さすがに売られすぎ?この急落で年初来安値接近の人気大型株3選

Summary

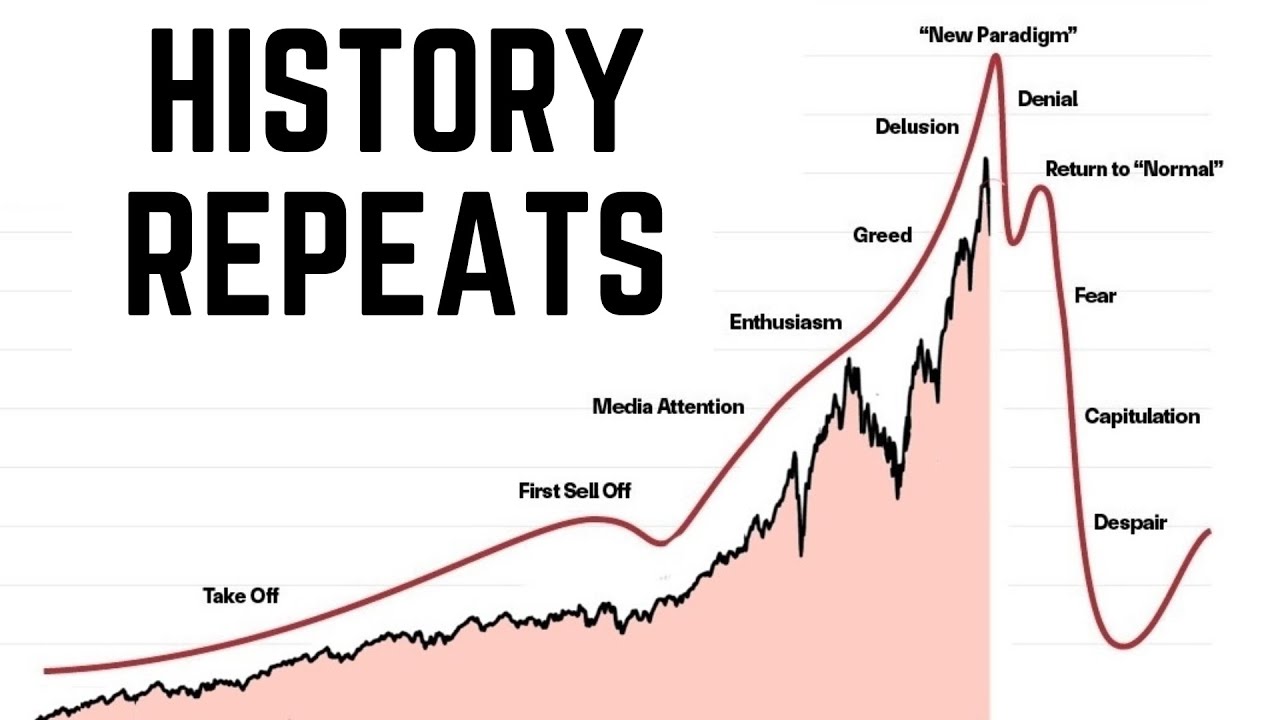

TLDRThe video script discusses the significant drop in the Nikkei average, with major stocks falling by around 3000 points from their highs. The host aims to spotlight three popular large-cap stocks that have become more affordable due to this downturn, presenting an opportunity for viewers who previously couldn't afford them. The stocks mentioned include Daikin Industries, known for air conditioning, with a focus on its performance in China and the U.S., NTT, a telecommunications giant, and Panasonic, which has shown growth despite recent challenges. The script also touches on the potential impact of regulatory changes on NTT and the importance of due diligence for investors.

Takeaways

- 📉 The Nikkei Index has dropped significantly, around 3000 points from its high.

- 💼 Popular high-value stocks have also seen major declines.

- 📈 Focus on three large-cap stocks that have dropped in price, presenting potential buying opportunities.

- 🏭 Daikin Industries: Once highly valued, now significantly cheaper due to a drop from 28,000 yen to 19,520 yen.

- 📊 Daikin's revenue is expected to double from 2020 to 2024, with significant growth in the U.S. market.

- 📡 NTT (Nippon Telegraph and Telephone): Experienced a major drop recently, offering a potential buying opportunity.

- 💰 NTT's dividend yield is 2.4%, with potential for growth if stock prices rise.

- 📰 Recent legislation changes impacting NTT, raising concerns about foreign ownership and control.

- 🔋 Panasonic Holdings: Stock price dropped from 1,800 yen to 1,350 yen, presenting a potential buying opportunity.

- 🚗 Panasonic's revenue growth driven by contributions from the EV battery sector and automotive information systems.

- 📉 Despite growth, Panasonic faces challenges with potential red ink in the automotive battery sector, impacting stock prices.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the significant drop in the Nikkei average and the opportunity to buy popular stocks at lower prices.

How much did the Nikkei average drop according to the script?

-The script suggests that the Nikkei average dropped by around 3000 points from its high.

What is the focus of the video in terms of stock selection?

-The focus is on selecting large-cap stocks that have become more affordable due to the recent market downturn and were previously too expensive to buy.

What is the script's advice regarding the timing of stock purchases?

-The script advises viewers to consider their own timing for buying stocks and not to feel obligated to purchase immediately after the video's suggestions.

Which company is mentioned as having a significant drop in stock price, and what was the reason?

-Daikin Industries is mentioned as having a significant drop in stock price, partly due to economic downturns in China, despite having good sales.

What is the script's view on Daikin Industries' future sales and profits?

-The script suggests that Daikin Industries' sales and profits are expected to grow significantly, with sales potentially doubling by 2024.

What is the script's perspective on NTT's stock price and its recent performance?

-The script indicates that NTT's stock price has dropped recently but notes that it could be a good buying opportunity as it has reached a low similar to its value in December of the previous year.

What recent news about NTT is mentioned in the script, and how might it affect the company?

-The script mentions the passing of the revised NTT law, which could potentially lead to foreign capital taking control of NTT and affecting its stock price.

Which stock is suggested as a potential buy due to its significant drop in price?

-Panasonic is suggested as a potential buy due to its significant drop in price, with its stock having fallen from around 1800 yen to approximately 1350 yen.

What are some of the factors contributing to Panasonic's growth mentioned in the script?

-Factors contributing to Panasonic's growth mentioned in the script include contributions from the U.S. electric vehicle (EV) battery production and recovery in car information systems sales.

What is the script's caution regarding Panasonic's车载 battery business?

-The script cautions that there is a risk of Panasonic's 车载 battery business falling into the red, which could potentially push the stock price down.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

2024年2月22日 新時代到来だ!日本株は青天井へ【朝倉慶の株式投資・株式相場解説】

「投資なんて指一本触れるな!」森永卓郎が警告する"新NISAのワナ"。日経平均乱高下、為替変動…大荒れ市場の真実(篠田尚子、藤野英人、馬渕磨理子、森永卓郎)TheUPDATE

Signs of a bubble emerging in ASX | The Business | ABC NEWS

日経平均株価暴落どした!?株は買い時なのか?ズボラ株投資

史上最高値日経平均株価40000円で全てトレードを返済しました。そんな話。

We are at the Precipice of a Major Turning Point for US Stocks…

5.0 / 5 (0 votes)