【徹底比較】一括投資vs積立投資、儲かるのはどっち?貯金200万の使い道

Summary

TLDRThe video script discusses the comparison between lump-sum investing and dollar-cost averaging (DCA), focusing on the best investment strategies for salarymen. It highlights the benefits of DCA, such as reducing average purchase costs and minimizing emotional stress during market downturns. However, it also acknowledges lump-sum investing's potential for higher returns in a bullish market. The speaker shares personal experiences and insights, suggesting a balanced approach, like spreading investments over one to two years to average out entry points. The script emphasizes the importance of finding an investment style that aligns with personal financial goals and risk tolerance, ultimately advocating for a strategy that allows for a clear justification, even in the face of market volatility.

Takeaways

- 📈 The speaker begins by comparing lump-sum investing and dollar-cost averaging (DCA), which is a method of investing a fixed amount of money at regular intervals.

- 💡 For beginners or those with savings, the speaker suggests considering how to invest their savings wisely, whether through lump-sum or DCA.

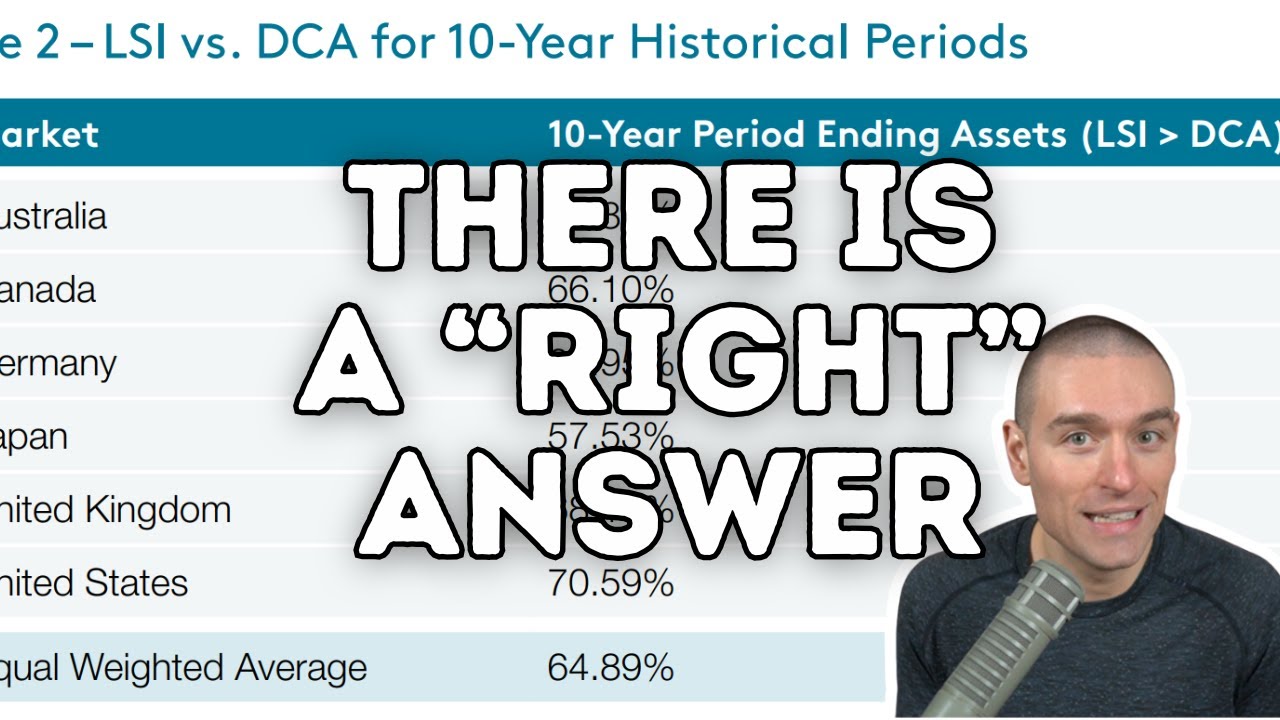

- 🌐 The speaker highlights that while DCA can lower the average cost of investments over time, lump-sum investing can be more advantageous if the market is trending upwards.

