of cash flow.

- 📊 Accrual basis accounting includes income and expenses when they are incurred, regardless of cash flow, which can lead to inaccuracies in certain contexts.

- 📝 For a Profit First assessment, it's important to analyze financial reports based on cash movements rather than balances.

- ⚖️ Accurate cash flow assessment helps prevent significant errors in financial evaluations, especially in businesses with delayed payments.

- 🔍 The main goal is to understand cash inflows and outflows rather than achieving perfect balance sheets.

- 💼 Financial professionals should prioritize asking for cash basis reports to gain the most useful insights.

- ⚠️ Overemphasis on perfect accuracy in financial reporting can create unnecessary workload without substantial benefits.

- 📉 Certain liabilities, like GST and superannuation payables, should be analyzed based on cash movements during the reporting period.

- 👍 The focus should be on where to look for information that informs financial decisions rather than solely on balancing accounts.

Q & A

What is the main difference between cash basis and accrual basis accounting?

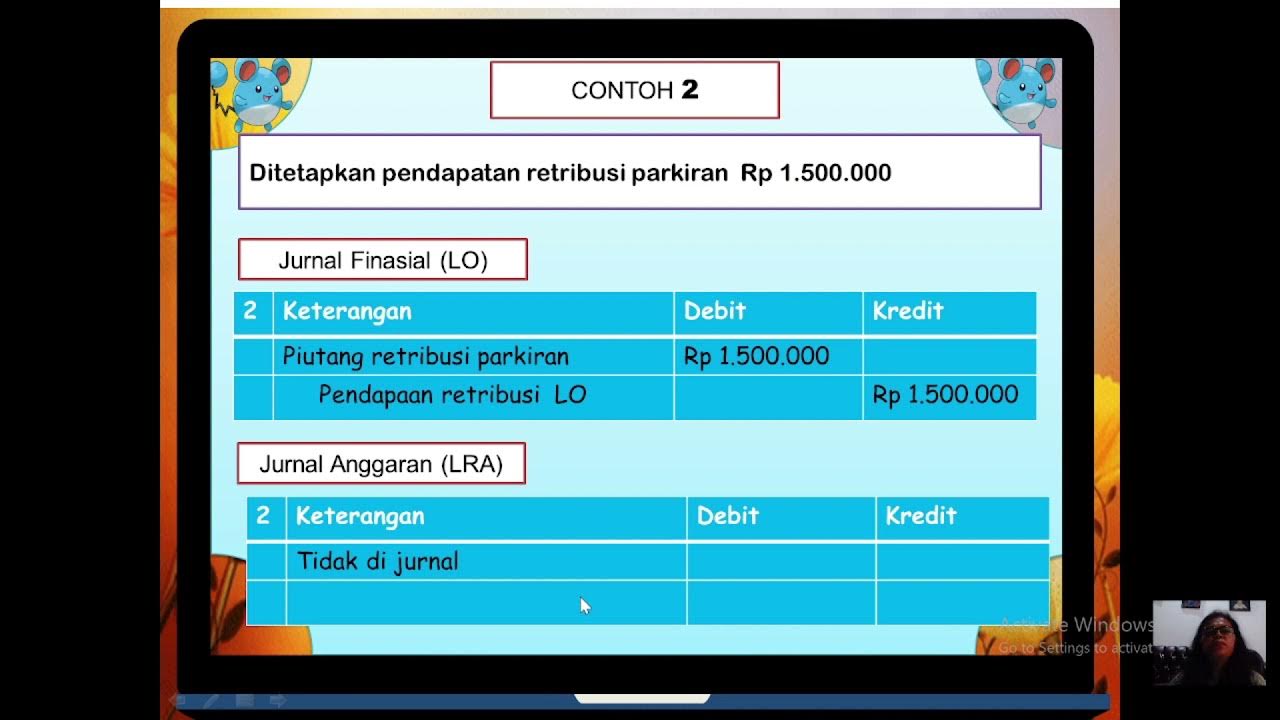

-Cash basis accounting focuses on actual cash flow, recording income and expenses when cash is exchanged. Accrual basis accounting records income and expenses when they are incurred, regardless of cash movement.

Why is it important to understand cash and accrual accounting when implementing Profit First?

-Understanding these concepts is crucial because Profit First relies on accurate assessments of cash flow to determine profitability and allocate funds effectively, impacting financial health and decision-making.

How does cash basis accounting affect the accuracy of financial reports?

-Cash basis accounting provides a clearer picture of immediate financial health by reflecting only the cash movements during a specific period, which helps avoid discrepancies from accounts receivable or payable.

What should businesses focus on when analyzing their balance sheet in the context of cash basis accounting?

-Businesses should focus on actual cash movements during the reporting period rather than the overall account balances, as this will provide more relevant information for financial assessments.

What types of financial obligations should be monitored under cash basis accounting?

-Key financial obligations include actual cash payments made during the period, such as superannuation payable, GST payable, and movements related to loans or director's loans.

What impact can delayed invoicing have on financial assessments?

-Delayed invoicing can lead to significant inaccuracies in reported income if assessments are based on accrual accounting, as they may not reflect the actual cash available for use by the business.

How can business owners ensure they receive useful financial reports?

-Business owners should specifically request that financial reports be prepared on a cash basis to ensure they reflect the most relevant cash movements and assist in effective decision-making.

What is meant by 'cash out' in the context of assessing financial health?

-Cash out refers to the actual cash expenditures during a specific period, which are crucial for understanding the business's liquidity and overall financial position.

Why might it not be necessary for reports to be 100% accurate?

-While accuracy is important, the focus should be on obtaining the main information that informs business decisions, rather than ensuring every detail is perfectly aligned with accounting standards.

What is the overarching goal of running assessments on a cash basis for businesses?

-The goal is to provide clarity on cash flow, allowing business owners to make informed financial decisions based on actual income and expenses rather than theoretical figures that may not represent real-time conditions.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)