92-year-old woman loses life savings in online scam

Summary

TLDRThis segment covers the growing issue of overseas scammers targeting vulnerable Americans, especially the elderly. Leslie recounts how her mother fell victim to a scam where criminals, posing as government agents, convinced her to withdraw her life savings to buy gold. Despite pleas to her bank, Charles Schwab, no action was taken as banks are limited in what they can do without government backing. Some banks, however, are training staff to spot unusual transactions. The investigation also highlights efforts to expose scam operations overseas, showing the scale of the problem.

Takeaways

- 💰 Overseas online scammers are increasingly targeting vulnerable Americans, stealing billions of dollars.

- 💼 Jim Axelrod interviews a woman whose elderly mother lost her life savings to an overseas scam.

- 🔔 Leslie, the daughter, was alerted by Charles Schwab about suspicious transactions from her mother’s investment account.

- 👩💻 Scammers pretended to be government IT experts and convinced Leslie's mother to withdraw money to buy gold as a 'safer investment.'

- 🤐 The scammers told the elderly woman to keep the transactions secret, fearing government repercussions.

- 📑 Leslie was a trusted contact on Schwab’s paperwork but had no idea her mother was being scammed.

- 🏦 Charles Schwab, like other financial institutions, is limited in preventing clients from accessing and transferring their own money.

- 🚨 Some banks, like credit unions, are training tellers to recognize unusual withdrawal patterns and alert trusted contacts or authorities.

- 👮 Involving local police can sometimes make it easier for scam victims to understand they're being defrauded.

- 🌍 CBS News is investigating international scam operations, including exposing scammers in Ghana who justify their actions.

Q & A

What is the main focus of the story in the transcript?

-The main focus is on the growing epidemic of overseas online scammers robbing vulnerable Americans, especially elderly individuals, of their life savings.

Who is the primary victim discussed in the story?

-The primary victim discussed is an elderly woman named Ruth, who was scammed into taking money out of her investment account to buy gold, believing it was a safer investment.

How did the scammers convince Ruth to withdraw her money?

-The scammers pretended to be IT experts from the government, claiming her computer had been hacked, and convinced her to withdraw money to buy gold as a safer investment.

What role did Leslie play in this case?

-Leslie, Ruth's daughter, was listed as a trusted contact on Ruth’s Charles Schwab account. She was alerted by Schwab about large wire transfers and tried to find out more about what was happening.

Why did Ruth not tell her family about the scam?

-The scammers told Ruth to keep the situation a secret, warning that the government might punish her and that her family could get into trouble if she revealed anything.

What is Charles Schwab's stance on stopping suspicious transactions?

-Charles Schwab stated that it's difficult for them to prevent clients from making transactions, as it is ultimately their money, and intervening could lead to complaints if legitimate investments are blocked.

What do financial institutions want from the government in such cases?

-Financial institutions like Schwab are seeking government backing to step in and block transactions when they have reason to believe a client is being scammed.

How are some banks handling suspicious transactions?

-Some banks, like a credit union in Iowa, train their tellers to recognize unusual withdrawal patterns and involve family members or trusted contacts to prevent scams. They also collaborate with local police to intervene.

What is one method that might help convince scam victims they are being defrauded?

-Involving law enforcement, such as having a police officer explain the scam, can sometimes be more effective in convincing victims they are being defrauded compared to a family member's warning.

What can viewers expect from this investigative story?

-Viewers can expect a detailed investigation, including footage of a boiler room in Ghana where scammers operate, and interviews with the scammers explaining why they do it. This will air on CBS Evening News and CBS Mornings.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Protecting Our Elders: How to Spot and Stop Abuse

How phone scammers are using AI to imitate voices

Phishing - SY0-601 CompTIA Security+ : 1.1

宿泊予約アゴダに改善要請「予約したのに泊まれる部屋がない」旅行2日前に勝手にキャンセル 相次ぐ宿泊予約トラブル 背景には空室枠の転売か〈カンテレNEWS〉

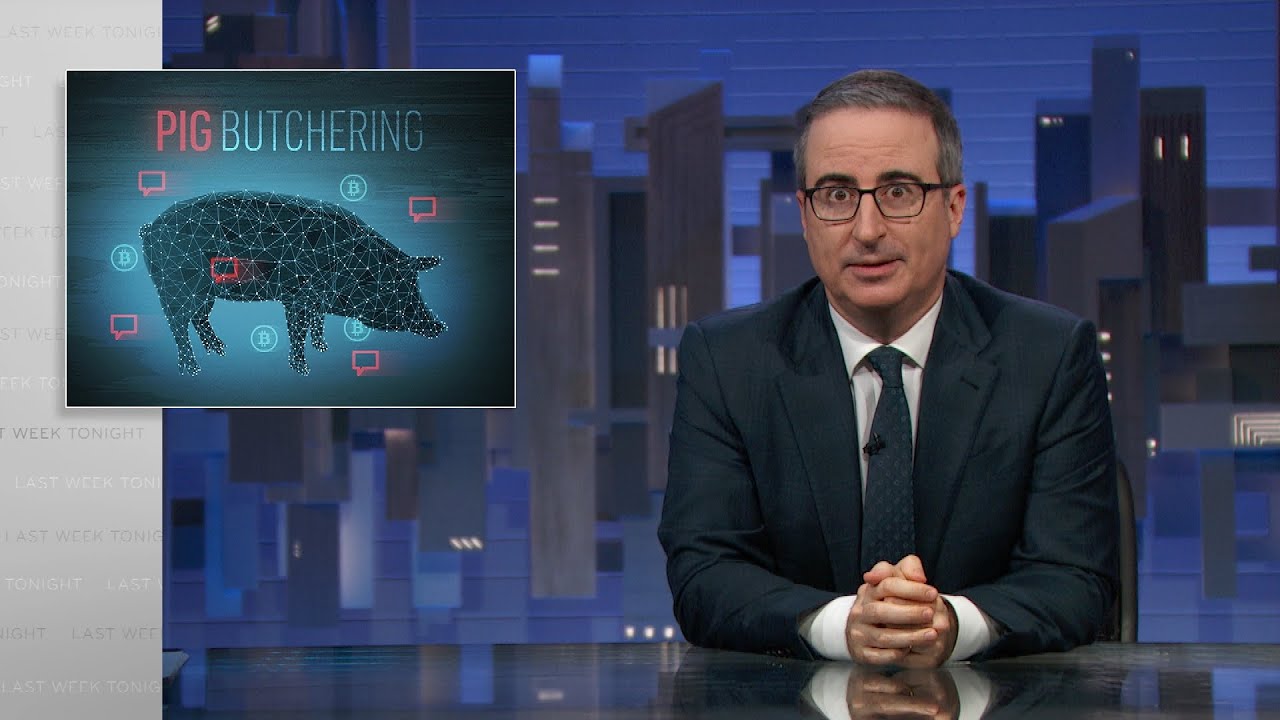

Pig Butchering Scams: Last Week Tonight with John Oliver (HBO)

Guia do Trânsito - Poluição em São Paulo

5.0 / 5 (0 votes)