Operational Risk and the Management of Operational Risks (Operations & Operational Risk Management)

Summary

TLDRThis video offers an in-depth look at operational risk, its types, and the importance of managing it. It covers the definition, impacts, and the comprehensive process of operational risk management, including risk identification, assessment, mitigation, and monitoring. The video also highlights the benefits of effective risk management and a seven-step approach to mitigate risks, emphasizing the necessity of a robust strategy to protect a business's reputation and financial stability.

Takeaways

- 📈 Operational risk refers to the potential for business operations to fail due to internal inefficiencies, human error, or external events.

- 🏦 The Basel Committee on Banking Supervision defines operational risk as the risk of loss from inadequate or failed internal processes, people, systems, or external events.

- 🌐 Operational risk encompasses business continuity, crisis management, process systems, and IT risks, among others.

- 🔍 A sophisticated approach to operational risk management can enhance a business's ability to thrive and grow.

- 🚨 Operational risk can include legal, human capital, physical assets, and bottom-line business risks, but typically excludes strategic and reputational risks.

- 🛠️ Operational risk management is a continuous process involving risk assessment, control implementation, and monitoring.

- 👥 Every individual in an organization plays a role in operational risk management, contributing to a strong safety culture.

- 💡 Integrated Risk Management (IRM) uses technology to predict significant risks and connect different risk mitigation areas.

- 📊 The benefits of operational risk management include improved business reliability, risk management effectiveness, and decision-making.

- 🔑 The operational risk management process consists of risk identification, assessment, mitigation, and monitoring and reporting.

Q & A

What is operational risk?

-Operational risk is the possibility of business operations failing due to inefficiencies or breakdowns in a firm's internal processes, people, and systems, human error, and external events such as regulatory changes.

What are the common sources of operational risk?

-Common sources of operational risk include internal process failures or gaps, human error, system failures, and external risks imposed by customers, suppliers, natural disasters, regulatory changes, or geopolitical shifts.

How does operational risk relate to a company's strategic objectives?

-Operational risk impacts the firm's strategic objectives by potentially causing damage to the business, including loss, regulatory overhead, and reputational damage. Effective management of operational risk helps protect these objectives.

What are the types of operational risk mentioned in the script?

-The types of operational risk include fraud, other criminal activity, workplace policies and safety, products and business practice, physical assets, business disruption, and process management.

What are the impacts of operational risk if not managed properly?

-If operational risks materialize and are not managed properly, they may cause significant damage to a business, including outright loss, increased regulatory overhead, and reputational damage.

What is the role of corporate leaders in operational risk management?

-Corporate leaders should make safety part of their value structure by initiating and driving a safety culture throughout the organization.

What is integrated risk management (IRM)?

-Integrated risk management is a concept where software and technology work together to help organizations predict where their most significant risks might be while connecting different risk mitigation areas through cloud technology.

What are the benefits of operational risk management?

-Benefits of operational risk management include improved reliability of business operations, strengthened decision-making processes regarding risk management, reduction in losses caused by poorly identified risks, early identification of unlawful activities, lower compliance costs, and reduced potential damage from future risks.

What are the key steps in the operational risk management process?

-The key steps in the operational risk management process are risk identification, risk assessment, risk measurement, risk mitigation, and monitoring and reporting.

How can a company reduce its operational risk?

-A company can reduce its operational risk by developing a sound operational risk management strategy, which includes understanding the nature of the business and associated risks, implementing relevant controls, and continuously assessing and managing those risks.

What is the seven-step approach to mitigate operational risk?

-The seven-step approach to mitigate operational risk includes task segregation, curtailing complexities in business processes, reinforcing organizational ethics, putting the right people in the right jobs, regular monitoring and evaluation, periodic risk assessment, and learning from past risk incidents.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