- 📊 A simulation is presented comparing the growth of a lump-sum investment versus DCA over a 20-year period, showing that lump-sum investing can lead to higher returns.

- 💰 The potential for lower transaction fees with lump-sum investing is discussed, as buying in larger amounts can reduce the fee rate.

- 📉 The speaker warns of the risks associated with lump-sum investing, such as the potential for significant losses if the market drops soon after investing.

- 🤔 The psychological aspect of investing is touched upon, noting that DCA can be less stressful as it spreads out the investment over time, reducing the impact of market volatility.

- 🧐 The importance of investing within one's means and having a strategy that accounts for personal risk tolerance is emphasized.

- 🌟 The speaker shares personal experiences to illustrate the benefits of DCA, such as being able to invest consistently without the pressure of timing the market.

- 🔢 The concept of 'dollar-cost averaging' is highlighted as a key advantage of DCA, allowing investors to buy more shares when prices are low and fewer when they are high.

- 🌱 The script concludes with a reminder that there is no absolute right or wrong approach to investing, and that individuals should find a strategy that aligns with their financial goals and risk appetite.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the comparison between lump-sum investing and dollar-cost averaging (regular investment), and how to consider investing a savings of 2 million yen.

What is the general recommendation for beginners in investing according to the script?

-The script suggests that for beginners, it's important to understand that while dollar-cost averaging can be beneficial, lump-sum investing can be more advantageous if the market is generally on an upward trend over the long term.

What is the significance of the S&P 500 index mentioned in the script?

-The S&P 500 index is used in the script as an example to illustrate the long-term upward trend of the stock market, which is an important consideration when deciding between lump-sum and regular investing.

What are the potential benefits of lump-sum investing mentioned in the script?

-The script mentions that lump-sum investing can lead to higher returns if the market continues to rise over time, and it can also result in lower transaction fees compared to regular investing.

What is the 'dollar-cost averaging' method mentioned in the script, and how does it work?

-Dollar-cost averaging is a method of investing a fixed amount of money at regular intervals, regardless of the price of the shares. This approach can lower the average cost per share over time and reduce the impact of market volatility.

What are some of the psychological aspects discussed in the script regarding investing?

-The script discusses the psychological stress that can come with lump-sum investing, especially for beginners who might be overwhelmed by the amount of money being invested at once. It also mentions the calmer approach of regular investing, which can help investors avoid making impulsive decisions during market downturns.

How does the script address the risks associated with lump-sum investing?

-The script addresses the risks by pointing out that if the market experiences a significant drop soon after a lump-sum investment, the investor could face substantial losses, which might deter them from continuing with their investment plan.

What is the 'rsi' mentioned in the script, and how is it used in investing?

-The 'rsi' refers to the Relative Strength Index, a technical indicator used to analyze overbought or oversold conditions in the market. In the script, it is mentioned as a tool that can help investors decide when might be a good time to buy.

What is the strategy suggested in the script for someone with 2 million yen in savings who is considering investing?

-The script suggests that instead of a lump-sum investment, it might be better to spread out the investment over 1 to 2 years. This approach can help average out the purchase cost and reduce the risk of investing at a market peak.

How does the script differentiate between investing for salarymen and other types of investors?

-The script suggests that salarymen, due to their stable monthly income, might find regular investing more suitable as it aligns with their income structure and reduces the need to constantly monitor and manage their investments.

What advice does the script give on finding an investment style that suits the individual?

-The script advises viewers to find an investment style that they are comfortable with and can justify in retrospect. It emphasizes the importance of being able to look back on an investment without regrets and having a clear rationale for the decisions made.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Is Dollar-Cost Averaging Better Than Lump-Sum Investing?

How To Buy Bitcoin In Bull Markets | Dollar Cost Averaging

Dollar Cost Averaging vs. Lump Sum Investing

Borong Bitcoin Episode 1 - Juni 2023

SIP vs. Lumpsum in Mutual funds | SIP vs. Lumpsum which is better? | Mutual funds

WTF Just Happened To Bitcoin?!

5.0 / 5 (0 votes)