Why is the dollar so powerful? | CNBC Explains

Summary

TLDRThe U.S. dollar, recognized as the world’s reserve currency, is widely used for international trade and held by governments globally. Its dominance stems from the economic and political stability of the United States, reinforced by its large economy and efficient banking system. Despite challenges, like the end of the gold standard in 1971 and calls for alternatives, the dollar remains strong due to high demand during global crises. While other currencies and cryptocurrencies are being considered, none have yet matched the dollar's influence in the global economy.

Takeaways

- 💵 The U.S. dollar is the official currency of the United States and is also used as the official currency in other countries.

- 🌍 The U.S. dollar is known as the world's reserve currency, with a significant portion held outside the U.S., especially in $100 and $50 bills.

- 📈 The dollar is considered a 'safe haven' in times of global economic uncertainty, which increases its demand and value.

- 🏦 The Federal Reserve helps stabilize the dollar during crises by setting up 'swap lines' with other central banks to avoid shortages.

- 💰 The U.S. dollar became the leading reserve currency after World War II, overtaking the British pound, and its strength was initially tied to gold.

- 🏅 The 1944 Bretton Woods Agreement pegged the world’s currencies to the U.S. dollar, which was still linked to gold at the time.

- 🚫 In 1971, the U.S. dollar was de-linked from gold, and the value of currencies began to float according to market forces.

- 📊 The U.S. dollar remains the most widely used currency in global foreign exchange transactions, far outpacing other currencies.

- 🔐 The U.S. has been accused of 'weaponizing' its currency through sanctions on countries like North Korea and Iran, preventing them from using the dollar in trade.

- 📉 Although alternatives like the euro, yen, and cryptocurrencies have been considered, none are currently capable of replacing the U.S. dollar as the dominant global currency.

Q & A

Why is the U.S. dollar considered the world's reserve currency?

-The U.S. dollar is considered the world's reserve currency because it is held by many governments in reserves and trusted for international trade. Its stability, backed by the U.S. economy, makes it a preferred choice for global transactions.

What factors contribute to the strength of the U.S. dollar?

-The strength of the U.S. dollar is driven by the U.S. economy’s size and stability, investor confidence in it as a 'safe haven' during times of uncertainty, and the U.S. Federal Reserve’s interventions to prevent shortages of the currency.

How did the U.S. dollar become the dominant global currency?

-The U.S. dollar became the dominant global currency after World War II, when countries met at the Bretton Woods conference and agreed to peg their currencies to the dollar, which was linked to gold at the time. The U.S. had accumulated most of the world’s gold reserves, which solidified its financial influence.

What caused the U.S. dollar to be de-linked from gold, and what was the impact?

-In 1971, U.S. President Richard Nixon de-linked the dollar from gold due to concerns over the U.S.'s dwindling gold reserves. This led to the creation of free-floating exchange rates where currencies’ values were determined by market forces rather than being fixed to gold.

Why do international transactions often use U.S. dollars instead of other currencies?

-International transactions frequently use U.S. dollars because it is widely accepted, stable, and backed by a large economy. It simplifies trade between countries that may not trust or use each other's currencies.

What is the role of the Federal Reserve in managing U.S. dollar shortages during economic crises?

-During crises, such as the financial and coronavirus crises, the Federal Reserve steps in to prevent dollar shortages by setting up 'swap lines' with other central banks. This ensures sufficient dollar liquidity for international trade and investment.

How does the U.S. dollar influence global commodity trading?

-The U.S. dollar dominates global commodity trading because commodities like metals, energy, and agricultural goods are typically priced in dollars. This reinforces its role as the global currency.

What are some criticisms regarding the U.S. dollar’s dominance?

-The U.S. has been accused of 'weaponizing' the dollar by using it to impose sanctions, such as those on North Korea and Iran. Critics argue that these sanctions unfairly restrict these countries’ ability to use the dollar in trade.

Can any other currency challenge the dominance of the U.S. dollar as the reserve currency?

-While other currencies like the euro, yen, and Chinese yuan are held in reserves, none currently rival the U.S. dollar in global influence. Calls for alternatives, such as cryptocurrencies, have emerged, but no immediate replacement for the U.S. dollar seems likely.

Why are stable currencies like the Swiss franc or Singapore dollar not as influential as the U.S. dollar?

-Although the Swiss franc and Singapore dollar are stable, their influence is limited by the smaller size of their economies and populations compared to the U.S. economy. The U.S. dollar remains more convenient and widely used in global trade.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