How to Trade Breaker Blocks | 100% winrate | ICT Simplified

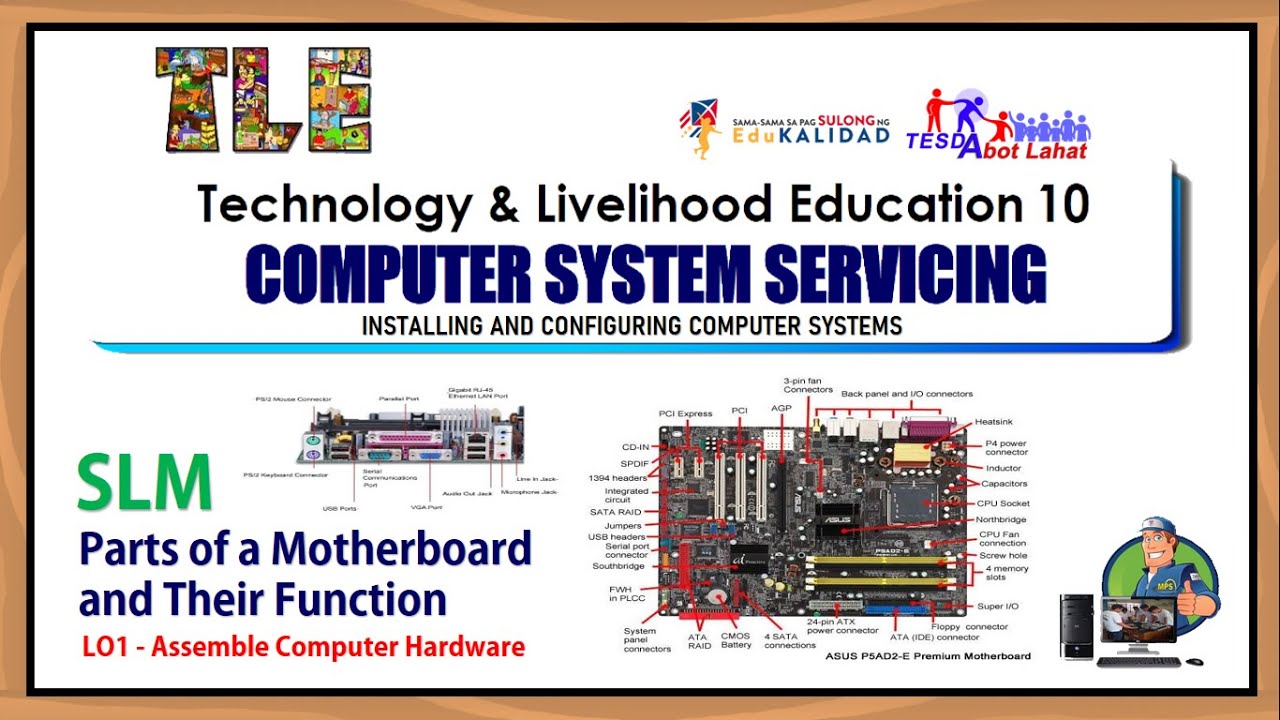

Parts of a Motherboard and Their Function - Part 2 Back Panel Connectors & Ports

Opera PMS - How To Create A Reservation

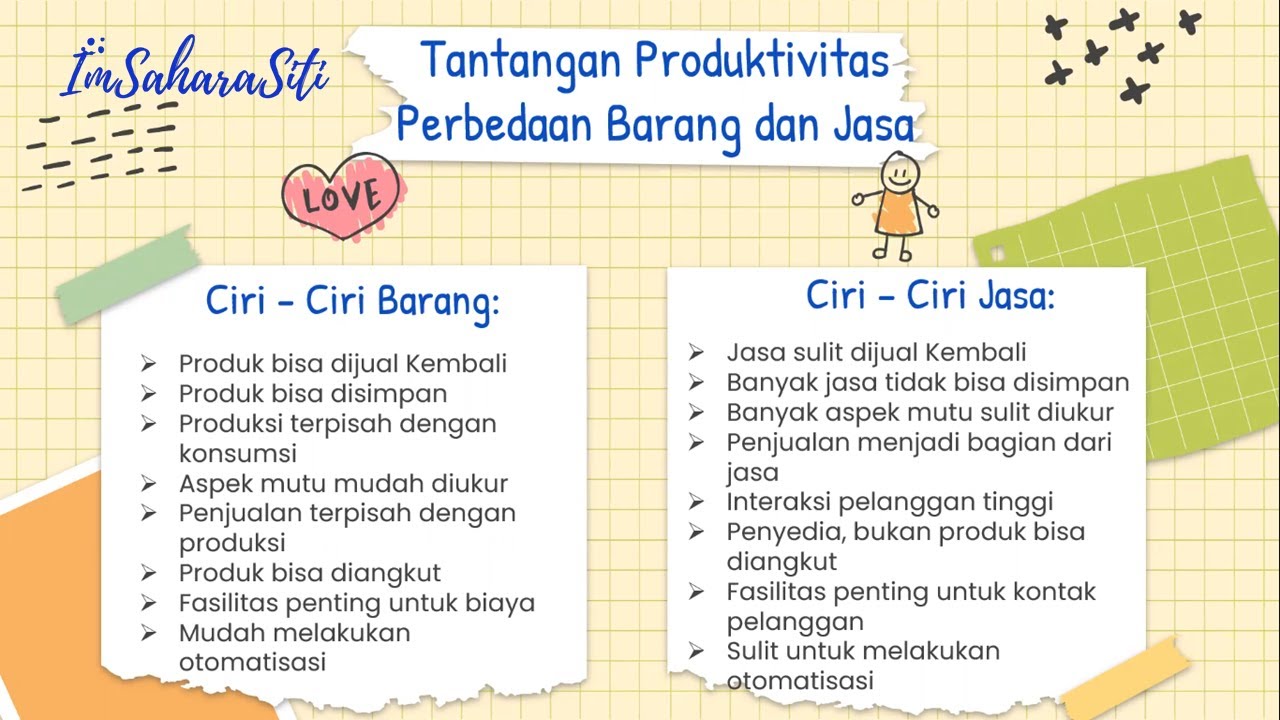

Video Pembelajaran Pengantar Manajemen _ Manajemen Operasional

How I Make Kamikaze Drones

"SAP Cloud for Customer (SAP C4C) Q&A", 50 Most Asked Interview Q&A of "SAP C4C" for Interviews !!

5.0 / 5 (0 votes)