Y1 30) Fiscal Policy - Government Spending and Taxation

Summary

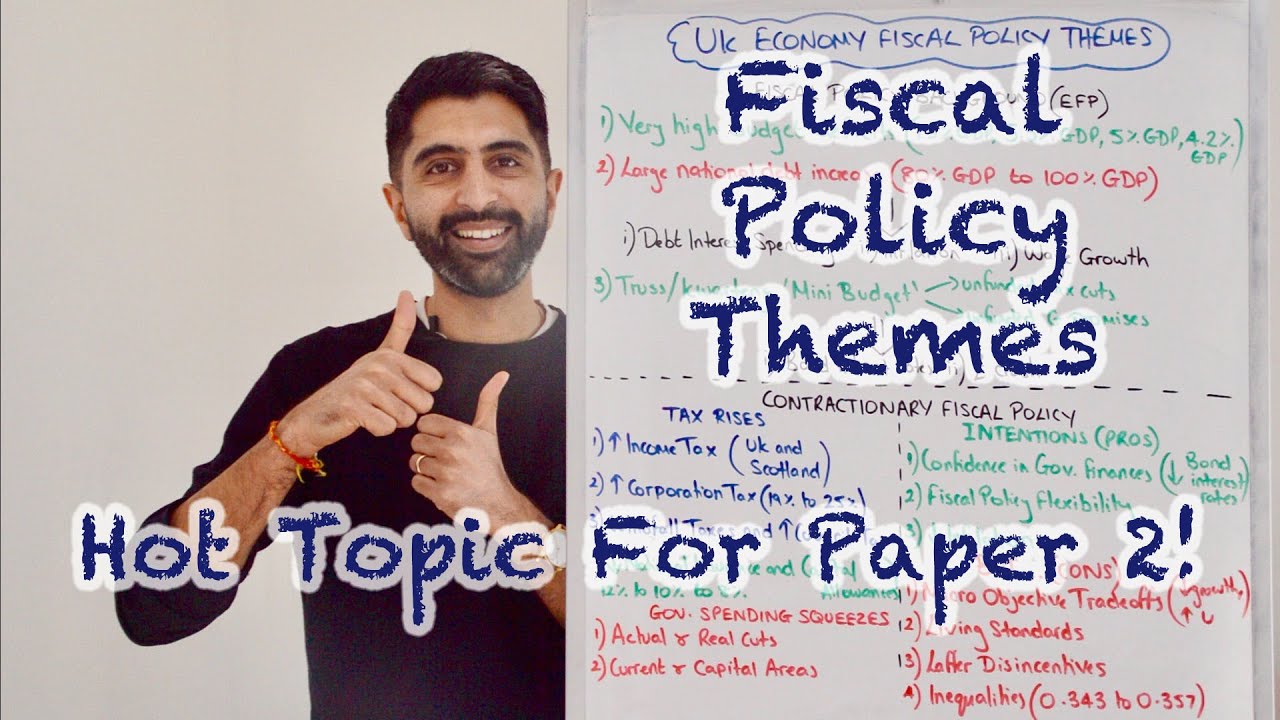

TLDRThis video provides an in-depth explanation of fiscal policy, focusing on expansionary and contractionary measures. Expansionary fiscal policy aims to boost aggregate demand through increased government spending and tax cuts, promoting economic growth and reducing unemployment. Contractionary fiscal policy, on the other hand, is used to cool down the economy, reduce inflation, and manage the government's budget deficit. The video also touches on income redistribution and the side effects of fiscal policies on long-term aggregate supply. A follow-up video will delve into the evaluation of these policies.

Takeaways

- 📈 Fiscal policy involves changes to government spending and taxation to influence aggregate demand (AD) in the economy.

- 🚀 Expansionary fiscal policy aims to boost AD, which can increase economic growth and reduce cyclical unemployment.

- 🏛️ Contractionary fiscal policy aims to reduce AD, potentially cooling down an overheated economy and helping to reduce the budget deficit.

- 💰 Expansionary fiscal policy can involve reducing income tax, which increases disposable income and boosts consumption.

- 🏢 Cutting corporation tax in expansionary fiscal policy can increase business investment, further boosting AD.

- 📊 Contractionary fiscal policy might involve raising taxes on the rich to redistribute income and reduce inequality.

- 📉 Contractionary fiscal policy can also help reduce the current account deficit by lowering income and reducing imports.

- 🔄 The multiplier effect in expansionary fiscal policy means that an initial increase in AD leads to more income and spending, further boosting economic growth.

- 🛠️ Government spending on infrastructure, education, and healthcare as part of expansionary fiscal policy can also indirectly boost long-run aggregate supply (LRAS).

- 🎯 While the primary goal of expansionary fiscal policy is to increase AD, it can also have side effects like improving productivity and increasing the economy's productive potential.

Q & A

What is fiscal policy, and what are its main components?

-Fiscal policy is a macroeconomic policy that involves changes to government spending and taxation in order to influence aggregate demand (AD) in the economy. Its main components are government spending (G) and taxation (T).

What are the two types of fiscal policy discussed in the transcript?

-The two types of fiscal policy discussed are expansionary fiscal policy and contractionary fiscal policy. Expansionary fiscal policy aims to boost aggregate demand, while contractionary fiscal policy aims to reduce aggregate demand.

When would a government use expansionary fiscal policy?

-A government might use expansionary fiscal policy during periods of sluggish growth or recession to increase economic growth, reduce cyclical unemployment, slightly increase demand-pull inflation, and reduce income inequality through welfare benefits and tax cuts for lower-income groups.

How does expansionary fiscal policy reduce unemployment?

-Expansionary fiscal policy reduces unemployment by increasing aggregate demand, which leads to higher production of goods and services. As firms need more workers to meet the increased demand, employment rises and cyclical unemployment falls.

Why might a government use contractionary fiscal policy?

-A government might use contractionary fiscal policy to cool down an overheating economy, reduce demand-pull inflation, lower the budget deficit, control government borrowing, and redistribute income by taxing higher-income individuals.

How can contractionary fiscal policy help reduce a current account deficit?

-Contractionary fiscal policy can reduce a current account deficit by lowering aggregate demand, which leads to reduced incomes in the economy. Lower incomes result in decreased demand for imports, which helps reduce expenditure on imports and, in turn, lowers the trade deficit.

What is the multiplier effect in the context of expansionary fiscal policy?

-The multiplier effect refers to the notion that an initial increase in aggregate demand (AD) leads to higher incomes in the economy, which causes more spending. This creates a virtuous cycle where increased spending leads to further increases in AD and economic growth.

What are some examples of tax policies under expansionary fiscal policy?

-Examples of tax policies under expansionary fiscal policy include reducing income tax rates for higher or lower income brackets, widening the tax-free allowance, and reducing regressive taxes like VAT to increase disposable income and boost consumption.

How can government spending boost aggregate demand under expansionary fiscal policy?

-Government spending can boost aggregate demand by increasing expenditures on healthcare, education, infrastructure, and public sector wages. These investments increase the G component in the AD equation, thereby boosting overall demand.

What is a side effect of expansionary fiscal policy on long-run aggregate supply (LRAS)?

-A side effect of expansionary fiscal policy is that certain policies, such as tax cuts or increased investment in education and infrastructure, can also boost long-run aggregate supply (LRAS) by improving labor productivity, increasing capital, and enhancing the productive efficiency of the economy.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)