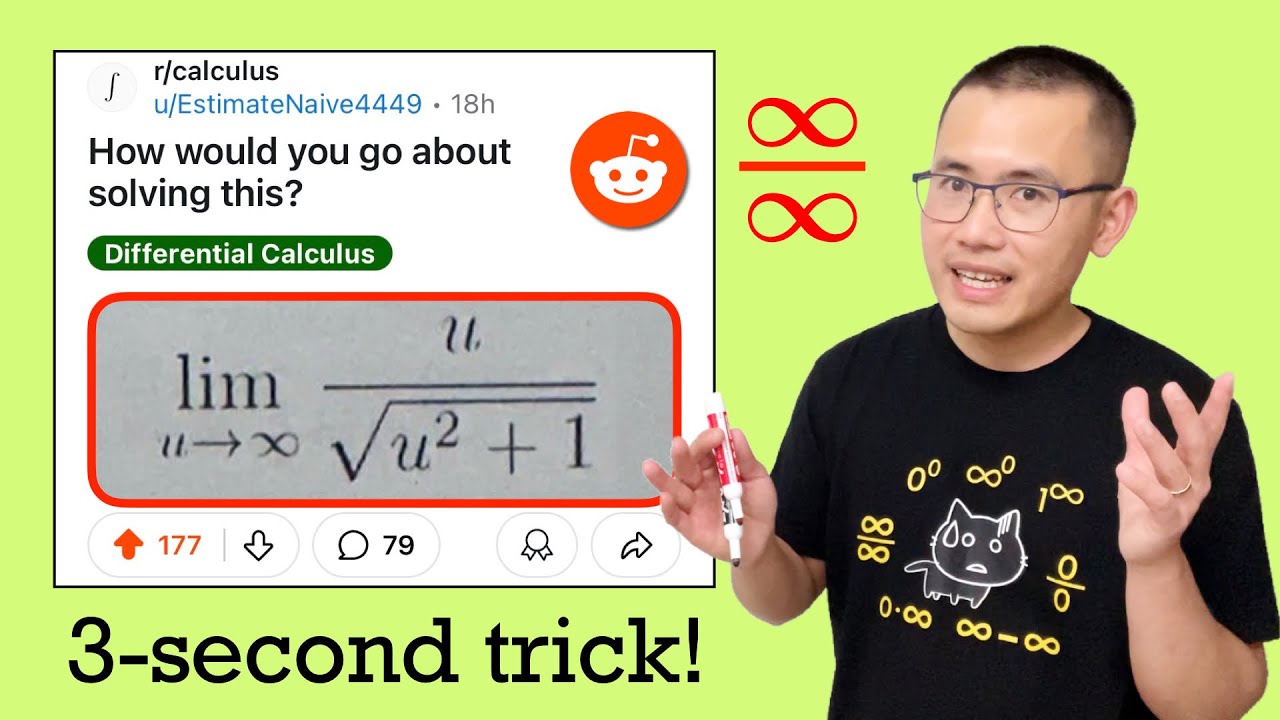

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Embedded Linux | Introduction To U-Boot | Beginners

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

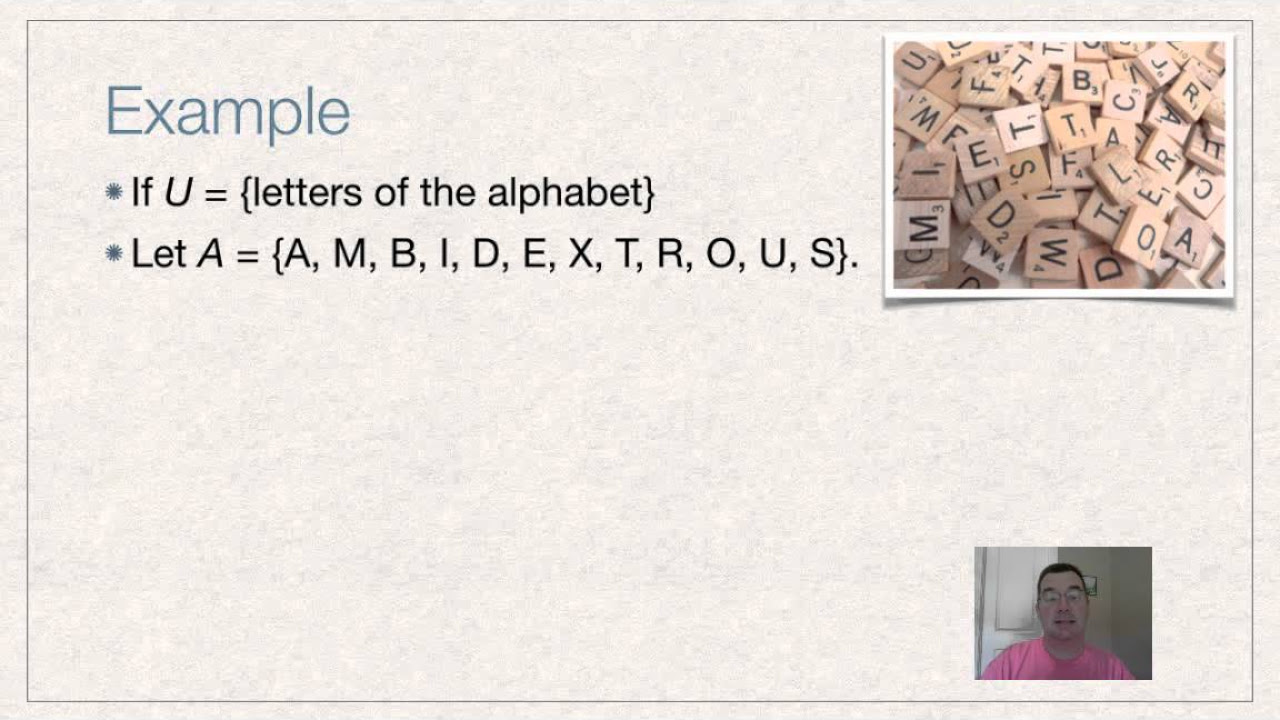

Complements of Sets

Kalah 6-0 dari Korea Utara, Timnas Indonesia U17 Gagal ke Semifinal Piala Asia

TIMNAS INDONESIA U17 KALAH SEGALANYA DARI KORUT DAN TERSINGKIR DARI PIALA ASIA!

5.0 / 5 (0 votes)