How Did He Make CRORES with a Low Salary?

Summary

TLDRIn this podcast episode, Sidharth, an engineer from a middle-class family, shares his journey to financial freedom despite a modest salary. Starting with a salary of ₹3.2 LPA, he grew his net worth to over ₹2 crore through strategic investments in mutual funds, government bonds, and leveraged Nifty positions. He emphasizes the importance of maintaining a savings mindset, disciplined investments, and the power of compounding. Sidharth also discusses his conservative approach to risk, leveraging credit wisely, and avoiding real estate as an investment. The episode offers valuable insights into smart financial planning and long-term wealth growth.

Takeaways

- 💼 Sidhart comes from a middle-class family in a tier-3 town and started his career with a modest salary of INR 3.2 lakhs per annum at Infosys.

- 📈 After switching companies, Sidhart's salary grew to INR 24 lakhs per annum, and today he and his wife collectively earn around INR 44-45 lakhs per annum.

- 💰 Despite lower initial earnings, Sidhart now has a total net worth of INR 2.1 crore, with investments spread across provident funds, mutual funds, and government bonds.

- 💡 Sidhart credits his disciplined savings habits for his financial success, never significantly increasing his spending despite salary hikes.

- 📊 His investment strategy involves 60% allocation to large-cap mutual funds, 20% to flexi-cap funds, and 20% to small-cap funds. He avoids real estate, focusing instead on stocks and bonds.

- 🏦 Sidhart has also invested in government bonds for regular cash flow and takes advantage of the interest rate cycle for capital appreciation.

- 📉 He employs a leveraged investment strategy in the Nifty Index, which he compares to taking out a home loan but with only a 10% down payment and protection from losses.

- 💳 Sidhart uses credit cards as a substitute for emergency funds, relying on a significant credit limit of INR 40 lakhs in case of sudden financial needs.

- 🛡️ He has three term life insurance policies and is planning to add health insurance once his child turns one year old, as advised by experts in the field.

- 💡 His advice to couples starting their financial journey is to explore the power of compounding and focus on increasing active income early in their careers.

Q & A

What was Siddhart's starting salary when he joined Infosys, and how did it change over time?

-Siddhart's starting salary at Infosys was 3.2 lakhs per annum. Over time, by the end of his tenure at Infosys, it had increased to 8.5 lakhs per annum.

How did Siddhart's salary increase when he switched companies?

-When Siddhart switched from Infosys to Capco, his salary increased to 24 lakhs per annum, representing a 3x increase. He later moved to his current company, Trear, where both his and his wife's combined salary is around 44-45 lakhs per annum.

How did Siddhart maintain a savings and investment discipline early in his career?

-Siddhart grew up with a savings mindset and continued saving even when his income was low. Despite salary increases, he did not proportionally increase his expenses, allowing him to save and invest more over time.

How does Siddhart's current cash flow from salary and investments look like?

-Siddhart and his wife have a combined monthly salary of around 2.65 lakhs, and Siddhart earns an additional 55,000 from government bond coupons. Their recurring monthly expenses are 1 lakh, 1.25 lakhs go into SIPs, and 60,000 goes toward a leveraged Nifty investment.

How has Siddhart's investment strategy evolved over time?

-Siddhart started with small investments, like 5,000 rupees a month in SIPs, and gradually increased this as his salary grew. He also diversified into mutual funds, government bonds, and leveraged Nifty positions, focusing on long-term wealth creation rather than quick gains.

What is Siddhart's approach to leverage in his investments?

-Siddhart takes a leveraged position on Nifty, similar to a home loan model where he puts down 10% and enjoys the gains from the full value of the investment. He uses financing at a 5% rate and protects against downside risks by paying for protection, ensuring he doesn’t lose money if the market falls.

How does Siddhart select mutual funds for his portfolio?

-Siddhart allocates 60% of his mutual fund investments in large caps, 20% in flexi caps, and 20% in small caps. He keeps his mutual fund selection simple by choosing one fund per category, focusing on performance, high AUM, low expense ratios, and management alignment with his philosophy.

Why does Siddhart invest in government bonds, and what advantages do they offer?

