HOW TO: THE EASIEST AND SIMPLEST WAY TO CREATE A MONTHLY BUDGET! 6-MINUTES PROCESS

Summary

TLDRIn this video, the host guides viewers through creating a simple monthly budget using a notebook, emphasizing the importance of using take-home pay. They advise starting with fixed expenses like rent and utilities, then moving to variable ones like eating out. A miscellaneous category is suggested for unexpected costs. The host demonstrates how to allocate remaining funds towards savings, gifts, or debt payments, advocating for a zero-based budgeting approach. This method has helped them pay off significant debt and achieve financial goals.

Takeaways

- 📋 Start by calculating your monthly income using your take-home pay after taxes and deductions.

- 💼 Use a simple notebook for budgeting, as it can be just as effective as electronic methods.

- 🏠 List your fixed expenses first, such as rent and utilities, as they do not change monthly.

- 🍔 Then, account for variable expenses like eating out or personal spending which can fluctuate.

- 📉 Prioritize expenses starting with the most important, ensuring your basic needs are covered first.

- 💸 Always include a miscellaneous category for unexpected expenses that may arise.

- 🧮 Total up your expenses to understand your spending and compare it with your income.

- 💰 Subtract your total expenses from your income to find out your remaining funds for the month.

- 🏦 Assign every dollar a job by allocating your remaining funds to savings, debt payments, or other goals.

- ✅ It's crucial to budget all your income down to zero to avoid unnecessary spending on non-essential items.

- 📅 Keep track of your bill due dates and write them in a monthly calendar to stay organized with your finances.

Q & A

What is the main topic of the video?

-The main topic of the video is teaching viewers how to create a simple monthly budget using a written method in a notebook.

Why does the speaker recommend using a notebook for budgeting instead of electronic methods?

-The speaker suggests using a notebook for budgeting because it can be a straightforward and effective method, despite the availability of electronic methods like Excel worksheets and budget apps.

What is the first step in creating a monthly budget according to the video?

-The first step in creating a monthly budget is to calculate your monthly income, specifically your take-home pay after taxes and deductions.

What does the speaker mean by 'take-home pay'?

-The speaker refers to 'take-home pay' as the net income after taxes, payroll deductions, and retirement contributions, which is the actual amount that is deposited into your bank account.

How much is the speaker's monthly income for the purpose of the video example?

-For the purpose of the video example, the speaker's monthly income is $2,300.

What is the difference between fixed and variable expenses as discussed in the video?

-Fixed expenses are those that do not change from month to month, such as rent, while variable expenses change and can include items like eating out or personal spending.

Why is it important to list expenses from most important to least important?

-Listing expenses from most important to least important ensures that essential bills are covered first, and it helps in managing funds effectively, potentially reducing discretionary spending if the budget is tight.

What is the purpose of having a miscellaneous category in the budget?

-The miscellaneous category is for unexpected expenses that might not have been initially accounted for, ensuring that there is some flexibility in the budget to cover such costs.

How does the speaker calculate the remaining funds after listing all expenses?

-The speaker subtracts the total expenses from the monthly income to determine the remaining funds, which in the video example is $470.

What does the speaker suggest doing with the remaining funds after all expenses are accounted for?

-The speaker suggests allocating the remaining funds to different categories such as savings, gifts, or additional debt payments, ensuring that every dollar is budgeted and given a purpose.

Why is it crucial to budget all income down to zero according to the video?

-Budgeting all income down to zero ensures that every dollar has a designated purpose, preventing excess spending on non-essential items and helping to meet financial goals.

What additional tip does the speaker provide for staying organized with finances?

-The speaker suggests writing in due dates for bills and noting upcoming expenses like birthdays or trips to be better prepared financially.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Financial Literacy—Making a Budget | Learn how to create a budget

Very Easy Salwar Cutting and Stitching | Salwar Cutting and stitching | Salwar

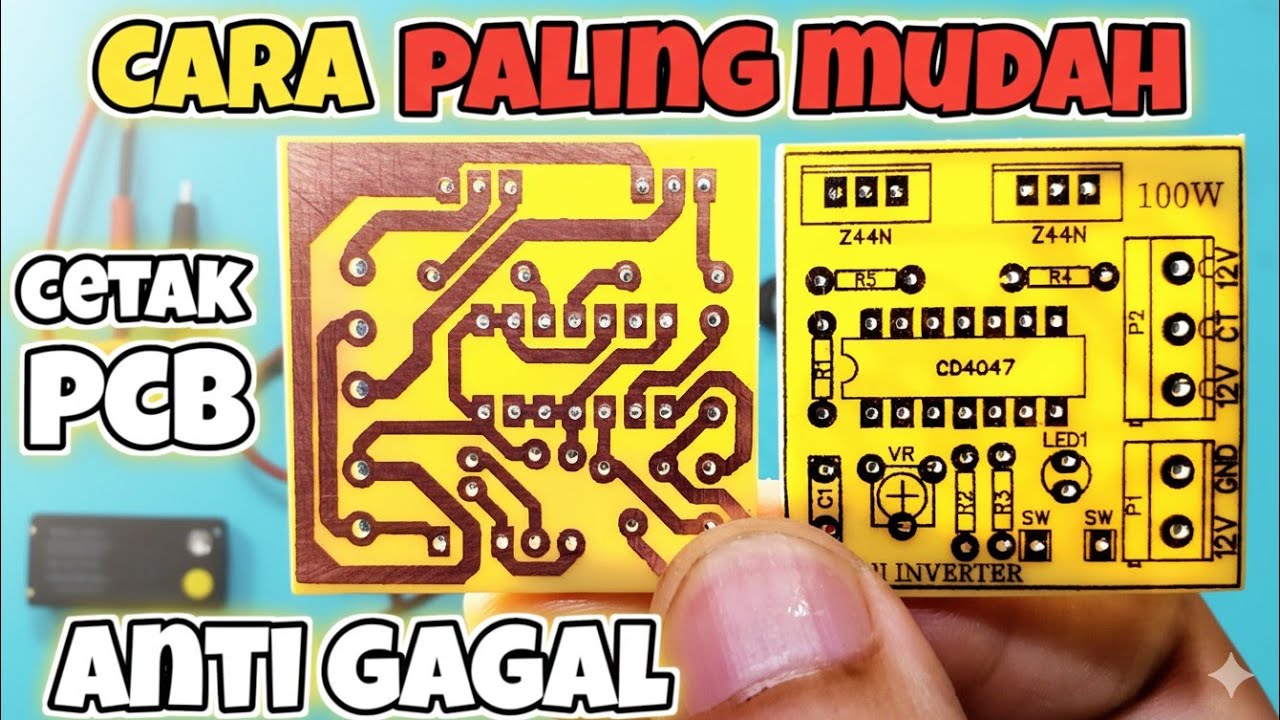

CARA CETAK PCB MANUAL Paling mudah anti gagal

Zero Based Budget | Dave Ramsey February 2017

How this Notebook Saved Me From Infinite Scrolling??

Outdoor Mushroom Beds | The Easiest Way to Grow Edible Mushrooms in Your Garden or Back Yard!

5.0 / 5 (0 votes)