-Siddhart invests in government bonds for stable cash flow and the potential for bond appreciation when interest rates fall. He buys long-duration bonds, which offer better returns as interest rates decrease, and he can also pledge bonds as collateral for additional margin.

What is Siddhart's take on real estate as an investment?

-Siddhart views real estate more as a consumption item rather than an investment. He believes India’s real estate boom was largely driven by black money, and he prefers more liquid, manageable investments like equities and leveraged products over real estate.

What is Siddhart's philosophy on credit, loans, and emergency funds?

-Siddhart does not carry any loans, apart from the leveraged Nifty position, and he does not believe in maintaining an emergency fund. Instead, he relies on his credit cards, which have a 40 lakh limit, as a buffer in case of emergencies, and he can liquidate investments if necessary.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Aashish Sharma A Working Professional Learns Digital Marketing In Hindi & Becomes Digital Rachayita

Ordinary To Extraordinary - 3 | Onkar Singh Dhanoa | Forever Living India

The #1 Way To Becoming A Millionaire as A Software Engineer

Online Income Generation by using Social Media Platforms By Aditya Goswami

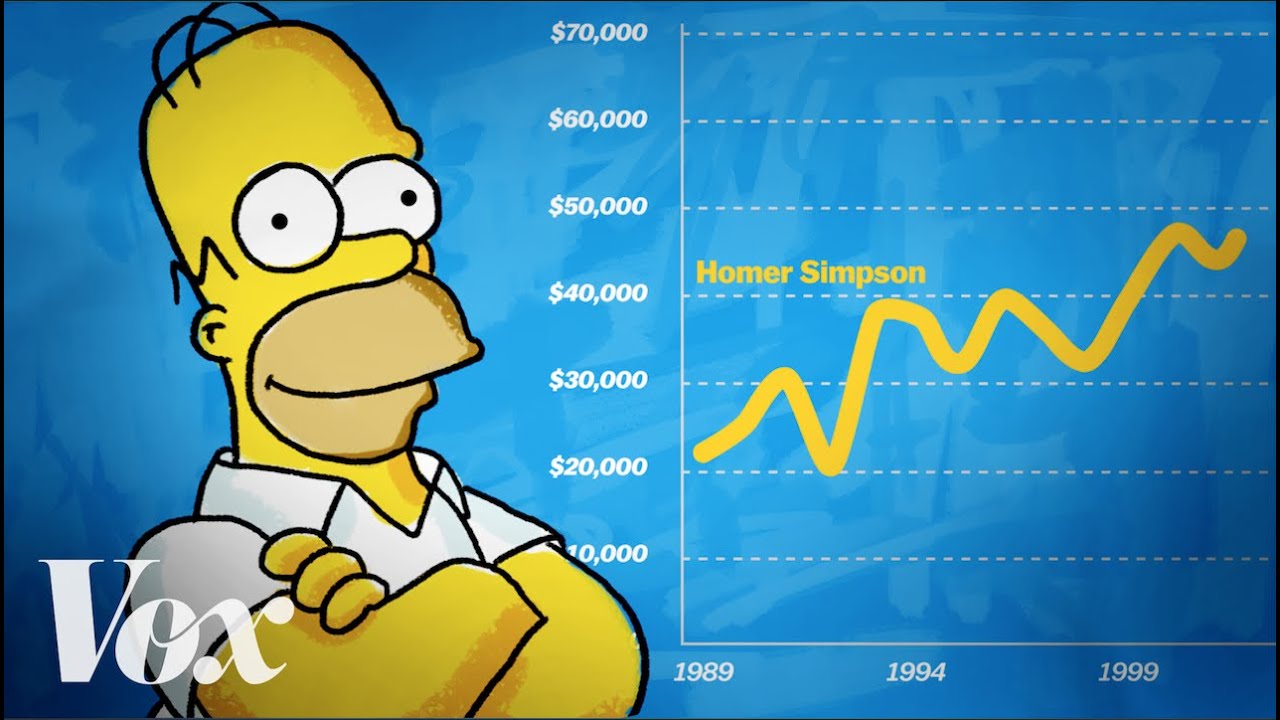

Homer Simpson: An economic analysis

Online Income Generation by using Social Media Platforms By Aditya Goswami

5.0 / 5 (0 votes)